Why Polkadot’s $17 price prediction depends on its relationship with Bitcoin

- DOT could rise as high as $17 if it breaks through the key resistance around $10.

- On-chain metrics showed that spot buyers were buying DOT aggressively.

According to analyst Michaël van de Poppe, Polkadot’s [DOT] upswing in the last 24 hours could be the start of a run that drives the price to an all-time high.

In the post, the analyst considered DOT’s performance versus Tether [USDT] and the one against the Bitcoin [BTC] pair. van de Poppe mentioned that the token formed higher highs and lower lows against USDT.

North is the direction

A higher high and lower low is considered a bullish signal. It shows that an asset can resist a downward trend and attain a higher value.

From the chart the analyst shared, DOT had established an uptrend from $8.97. But it faced a crucial resistance around the $10 region.

As it stands, a close above the resistance could foreshadow the trend that trigger a rally toward $17. Furthermore, if DOT hits $17, a breakout might occur and drive the value toward an all-time high.

Concerning its performance against Bitcoin, AMBCrypto, like the analyst, observed that it was at a cycle low. This condition validated the long-term bullish thesis for the token.

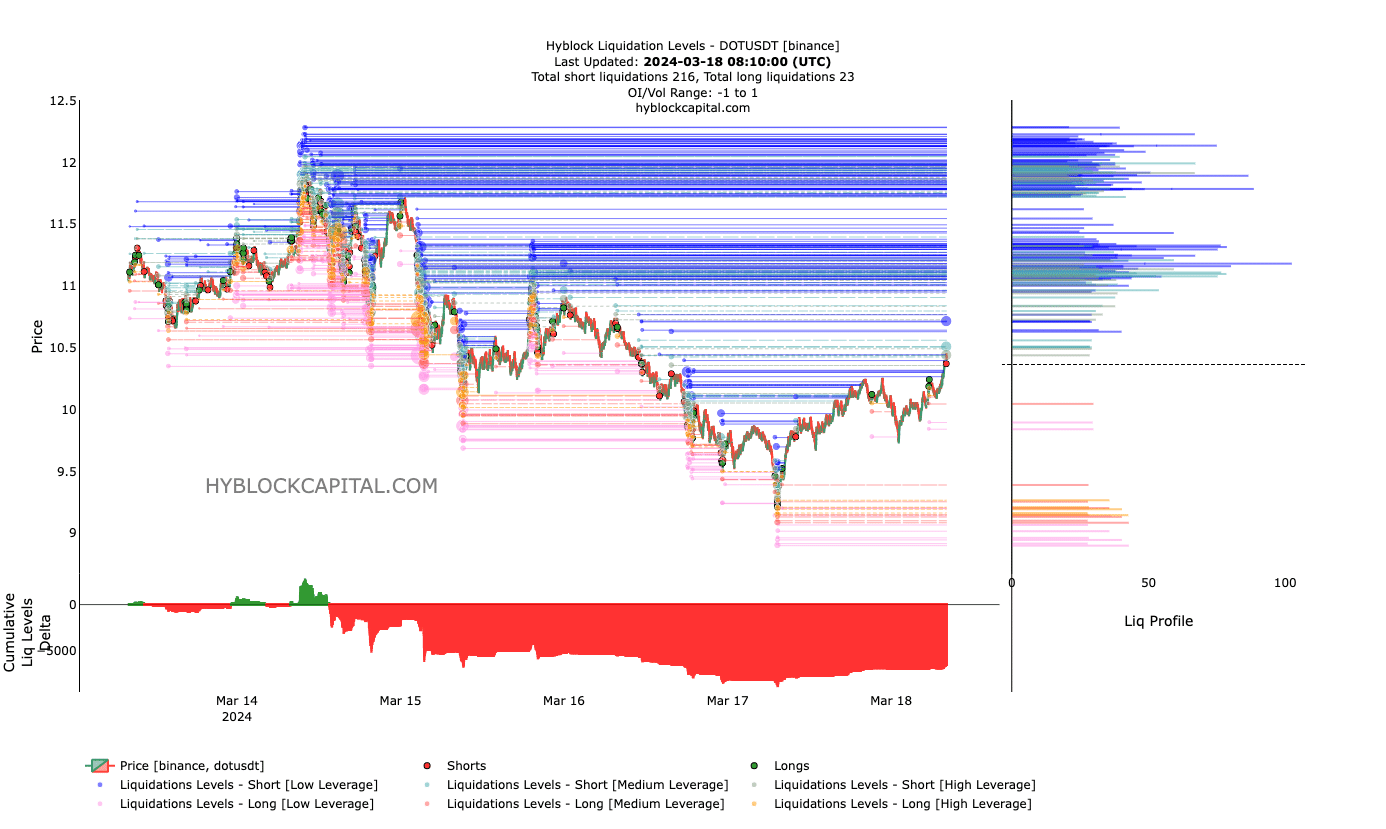

However, it is also important to assess DOT using other indicators. The first indicator we ran to was the Liquidation Levels available on HyblockCapital’s platform.

Liquidation levels show estimated price points where liquidation events might occur. On the plot, there is also a section for the Cumulative Liquidation Level Delta (CLLD).

This CLLD tells if actions in the derivatives market are fueling a bullish or bearish bias.

It’s not looking good for shorts

At press time, AMBCrypto noticed that there was no cluster of liquidity between $10.36 and $10.96. Therefore, DOT might find it easy to climb toward $11.

However, above the aforementioned value, lots of liquidation could take place, especially for high-leverage traders.

On the CCLD part, the inference we got was that shorts with medium to high leverage might have their positions wiped out. This was because the CLLD had dropped into negative territory.

The negative reading suggested that shorts were trying to catch the dip as DOT’s price slightly decreased. But long liquidation levels were also getting hit from the quick recovery.

Thus, this offers a bullish thesis for the token.

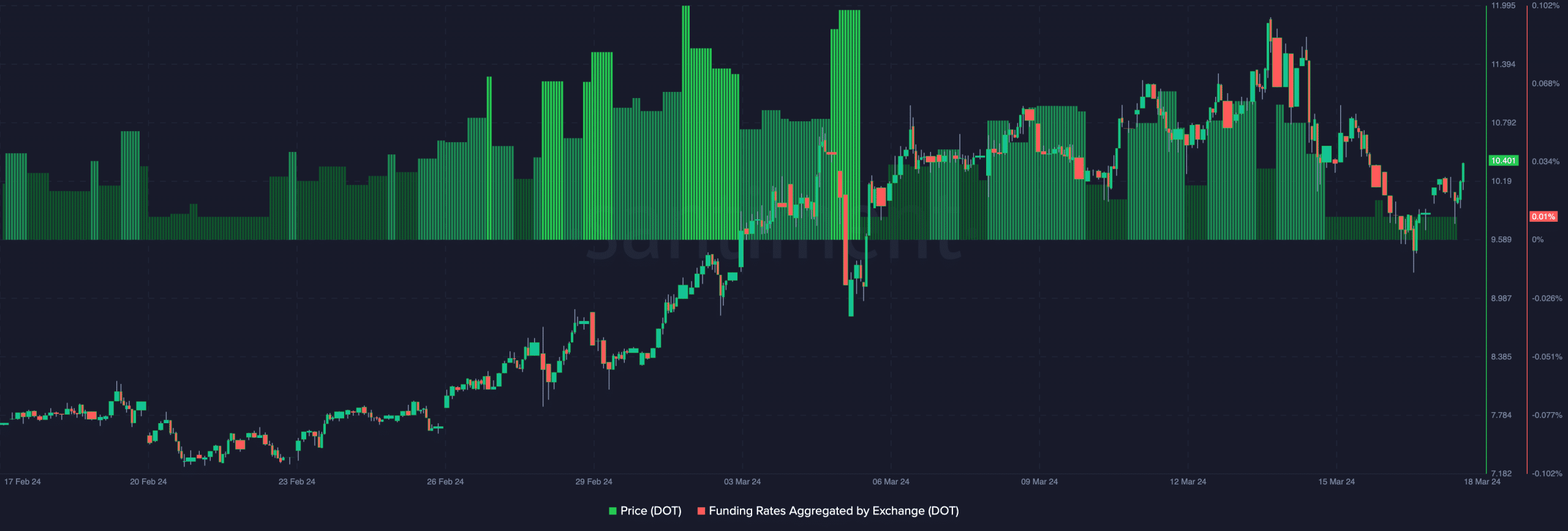

In addition, the Funding Rate was positive, indicating that open long positions were paying shorts to keep their positions.

For the uninitiated, funding is a product of the difference between the spot price and perp price. One thing AMBCrypto noticed was that the Funding Rate was becoming lower as DOT’s price climbed.

Read Polkadot’s [DOT] Price Prediction 2024-2025

This indicated that spot buyers were accumulating aggressively, while perp sellers were in disbelief. For the price of the token, this was a bullish signal.

As such, DOT’s northward run might continue over the coming weeks.