What Bitcoin’s HODLers tell us about investor psychology

- Bitcoin is in the early stages of HODLing as it gains more popularity.

- BTC could be headed for a demand shock.

Will the aggressive Bitcoin [BTC] bulls wake up when September ends? Well, the king coin just delivered its first bullish September since 2016. Part of the reason for the upside could be the observed shift in favor of long-term HODLing.

Is your portfolio green? Check out the BTC Profit Calculator

The idea that Bitcoin’s performance in September could be the start of its long-term bull trend is not far-fetched. The cryptocurrency is now closer than ever to a Bitcoin ETF approval, and the outcome could pave the way for a major demand shock due to a tsunami of liquidity.

The shifting tide from short-term profit-taking to long-term holding might be one of the early signs.

The bullish expectations reflect the sentiments of CryptoQuant analyst Yonsei_dent. The analysis revealed that Bitcoin has recently been experiencing low sell pressure.

More importantly, the number of Bitcoin long-term holders has been growing. This coincides with recently observed bullish momentum. The analysist has this to say about the current state of the market:

“If you look at the exchange holdings provided by CryptoQuant, you can see that they plummeted during the FTX incident in November 2022 and have been decreasing ever since.”

On-chain data reveals this about long-term hodling

The Bitcoin exchange reserve metric coincides with the statement. Its exchange reserves have been steadily declining since May. A potential reason for this observation could be the concerns regarding centralized exchanges and growing popularity.

The rise of self-custody also confirms that there is a preference for HODLing. The transfer from exchanges to private custody wallets also aligns with the long-term prediction.

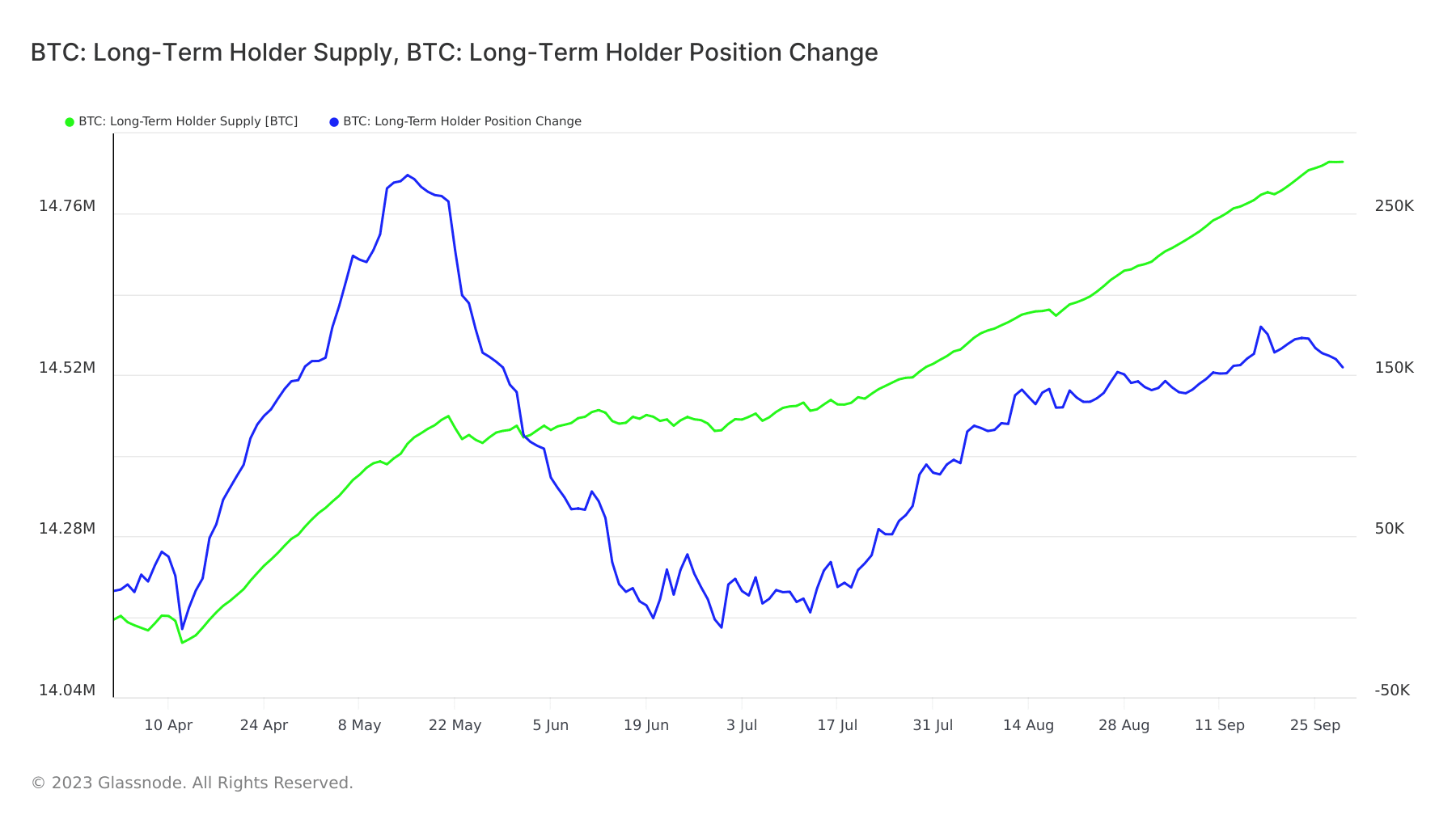

But how can we confirm that Bitcoin is indeed favoring long-term holders? Well, its long-term holder supply has been steadily growing. This means long-term holders are still not contributing much to sell pressure. The upside also suggested that many were accumulating at press time.

Bitcoin long-term holder position change pivoted on 17 September after previously rallying since July. The dip in the long-term position change suggested that we may see less pressure in the form of short-term profit-taking.

Read Bitcoin’s [BTC] Price Prediction 2023-24

The previous other time that the same metric demonstrated a pivot after a previous rally was from mid-May to end of June. Interestingly, there was a spike in demand during that period.

The shifting preference for HODLing, coupled with the slowing sell pressure, might pave the way for accumulation. However, the anticipated demand shock is not yet here, and there is still room for whales to shakedown the market again before the inevitable bull market kicks in.

![Solana [SOL] - Is there any good news after trading volume hits 2024 low?](https://ambcrypto.com/wp-content/uploads/2025/03/Solana_Abdul-400x240.webp)