How Ethereum’s falling gas fees affect the network

- Ethereum’s average fees returned to reasonable levels after reaching a high in 2023.

- NFT trades rise as gas prices drop, while self-custody and bullish sentiment boost Ethereum’s outlook.

Ethereum [ETH] has long been infamous for its exorbitant gas prices, which has driven away users and forced them to seek alternative networks or solutions.

However, there is good news on the horizon as Ethereum’s gas prices recently witnessed a significant drop.

Ethereum low on Gas

Ethereum’s gas prices have fallen noticeably, offering a respite to users.

Santiment’s data revealed that Ethereum’s average fees returned to more reasonable levels after reaching a 2023-high of $14 per ETH transaction in early May.

This decline in gas fees could have a positive impact on the Ethereum network. Additionally, Dune Analytics’ data indicated a surge in gas usage on Ethereum, further bolstering network activity.

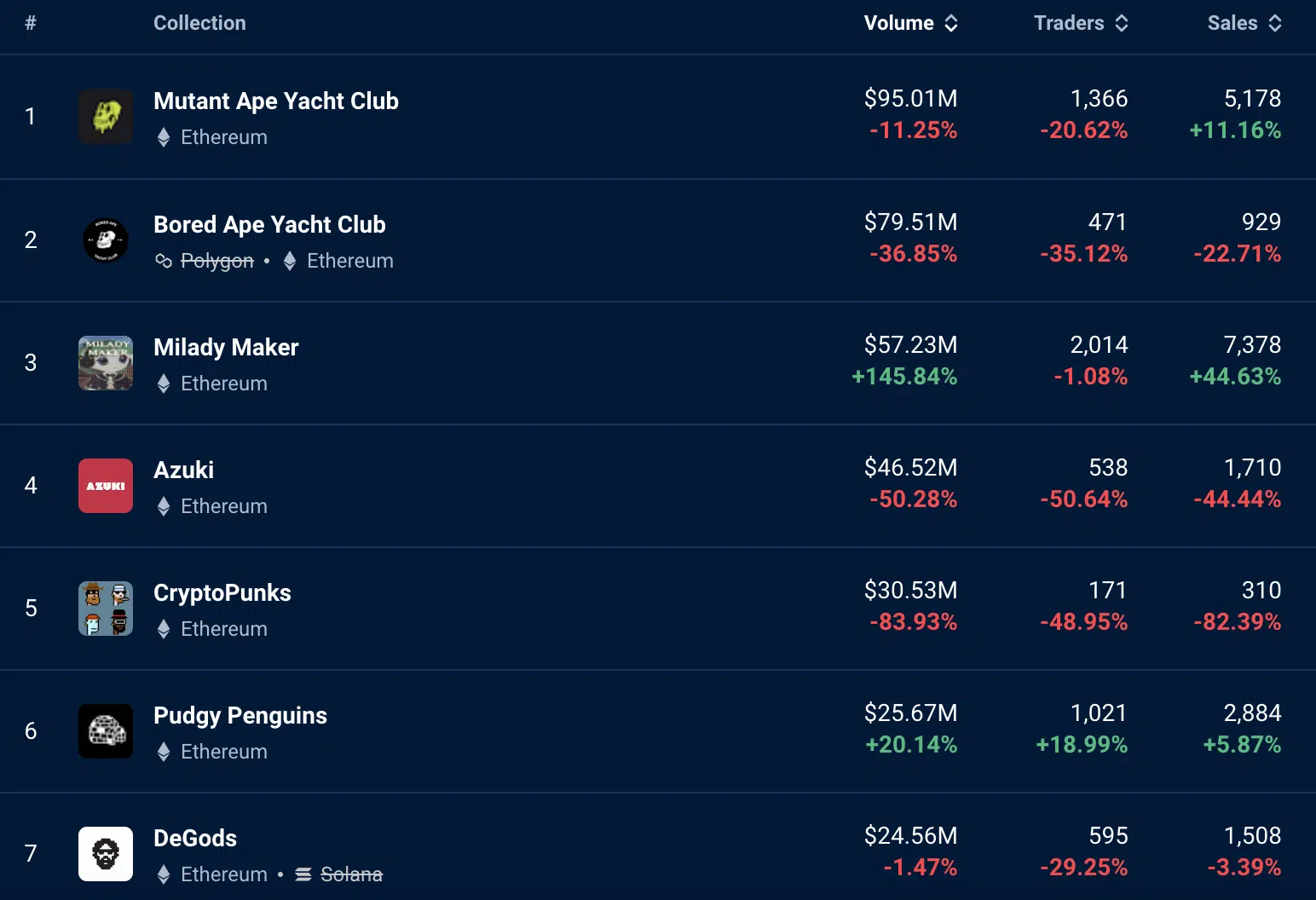

Notably, the decrease in gas prices has contributed to an increase in NFT trades on the Ethereum network. However, the surge in volume was not from popular blue chip NFT collections like Bored Ape Yacht Club (BAYC) or Mutant Ape Yacht Club (MAYC).

According to Dapp Radar’s data, these collections witnessed declining volumes and sales in recent months. Instead, newer NFT projects such as Milady Maker and other under-the-radar offerings have driven the spike in Ethereum NFT activity.

Looking at the price

When it comes to the ETH coin, Santiment’s data revealed that Ethereum is experiencing an all-time low in terms of availability on exchanges, indicating a growing trend of self-custody. This high level of self-custody is a bullish sign.

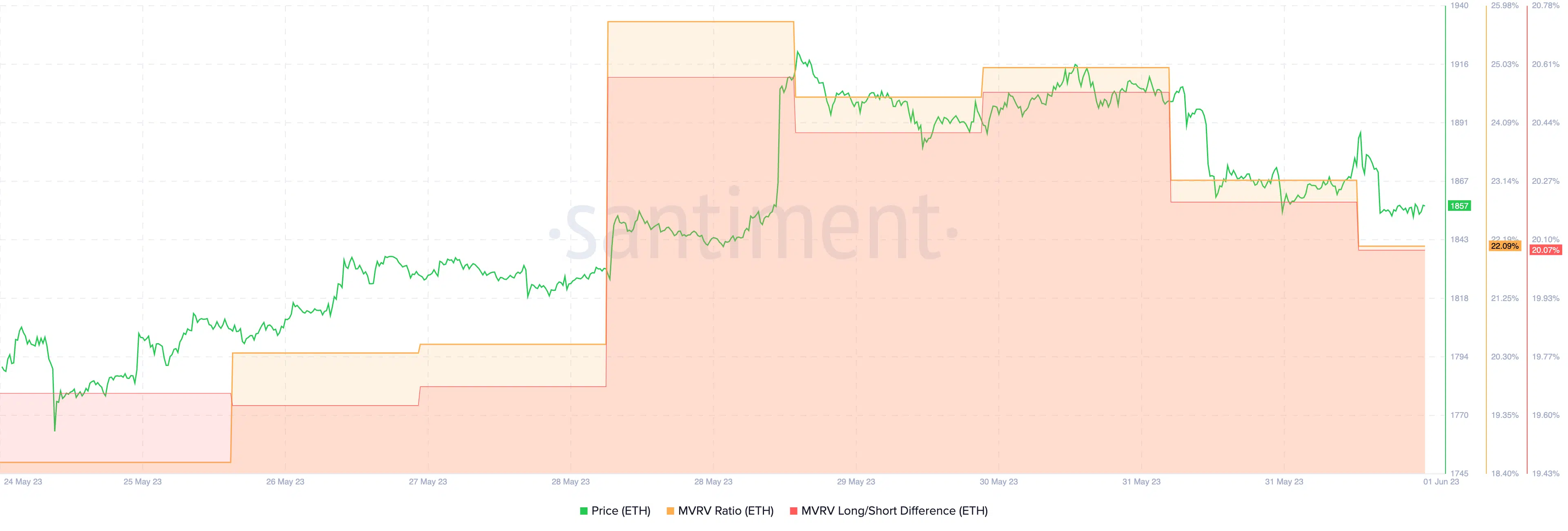

While ETH’s price has continued to rise, the surge in the MVRV ratio, along with increasing prices, suggests that many addresses holding ETH are currently profitable. These addresses may be more inclined to sell their holdings as prices rise.

Realistic or not, here’s ETH’s market cap in BTC terms

However, the long/short ratio indicates that the majority of these addresses are long-term holders, who are less likely to sell their holdings at the first sign of profit.

As traders become increasingly optimistic, the put-to-call ratio for ETH has been declining over the past few days. At the time of writing, ETH’s put-to-call ratio stands at 0.39 according to The Block. This indicated a shift in sentiment toward a more bullish outlook for Ethereum.