What caused Bitcoin miners to dump their coins in October

- Miners’ earnings from transaction fees increased in the last week.

- Miners liquidate their BTC stashes to meet their operational costs.

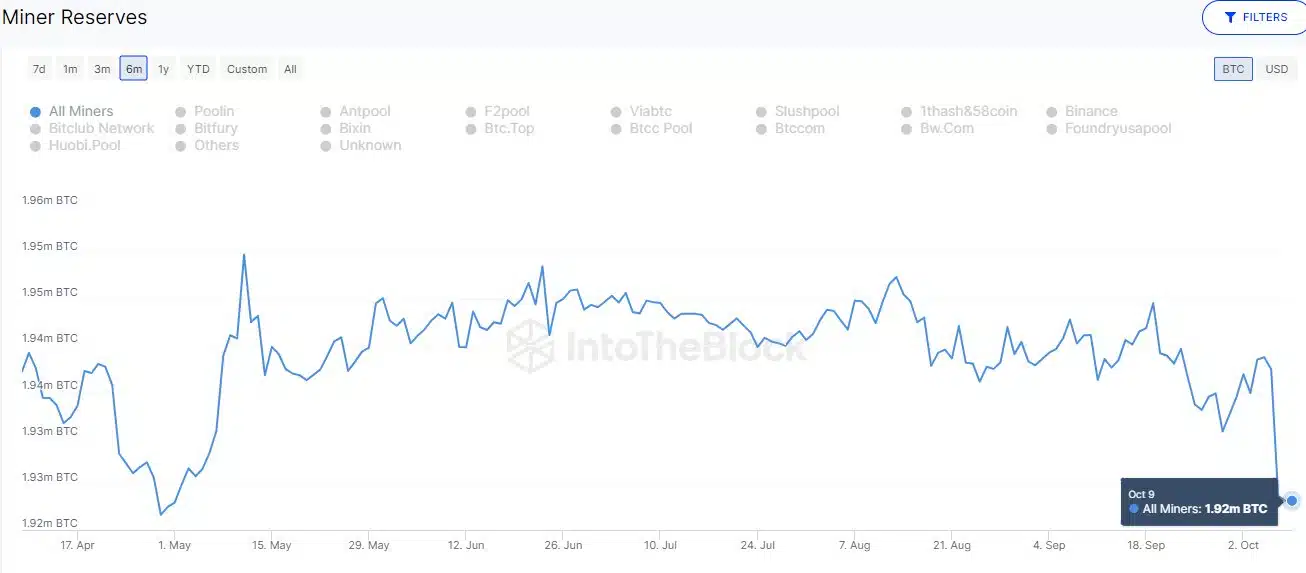

Bitcoin [BTC] miners shunned hoarding mentality and liquidated a significant chunk of their holdings in the last few days. According to on-chain analytics firm IntoTheBlock, miner reserves tanked by more than 20,000 since the start of the week, marking the most intense wave of selling since April.

Read BTC’s Price Prediction 2023-24

Significance of miner sell-offs

Sell-offs are typically viewed as bearish occurrences since they swamp the market with more coins. However, miner liquidations occur on a regular basis and should not be seen as an anomaly.

Miners are responsible for bringing new BTC coins into circulation. This happens in the form of fixed rewards, currently at 6.25 BTC, for every block they validate and add to the Bitcoin network.

While miners are rewarded in BTC for their efforts, cash is needed to cover their often high mining expenditures such as machinery, power, and rentals. Hence, they frequently dump their Bitcoins.

Typically, miners wait for a meaningful rise in the price of BTC before selling them off. However, this didn’t hold true in the current scenario. The king coin fell more than 2% from the beginning of the week until press time, data from CoinMarketCap revealed.

Miners capitalizing on last week’s gains?

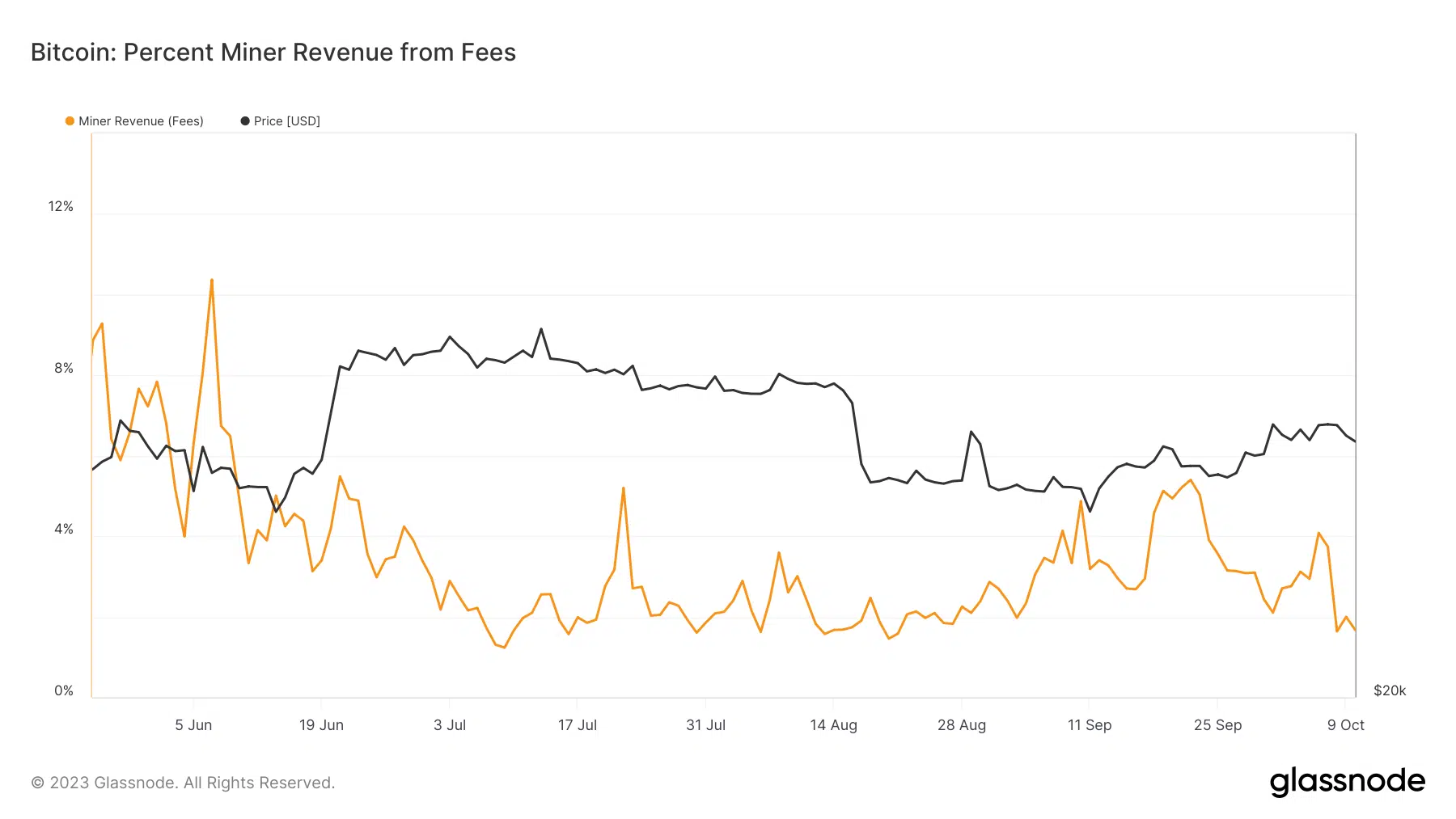

A closer inspection revealed that the proportion of miners’ total earnings from transaction fees witnessed a noteworthy spike last week. Interestingly, this was also the time when BTC rallied past $28,000 for the first time in six weeks.

These developments could have filled miners’ coffers sufficiently. Hence, fearing further price drops that would have impacted their revenue, these players quickly offloaded their bags.

Is your portfolio green? Check out the BTC Profit Calculator

While miner revenue saw a clear increase in recent days, it was important to put it in the broader perspective. Since the unprecedented jump in the first week of May, transaction fees collected by miners have been on a downward spiral.

The bearish nature of the market restricted the full utilization of the blockchain that used to happen earlier. As a result, transactions fell drastically and in turn the money which miners made by validating transactions.