What these metrics indicate about Algorand, Solana, Cosmos, vis-à-vis Ethereum

Ethereum being the second-biggest cryptocurrency on the planet faces its fair share of competition in the market. To add to that is the booming DeFi and smart contract functionality of many chains and protocols, which make them a competitor as well.

However, the second-generation cryptocurrency does lead in terms of return on investments. But is it possible, one of these 3 alts could compete with it?

Better returns than Ethereum?

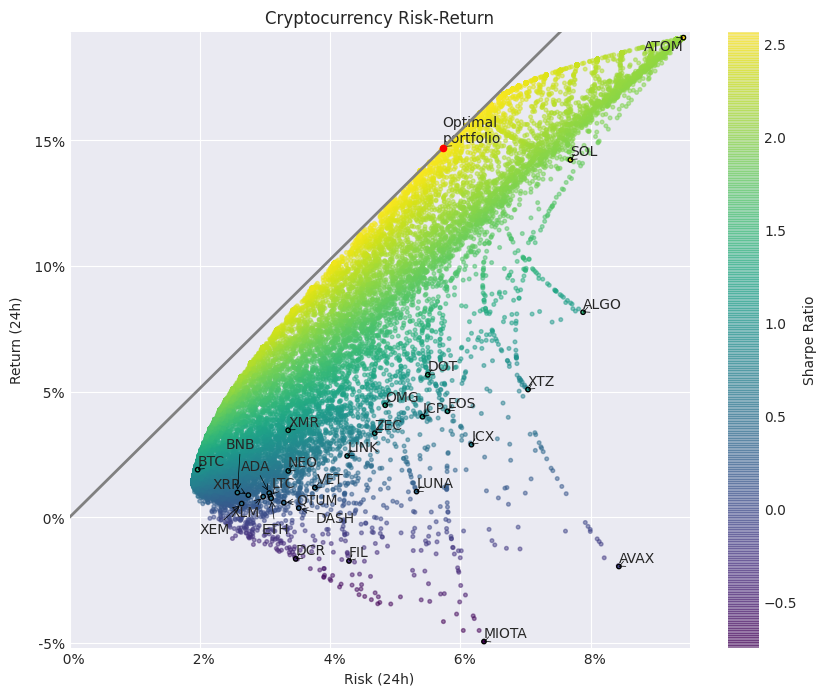

At least on paper. In the past 24 hours, analysis of various crypto tokens’ Sharpe Ratios bore some interesting results. ATOM, SOL and ALGO, all appear to be promising better results than other major assets, including Ethereum.

A lot of factors contribute to their surprising growth ranging all the way from investor participation to their recent developments.

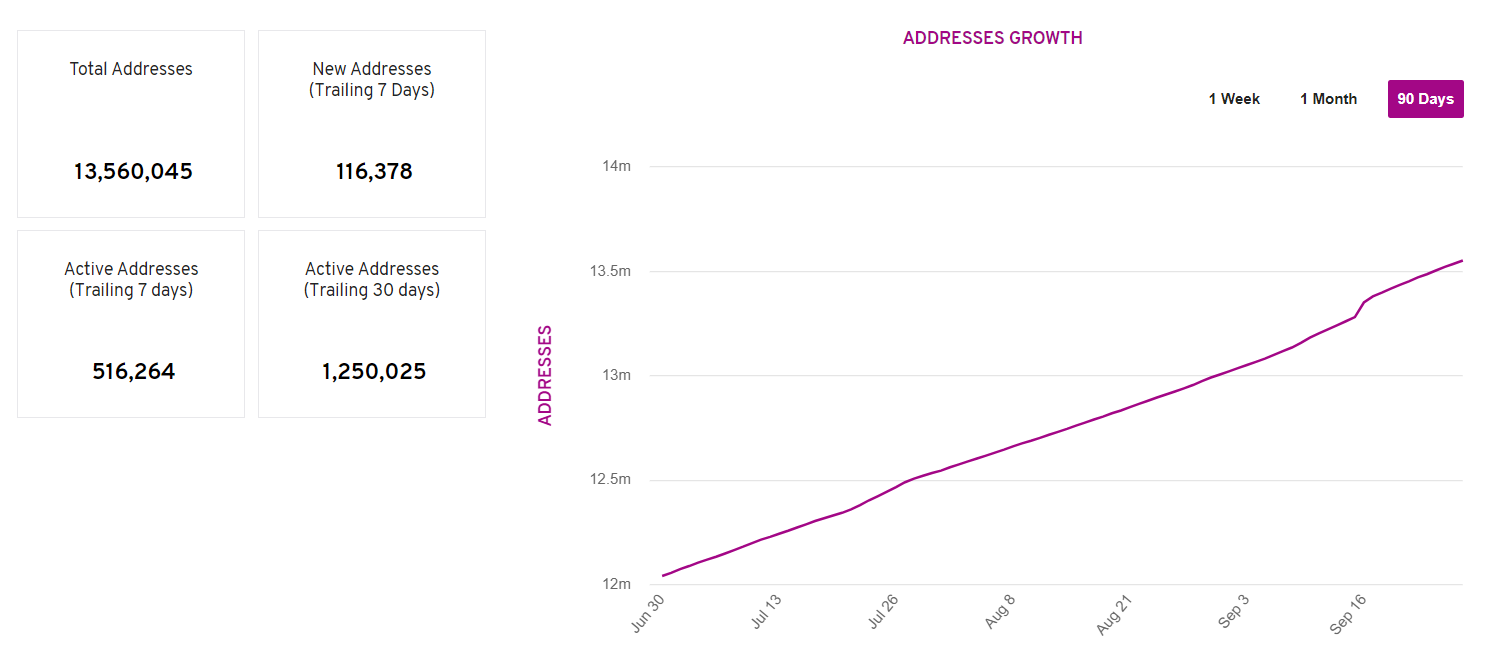

Algorand for one, has been a very attractive asset for a lot of of its customers. 3 days ago, the network achieved the milestone of registering 13.5 million addresses. What’s also surprising is that just at the beginning of the month it had reached 13 million addresses.

Algorand address growth | Source: Algorand

The reason behind the phenomenal pace of its rise is also attributed to the news of El Salvador’s government’s infrastructure being built on Algorand.

Solana on the other hand has DeFi to be credited for its rise. In less than a month its TVL has risen by almost 3 times to touch $9.1 billion. Even at press time, it is up by 7.8%, making it one of the best-performing assets.

Thanks to its low volatility, the altcoin has been seeing a significant rise in demand as well. Buy orders have been ranging from 2 million to 11 million SOL on a daily basis.

Solana buy-sell volume | Source: Coinalyze – AMBCrypto

Cosmos, known for its inter-operability, about a month ago announced the arrival of DeFi to the network via a cross-chain portal. It came as no surprise that since the news, the coins’ value rose by almost 91% in less than a month. Trading at $38.8, ATOM also created a new all-time high this month.

Cosmos 91% rise | Source: TradingView – AMBCrypto

Are they good for investment?

While they do display a solid result in terms of network performance and have been giving strong returns, their price movement doesn’t guarantee a rally always. Their correlation to Bitcoin is somewhat iffy – Algorand is at 0.57, Cosmos at 0.6, and Solana at 0.67.

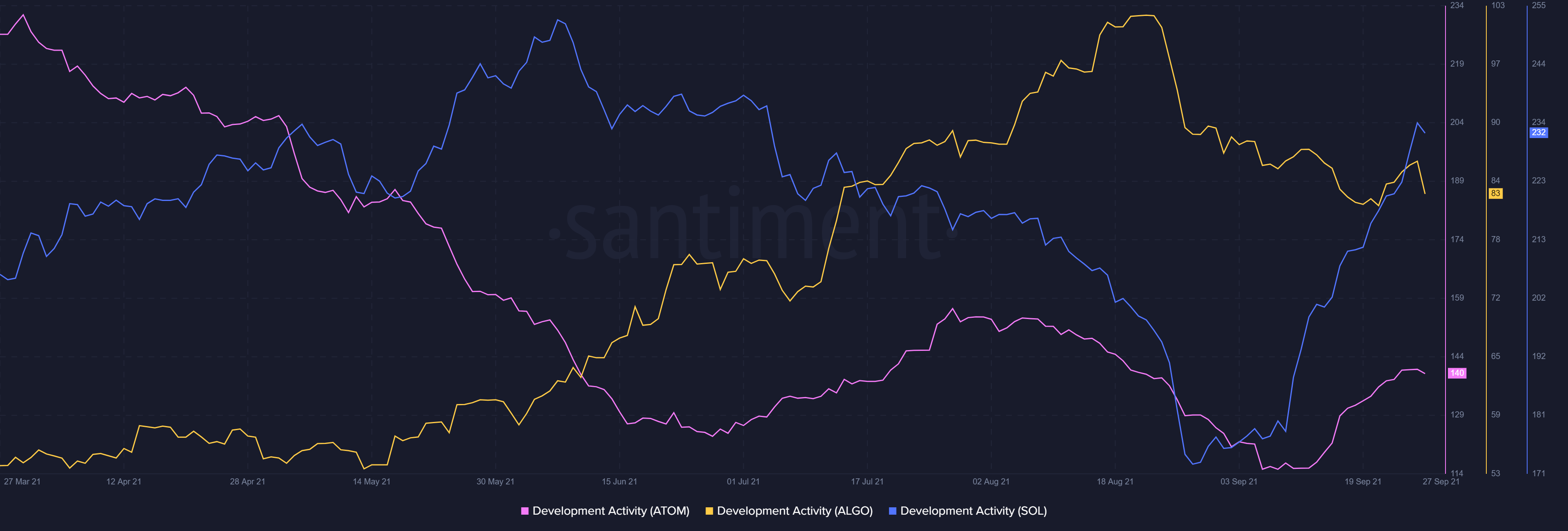

However, all three tokens’ networks have continuous development activity running with some major boost observed this month.

Development activities | Source: Santiment – AMBCrypto

So the data is right here and the decision is yours too. But always DYOR before making any investment.