Altcoin

What Polygon zkEVM’s victory over zkSync Era means

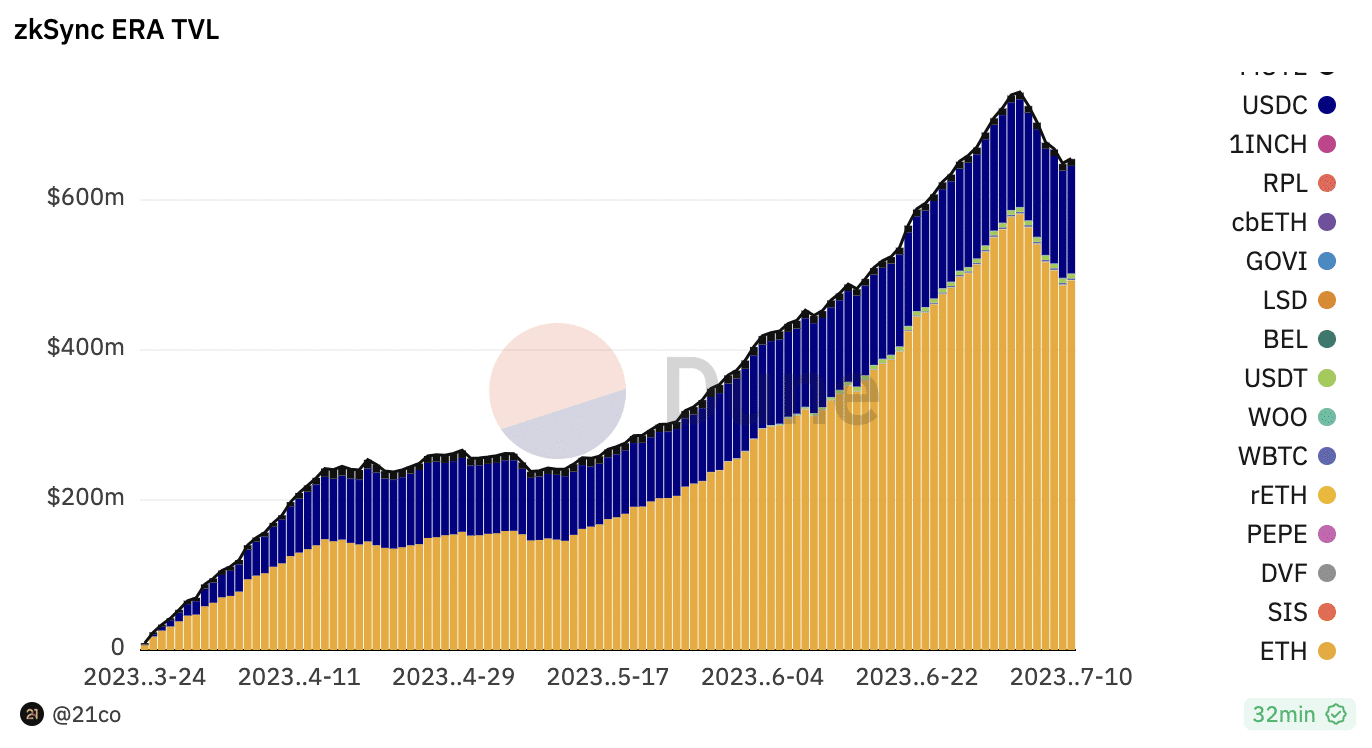

Polygon zkEVM’s TVL climbed by 2% in the last week, while a major outflow led to a 12% fall in zkSync Era’s TVL.

- Polygon zkEVM saw growth in the last week, while that of zkSync Era fell for the first time.

- MATIC’s price spent the last week in a narrow range.

The total value of assets locked (TVL) on Polygon [MATIC] zkEVM increased by 2% in the last week, while zkSync Era recorded a 12% drop in TVL during the same period, according to data from Dune Analytics.

Read Polygon’s [MATIC] Price Prediction 2023-24

In a tweet published on 10 July, on-chain analyst Tom Wan noted that before last week’s decline zkSync Era’s TVL had maintained an uptrend. Wan found further that the sudden TVL drop was attributable to the withdrawal of 55,000ETH (around $ 100 million) by a single Gateio Deposit address from the Layer 2 (L2) chain.

Also, Wan said:

“The stats are hinting zkSync Era has many Sybil addresses (new users, large portion of the addresses have not used arb/op before), it’s is likely that many of those 1.12M unique depositing addresses belong to the same entity.”

Hello, Polygon zkEVM

The mainnet beta version of Polygon zkEVM was launched on 27 March, and per data from Polygon, it has since recorded 161,517 cumulative wallets count. Interestingly, only a small percentage of these wallets actively complete transactions on the L2 platform.

With an active wallet count of 10,627 as of 8 July, only 6% of the total wallets on Polygon zkEVM participated in any form of on-chain activity.

Although the count of active wallets on the chain remained low, daily transactions executed on Polygon zkEVM witnessed a steep surge since the beginning of June. According to data from PolygonScan, the daily transactions count on the scaling network has increased by over 250%.

The reason for the growth in daily transactions on Polygon zkEVM was not far-fetched, as data from PolygonScan revealed a significant decline in the average gas price spent on transactions on the network since May.

The decrease in gas fees likely played a role in attracting new users to the platform. Additionally, it would have incentivized existing users to conduct more transactions on the chain. This likelihood is supported by the rise in daily gas usage, indicating an increased utilization of the zkEVM platform.

MATIC sellers are in charge now

MATIC spent the last week oscillating within a narrow price range. At press time, MATIC exchanged hands at $0.6772, logging a 1% decline in value in the past 24 hours, according to

CoinMarketCap.Is your portfolio green? Check out the Polygon Profit Calculator

On a daily chart, key momentum indicators Relative Strength Index and Money Flow Index, trended downwards. They were both positioned beneath their respective center lines. This signaled an uptick in MATIC distribution.

Increased MATIC sell-off was made obvious by assessing the alt’s Directional Movement Index. At the time of writing, the sellers’ strength (red) at 21.25 rested solidly above the buyers at 18.53