What Bitcoin’s post-halving history tells us about BTC’s 2024 prices

- Buying sentiment remained dominant in the market.

- Market indicators hinted at a few more slow-moving days.

The Bitcoin [BTC] halving triggered a bull rally for altcoins, but BTC itself did not showcase much volatility. However, if historical data is to be believed, then things might turn bullish for BTC as well.

Therefore, AMBCrypto analyzed BTC’s state to understand what to expect from it after a few days of halving.

Bitcoin remains calm post-halving

Just a few days after the much-awaited BTC halving, altcoins began bull rallies, allowing several cryptos to register double-digit growth. Meanwhile, BTC laid low, as it didn’t push its price up by a huge margin.

According to CoinMarketCap, BTC was up by 2% in the last 24 hours. At the time of writing, it was trading at $64,992.95 with a market capitalization of over $1.28 trillion.

But there was more to the story, as BTC in the past has displayed similar behavior. Rekt Capital, a popular crypto analyst, posted a tweet about past incidents.

As per the tweet, BTC’s price has always consolidated during the halving months back in 2020 and 2016. This indicated that investors might witness less volatility in April.

But the trend might change in May and June, as historically, BTC’s price has gained bullish momentum in the months that followed halvings. Therefore, the chances of BTC closing Q2 on a good note seemed high.

What lies ahead in the short term?

If history repeats itself, things might turn volatile for BTC next month, but to see what investors should expect in the short term, AMBCrypto analyzed BTC’s metrics.

Our analysis of CryptoQuant’s data revealed that BTC’s exchange reserve was dropping. This meant that buying sentiment was dominant.

The king of crypto’s Binary CDD indicated that long-term holders’ movements in the last seven days were lower than average, suggesting that they have a motive to hold their coins.

Buying sentiment among US investors was also dominant, as evident from its green Coinbase Premium. This meant that investors were confident in BTC and expected its value to rise in the coming weeks.

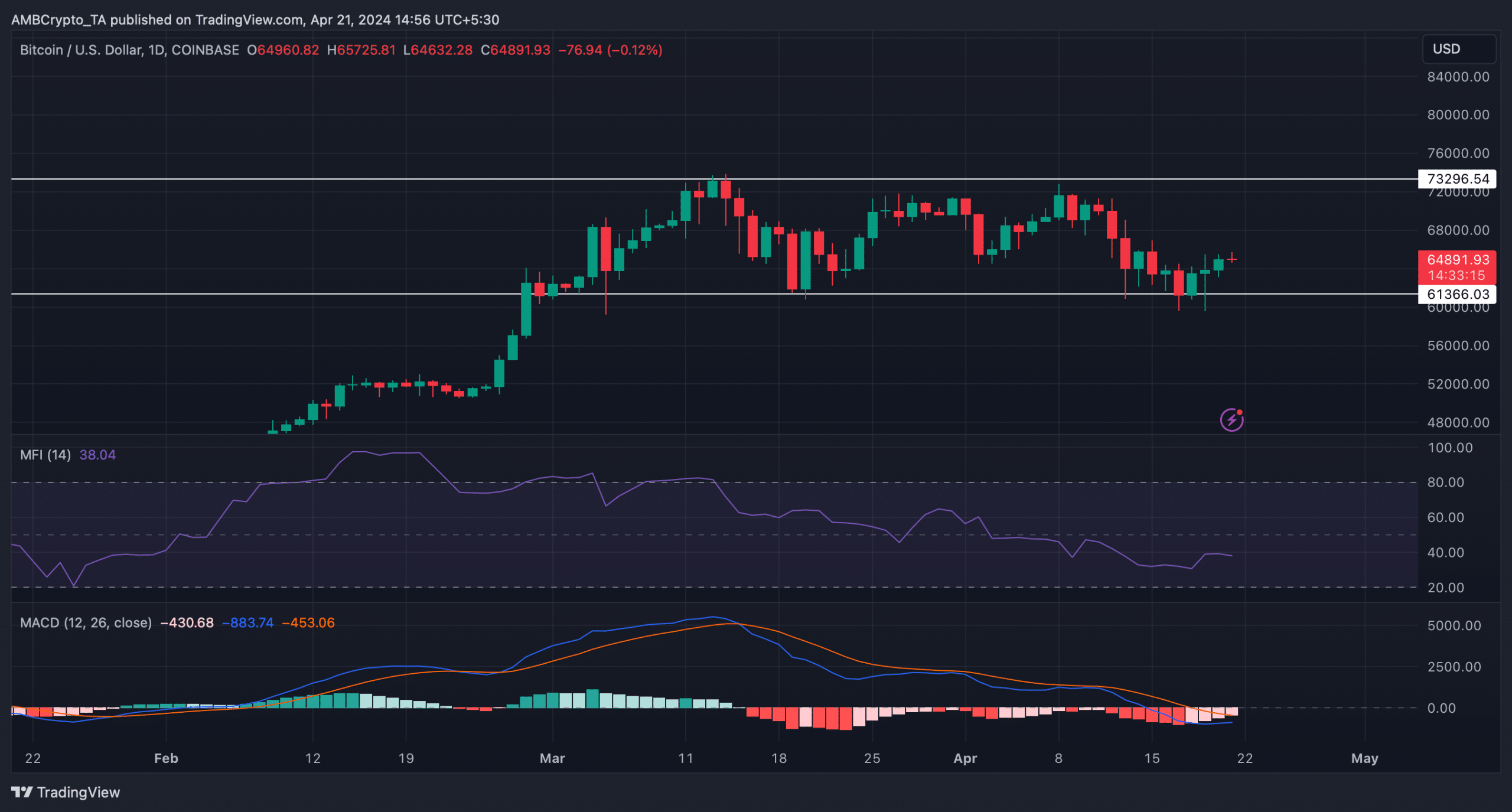

To see which direction BTC might head during the upcoming week, AMBCrypto took a look at its daily chart. As per our analysis, BTC’s price might continue to move in a parallel channel between its ATH and $61k.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Its Money Flow Index (MFI) went sideways under the neutral mark, further indicating a few more slow-moving days.

However, the MACD displayed the possibility of a bullish crossover, which, if it happens, might allow BTC to turn volatile.