What if the dollar drops to “3 rubles”? Where and how can Belarusians invest?

On August 9, 2020, the presidential elections were held in Belarus. They led to massive protests, numerous detentions, and economic losses. While the Belarusians are fighting at rallies, the exchange rate of their ruble is slowly and surely going down, as in a month it has lost 15% of its value.

There is a rumor circulating across the country that deposits in state banks may be frozen. In this regard, many exchangers may well run out of foreign currency and Belarusians will buy up dollars en masse even at an overvalued rate, and as such, the queues to ATMs will stretch out for several kilometers.

Just as the Belarusians are fighting for change, they should be fighting for the safety of their funds. One of the best options for them right now is to invest in digital currencies. This article is a guide for Belarusians on how to buy cryptocurrencies profitably and quickly.

How to protect one’s savings

Why is it profitable for Belarusians to “enter the cryptocurrency market” right now? First of all, the market is fully legalized in Belarus. Secondly, Bitcoin and other coins have entered a stage of active growth, so those who invest in cryptocurrencies right now can get a good profit by the end of the year. Thirdly, cryptocurrencies cannot be frozen or confiscated, unlike deposits in state banks.

For example, there was talk about the freezing of deposits in Belarusian banks back in 2011. In 2014, those rumors resurfaced against the backdrop of the fall of the ruble, but the chairman of the board of the National Bank assured his Belarusian compatriots that there were no prerequisites for the freezing of deposits. It is difficult to predict what will happen to the deposits now due to the unstable situation in the country. Therefore, it makes sense for Belarusians to keep their savings in cryptocurrencies and even receive passive income, the percentage of which is higher than that of the deposits of any of the Belarusian banks. More on this below.

Despite the fact that Belarus is considered to be an important hub for blockchain businesses, the overwhelming majority of citizens of the country have neither crypto wallets nor experience with exchanges and exchangers. So, how is it easier and faster for Belarusian citizens to buy cryptocurrencies?

There are several ways of buying Bitcoin and other cryptocurrencies using a bank card. They differ in the degree of complexity and reliability, but an optimal method cannot be singled out, as the choice depends on the preferences of each specific user.

Method 1: Buy through an online exchanger

Commission: 2-5%

There are hundreds of crypto exchangers on the market, and most are registered in Russia, although there are also Estonian ones. Exchangers vary greatly in their level of “officiality”, as some are licensed and require verification, while others are completely anonymous.

Working with an exchanger is always a risk because the user’s funds are not insured. But if one does not want to go through identity verification, then the exchanger is the only option.

What should be done:

1) Register a separate crypto wallet. There are many good, easy-to-use wallets out there, like RD, Mycelium, and Exodus. When creating a wallet, the user will receive a secret key, which usually consists of a 12-14 word phrase. Users should be sure to save or write it down in a safe place. If they lose access to the device, the wallet can only be restored using the secret key. Also, users should copy the wallet address to enter it in the exchanger.

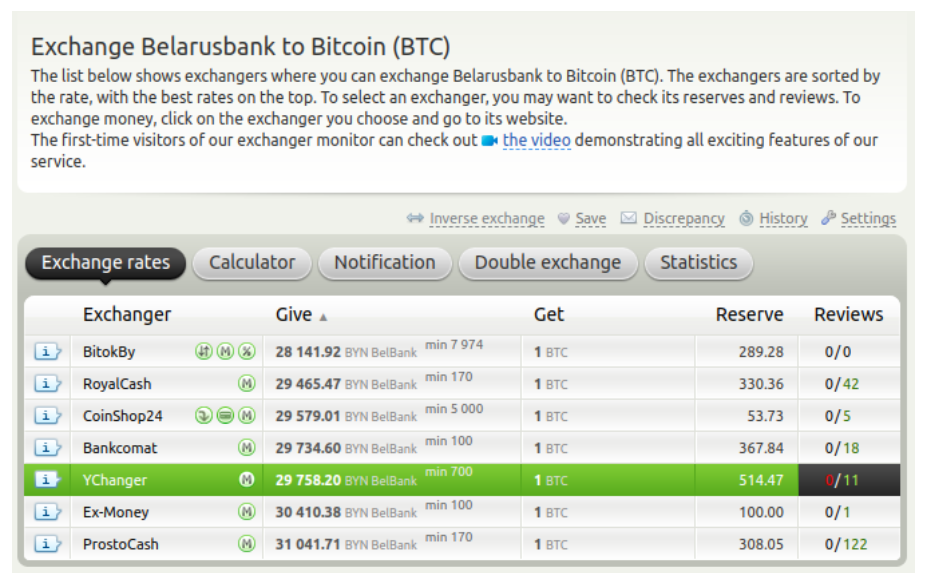

2) Go to the BestChange aggregator site – there are hundreds of exchangers on it.

3) Select a payment method in the left column. Click on the arrow at the bottom of the column to expand the full list. It has, in particular, Belarusbank, Visa / MasterCard BYN, as well as ERIP.

4) Select the desired cryptocurrency in the right column. A list of exchangers that support this operation will be displayed.

Source: GetETH

5) Visit several exchange sites and compare their conditions and requirements. Exchangers with the best rates on BestChange sometimes charge hidden fees. Some work around the clock, others only from 9 to 18. Some send cryptocurrencies almost immediately, others take several hours to process the operation.

6) If one finds a suitable exchanger, then they should follow the instructions for sending the funds. Users should also make sure that they have copied their wallet address correctly. The transfer of the funds can take several hours.

Method 2: Buy using a bank card through the exchange

Commission: 0% -3%

This is perhaps the safest way because acquirers only work with trusted exchanges. That is, users can at least be sure that the funds will not be lost and they will actually receive the Bitcoins they purchased.

Another advantage is that there is no need to start a separate crypto wallet before purchasing. The exchange automatically assigns a wallet number to the user where the coins will be transferred to.

On the other hand, official exchanges have a verification system. This is partly a requirement of acquirers, partly a way to prevent money laundering and other illegal activity on the exchange.

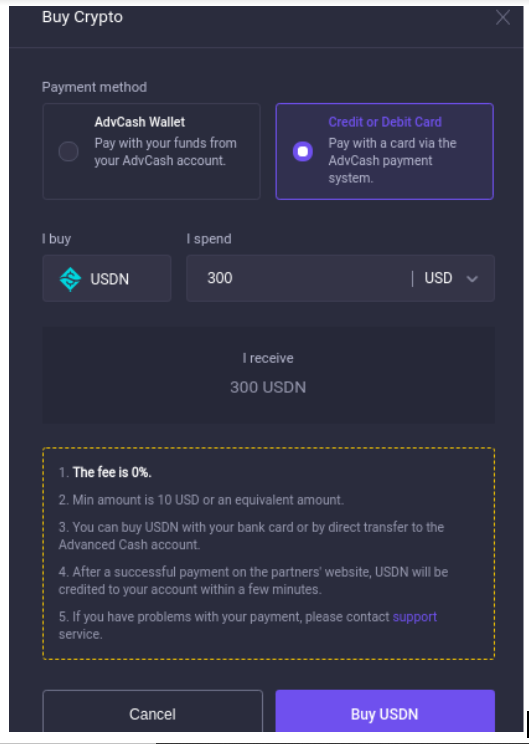

The size of the commission when buying crypto on the exchange using a bank card depends primarily on the terms of the agreement between the acquirer and the exchange. The average market commission is 2.5%, although, for example, on Waves.Exchange users can buy Bitcoins with a commission of 0.5% thanks to the integration with the AdvCash payment system.

When buying a digital dollar USDN, no commission is charged at all, as coins can be obtained at the rate of 1 USDN = 1 USD. The USDN digital dollar is interesting in that it supports staking – a certain kind of deposits in cryptocurrencies. The income from staking is 12-15% per year, which is a good alternative to bank deposits, especially in times of crisis, when banks may at any time stop returning deposits and go bankrupt. USDN can be easily withdrawn back to the bank card, having previously been exchanged for Bitcoin or any of the other popular cryptocurrencies (ETH, USDT, LTC, etc.).

What should be done:

1) Register an account. Sometimes identity verification (KYC) is needed at this stage. Users will need to upload a photo of their passport and a selfie with it. Registration on Waves. Exchange will only take a couple of minutes because it takes place without verification.

2) Make a purchase using the card. If the exchange does not directly accept Belarusian rubles, then a conversion will be made, for example into dollars. The cryptocurrency will be sent to the wallet in the exchange in a few minutes or even instantly.

Source: GetETH

3) Although exchanges are generally quite reliable, it is not recommended to store large amounts of cryptocurrency in an exchange wallet. If one does not plan to trade cryptocurrencies or invest in staking in the coming months, they should create a separate crypto wallet and transfer the coins to it (see “Method 1”).

Method 3: via LocalBitcoins

Commission: 2-5%

LocalBitcoins is a legendary P2P cryptocurrency exchange service. This is a kind of AirBnB for Bitcoin: buyers and sellers publish bids. Everyone there sets the exchange rate and conditions that are convenient for them.

LocalBitcoins has grown from a semi-clandestine and anonymous service into a serious legal company. Recently, identity verification is required on the platform.

The platform acts as a guarantor that the seller will receive payment only after the cryptocurrency arrives onto their wallet.

What should be done:

1) Register a crypto wallet as described in Method 1.

2) Register at LocalBitcoins. To do this, users need to indicate their email address, full name, country of residence and phone number. Users will automatically receive a T0 verification level, which does not allow them to make an exchange.

3) Pass verification at the T1 level: it will allow users to make transactions worth up to 20,000 euros per year. To do this, users will need to provide the address of their residence and upload a scan or photo of their passport.

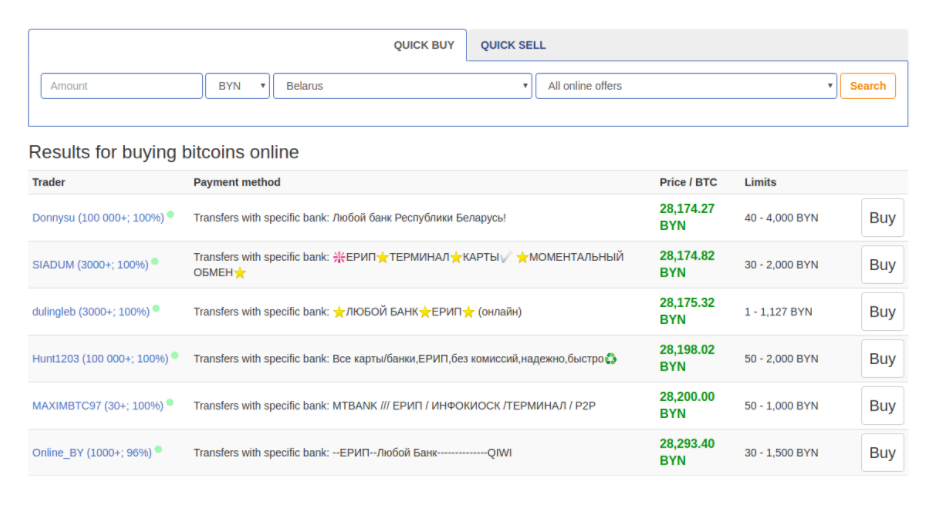

4) On the https://localBitcoins.com/ru/buy_Bitcoins page, users should select Belarus in the list of countries and BYN in the list of currencies. All the available offers with exchange rates and short terms will then be displayed.

Source: GetETH

5) Open several offers and study the conditions. For example, some sellers offer an exchange in person, while others ask for a photo of the card for confirmation. There is often a minimum and maximum limit on the size of the transaction (for example, 1,000 Belarusian rubles).

6) If one finds a suitable offer, they should follow the instructions of the seller.

What is the best way to buy crypto?

If the goal is to buy crypto with a minimum commission, then the best options are LocalBitcoins and Waves.Exchange (0% when buying USDN and 0.5% in the case of BTC). When buying on LocalBitcoins, users should choose a highly rated seller, even if their rate is far from the best. In both cases, users will have to go through verification.

If, for some reason, a user is not ready to provide personal information, then they will have to buy crypto through an exchanger. Again, they should pay attention to reviews on BestChange and choose a major exchanger (i.e. with a large cryptocurrency reserve).

Exchanges that cooperate with payment systems and banks are suitable for those who are primarily concerned about security. However, users should pay attention to the card commission, as it sometimes exceeds 3%.

Bitcoin enthusiasts often say that you are “your own bank” with cryptocurrencies. No one is able to freeze the funds on a crypto wallet, and users can transfer them to any other address in the world in a few minutes. At the same time, the profitability of cryptocurrencies is much higher than the interest rate on bank deposits.

If you have never bought Bitcoin, then it may seem that it is too difficult. However, in the current situation, it is worth considering that perhaps it is really time to become “your own bank”.

Disclaimer: This is a paid post and should not be considered as news/advice.