What you need to know about MakerDAO’s “Smart Burn” mechanism

- MakerDAO’s Smart Burn Engine (SBE) aims to reduce MKR supply, holding potential for MKR’s future.

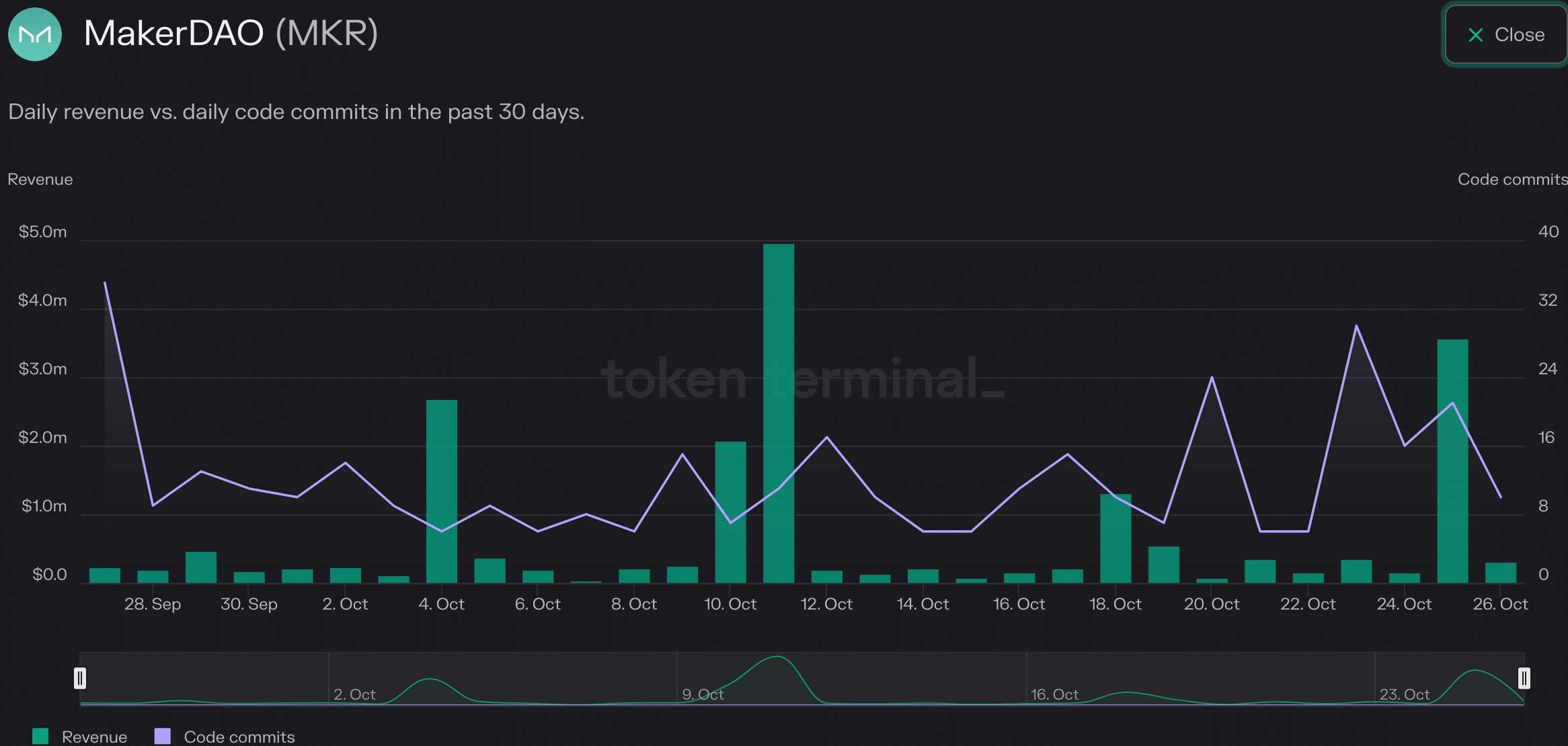

- Revenue surges, but development activity slows.

MakerDAO[MKR], despite losing its top ranking in terms of TVL in 2023, has continued to make progress and developments across various aspects of its protocol.

Is your portfolio green? Check out the MKR Profit Calculator

Smart Burn Engine Ignites MakerDAO

MakerDAO introduced the Smart Burn Engine (SBE) on 5 July, 2023, designed to “burn” MKR by utilizing protocol surplus.

When the surplus exceeds $50 million, the mechanics kick in. Surplus DAI is used to swap for MKR on Uniswap’s DAI-MKR pool, adding more liquidity.

So far, about $16.2 million in DAI has been spent to acquire MKR, enhancing liquidity.

Based on this growth, an estimated $72.7 million worth of MKR is expected to be purchased by the SBE in the next year. This approach aims to maintain buy pressure on MKR as long as the protocol’s surplus remains above $50 million.

.@MakerDAO introduced its Smart Burn Engine (SBE) on July 5, 2023, designed to ‘burn’ MKR by leveraging protocol surplus. ?

The mechanics activate when the protocol surplus exceeds $50M.

Here’s how it works:

1. Surplus DAI is used to swap for MKR on the Uniswap v2 DAI-MKR… pic.twitter.com/EwvD6iNM4m

— Delphi Digital (@Delphi_Digital) October 27, 2023

The introduction of the Smart Burn Engine holds the potential to significantly impact MakerDAO and its native token MKR.

This innovative mechanism, designed to reduce the MKR supply, benefits token holders and strengthens the project’s fundamentals.

Revenue Surges for MakerDAO

In line with its expansion efforts, MakerDAO witnessed a substantial surge in revenue. According to data from Token Terminal, the protocol’s revenue surged by an impressive 94.4%.

This indicated that MakerDAO’s revenue-generating mechanisms and DeFi activities were effectively contributing to the project’s overall financial health.

While MakerDAO’s revenue was flourishing, development activity within the protocol showed a slowdown. The number of code commits on the MakerDAO GitHub decreased by 19.3% over the last month.

This decline in development activity might be attributed to a focus on refining existing features rather than introducing new ones. It could also signify that MakerDAO is entering a consolidation phase after previous periods of rapid development.

Realistic or not, here’s MKR’s market cap in BTC terms

The MKR token, at the time of writing, was trading at $1373. Although it has been a strong player in the DeFi space, the price of MKR witnessed a decline in recent weeks.

Furthermore, the network growth of the MKR token decreased significantly, suggesting a waning interest from new addresses.