What XRP’s rising exchange supply tells you about its future prices

- XRP was at risk of a breakdown after trading within a consolidation phase, with analysts predicting a possible drop to $0.4319.

- Supporting evidence from various market indicators strengthens the forecast of an impending fall.

On the daily chart, Ripple [XRP] has been underperforming, and the trend appears set to continue. It has already experienced a 1.71% decline, with expectations of further decreases.

XRP consolidation could lead to a breakdown

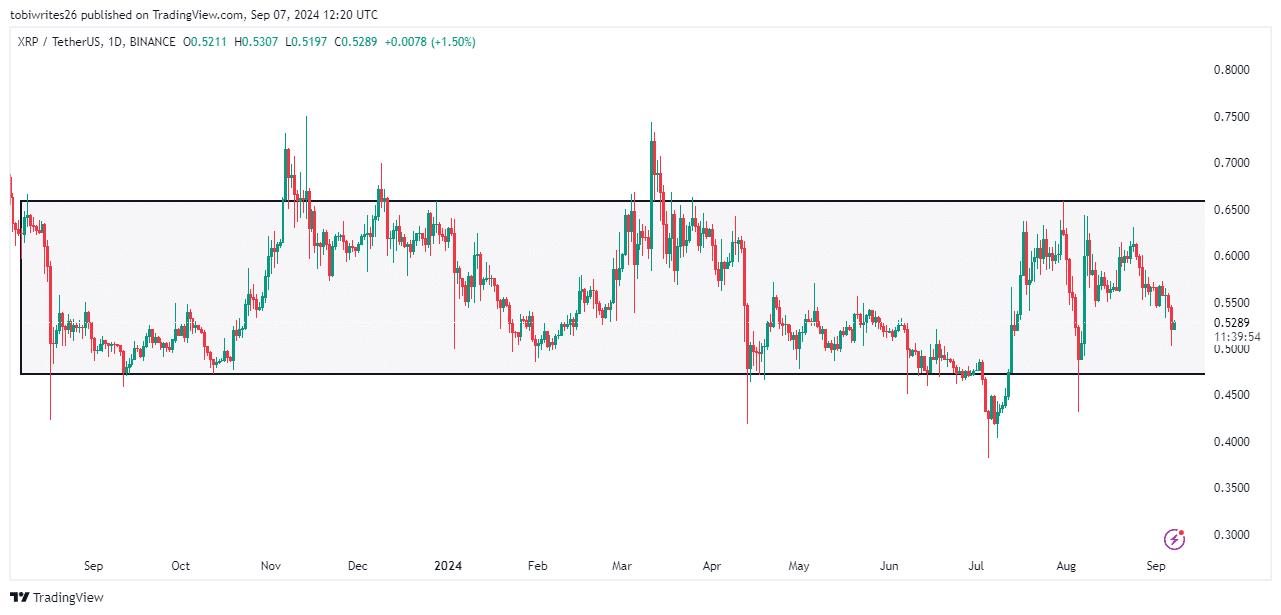

XRP has been consolidating within a defined daily range for over a year, a movement that began in August according to AMBCrypto’s chart analysis.

Consolidation phases typically represent periods of accumulation, where the price oscillates between the upper and lower bounds of a rectangle, often setting the stage for either a significant breakdown or breakout.

As of this writing, XRP has recently rebounded from the upper bound or resistance line and is likely to descend to the bottom of the channel where buying pressure could potentially drive its price higher, continuing its pattern of oscillation.

However, AMBCrypto reports that the selling pressure has intensified, suggesting that the lower bound or support line may not hold which will cause a further decline in the asset’s value.

Increased supply places sell pressure

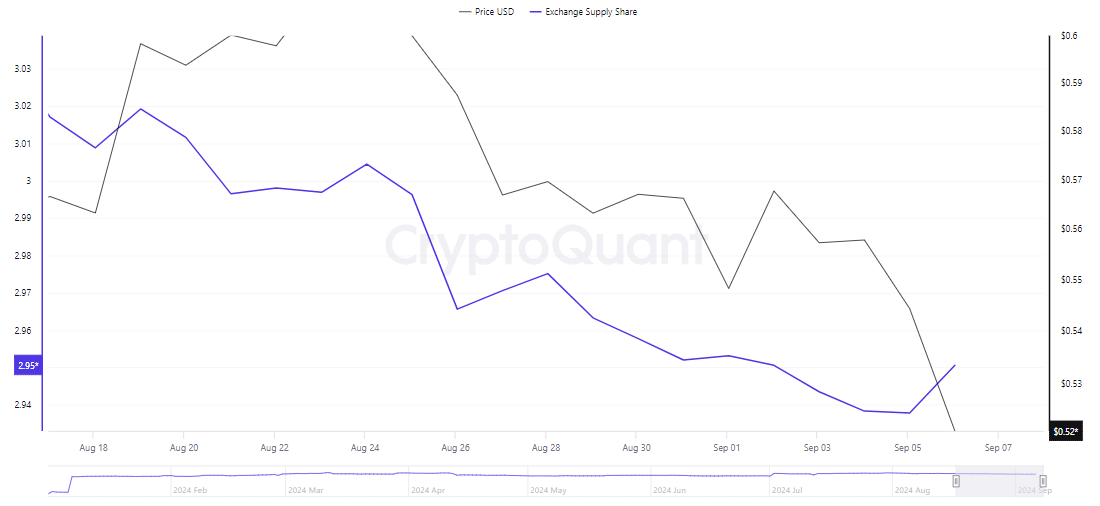

AMBCrypto’s analysis using data by Cryptoquant indicates a notable increase in the Exchange Supply Share of XRP over the last 24 hours, suggesting a potential major drop in its price.

This increase points to a higher availability of the token on exchanges, creating downward pressure on its price due to the influx of potential sellers.

A significant surge in supply, often influenced by whales transferring large quantities of XRP to exchanges for sale, has been observed. \

Recently, Lookonchain recorded a transaction where a whale moved 95 million XRP, equivalent to over $49 million, in recent hours with more transactions recorded.

Moreover, according to Cryptoquant, there has been a steady rise in the exchange inflow of XRP since the beginning of the month, further increasing the total supply on exchanges.

Retail traders’ activity adds to bearish move for XRP

A detailed analysis of Open Interest (OI) from Coinglass, which tracks unsettled transactions, shows a significant decline of 7.02% to $563.97 million which suggests that retail traders are increasingly active, with potential implications for a lower XRP price.

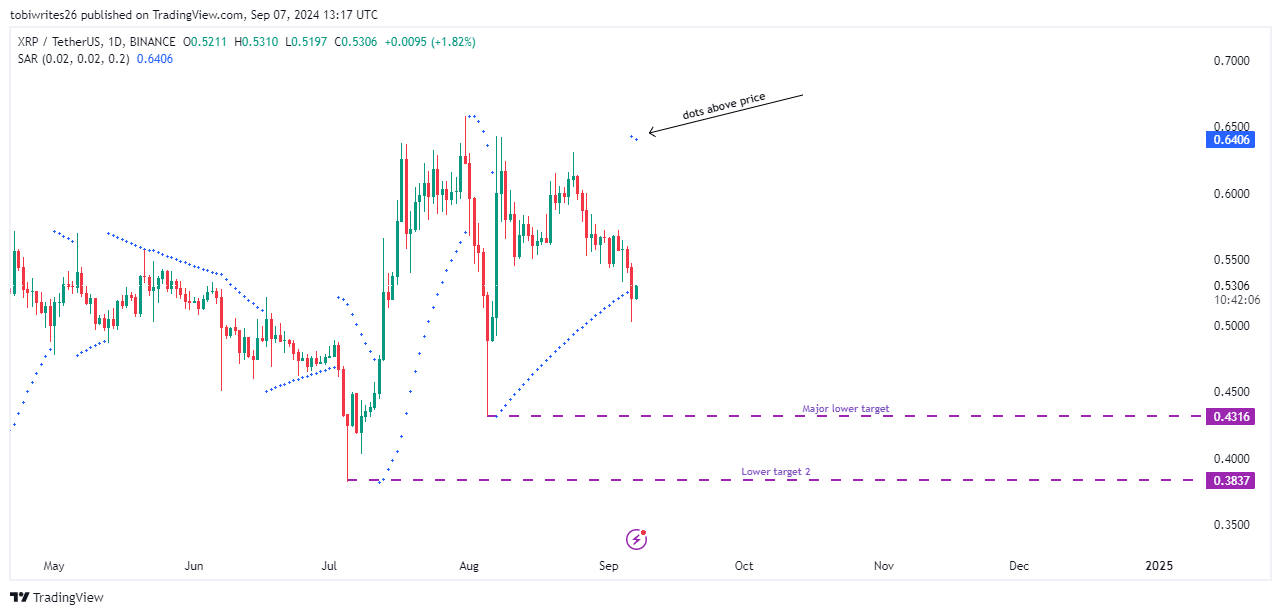

This bearish outlook is further supported by the Parabolic SAR (Stop and Reverse) indicator.

The Parabolic SAR helps identify potential price reversals and momentum, marked by dots that appear above or below price bars on charts. A change in the position of these dots indicates a trend shift.

Read Ripple’s [XRP] Price Prediction 2024-25

For XRP, the Parabolic SAR has appeared above the price bars which signals an anticipated decline in its value in the upcoming trading sessions.

If this downward pressure continues, the token could potentially drop to support levels of $0.4319, or even lower to $0.3823 if selling pressure intensifies.