Altcoin

What MakerDAO’s new proposals mean for MKR

In the face of a bear market, MakerDAO is unwavering, presenting substantial protocol changes.

- MakerDAO governance remained active amid a slow market.

- A governance poll could double Maker’s T-bill allocation, leading to increased revenue and buyback.

Despite the bear market affecting many cryptocurrencies and protocols, MakerDAO[MKR] remained resilient, pushing forward with proposals to enhance the protocol.

Is your portfolio green? Check out the MKR Profit Calculator

More polls, more goals

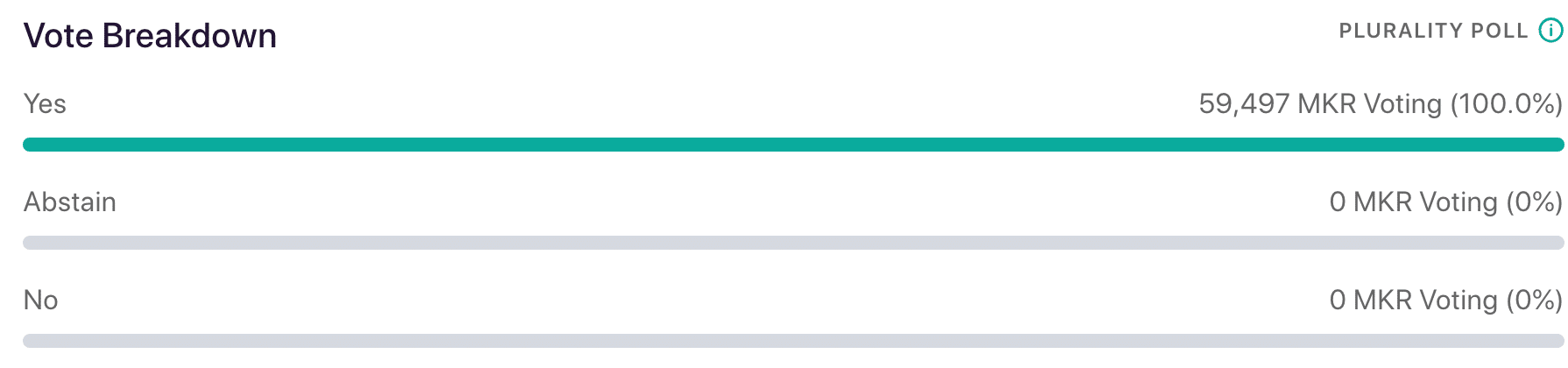

Recently, a poll on Maker’s governance board aimed to reactivate the Debt Ceiling Instant Access Module, allowing users to adjust debt ceilings for real-world asset vaults within specific limits.

The proposed changes include a maximum debt ceiling of 3 billion DAI, a target available debt of 50 million DAI, and a cooldown period for ceiling increases set at 24 hours.

If the proposal is approved, MakerDAO would allocate a significantly larger portion of its assets to Treasury Bills (T-bills), which are low-risk, short-term government bonds. Doubling the allocation means that MakerDAO would invest a much larger amount of its funds into these T-bills than it currently does.

By allocating more funds to T-bills, MakerDAO could earn more interest income. T-bills typically pay interest to their holders, and by investing more in them, MakerDAO would generate additional revenue from these interest payments.

Maker Governance Proposal To Double T-Bill Allocation

A poll has been posted to Maker’s governance board that seeks to reactivate the Debt ceiling instant access module which used to allow users to adjust the debt ceiling of their real world asset vaults within constraints.

The… pic.twitter.com/2Pq1YjECxO

— ASXN (@asxn_r) September 26, 2023

Apart from MakerDAO, the tokenized public security market in general has also been active. It has a current value of $343 million and 6% month-over-month growth according to Seb Ventures’ data

.The launch of three permissionless tokens in this space (OSDY, USDM, stEUR) in September suggested the increasing popularity of tokenized securities.

State of MakerDAO and MKR

Despite the growing number of proposals on the MakerDAO governance, there was a decline in revenue observed on the protocol.

According to token terminal’s data, a 37.8% drop was recorded in protocol-generated revenue over the last month. This could be due to various factors, including market conditions and changes in user behavior.

Realistic or not, here’s MKR’s market cap in BTC terms

The price of MKR, MakerDAO’s native token, in contrast saw substantial growth, reaching $1407 at the time of writing. This surge in price indicated investor confidence and interest in the protocol’s developments.

While the number of MKR holders remained relatively stable during this period, there was a notable increase in velocity. This suggested that existing holders might have become more active in trading or utilizing MKR within the MakerDAO ecosystem.