What role are Bitcoin’s hodlers playing in this market cycle?

Bitcoin’s price is rangebound in the current market cycle. Both fundamental and technical analysts will tell you there were ample buying opportunities and local bottoms since the price crossed $20k. But is that all there is? Every local bottom is unlike the previous one, some are close together on the price chart, and buying a local bottom is only as profitable as the bounce back in price, within a tight time frame. Additionally, it relies heavily on the volatility of the asset, and interestingly, the below metric shows that many retail traders continue to be on the fence.

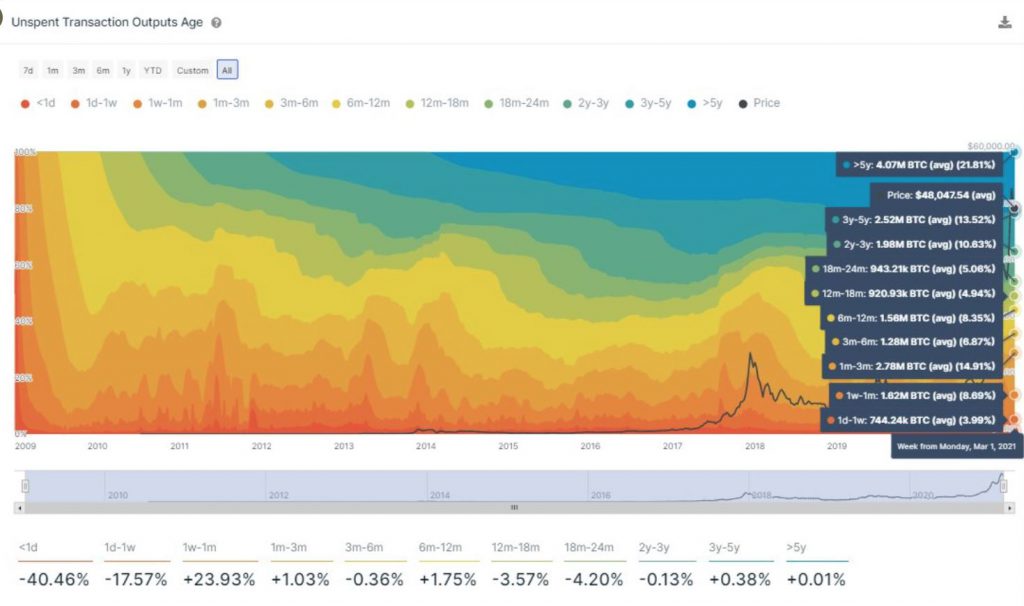

In the past 5 years, based on this chart, 21.81% of the total Bitcoin circulating supply hasn’t been moved at all. This is a significant indicator and since Bitcoin hit an ATH of $58330, a large percentage of the supply was active. Additionally, active supply had hit an ATH several times before the price hit an ATH.

Added to this, HODLer patterns have changed. The supply that was dormant for 7+ years was active on spot exchanges. This coincided with the time when institutions were accumulating Bitcoin. And this 21.81% did not move on the network, even during the latest ATH. What’s more, is that not all of this can be attributed to lost or stolen Bitcoin. This signals that there is a significant percentage of HODLers waiting to make the next move with their dormant Bitcoin.

On exchanges, the NetFlow continues to remain positive and there are more Bitcoin hitting exchanges than the quantity that leaves. There is a steady inflow from miners, whales, and retail traders and this inflow is significantly higher than previous stages in the market cycle. The scarcity narrative is out of the question and this signals a likelihood of a drop in Bitcoin’s price.

However, HODLer activity has not registered an increase despite this. The on-chain analysis also signals a bearish sentiment currently and unless there is a change in the Bitcoin held dormant, the price shift on spot exchanges may be largely a reflection of whale activity on derivatives exchanges and institutional investment inflow.

![Ethereum [ETH] targets $1,810 – Will THIS crucial level ignite a breakout?](https://ambcrypto.com/wp-content/uploads/2025/04/Gladys-59-400x240.jpg)