What you need to know about this ‘large outlier’ in the Bitcoin market

Bitcoin has managed to soar from under $30K to above $45K and as the king coin inched closer to its ATH, bullishness was the tune of the hour. However, amid the general price gains as portfolios were expanded and investors went all into the trade, Bitcoin lost momentum. BTC’s upward momentum came to a halt as Bitcoin closed below $44K on August 12, and while this price consolidation didn’t come as a surprise, the falling of certain indicators below the expected levels did.

Institutional interest low?

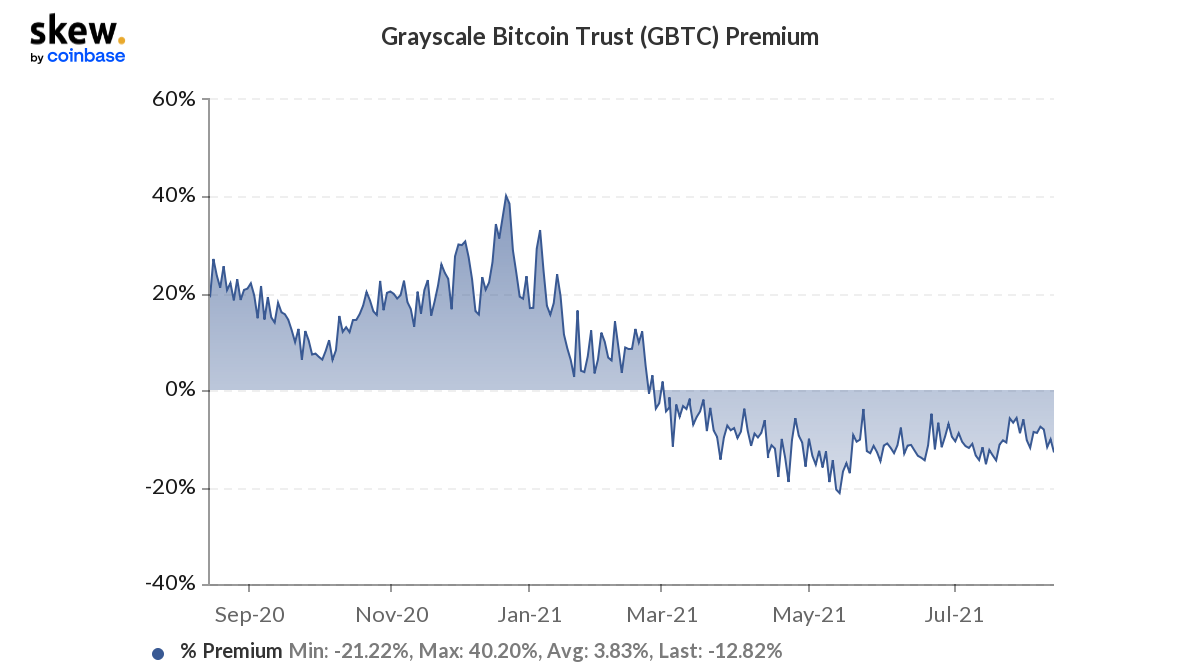

It isn’t unknown that institutional interest in BTC acts as a major catalyst for its price. One metric that gauges institutional interest in the coin is Grayscale Premium, which tracks the capital flows into the Grayscale Bitcoin Trust (GBTC). Oddly, however, as Bitcoin prices kept going up the Grayscale Premium made lows. While the premium has oscillated in the negative territory since March, its values kept depreciating at the time of writing.

A higher Grayscale Premium highlights a higher bitcoin inflow into Grayscale Bitcoin Trust which prompts GBTC to trade at a premium with respect to the BTC spot price. Conversely, a lower premium means a declining BTC inflow, prompting GBTC to trade at a discount to Bitcoin spot pricing. In hindsight, it is notable that the premium’s average stood at 3.83% at the time of writing while its latest value reads -12.8%, which was too low considering BTC’s price.

BTC held by shareholding

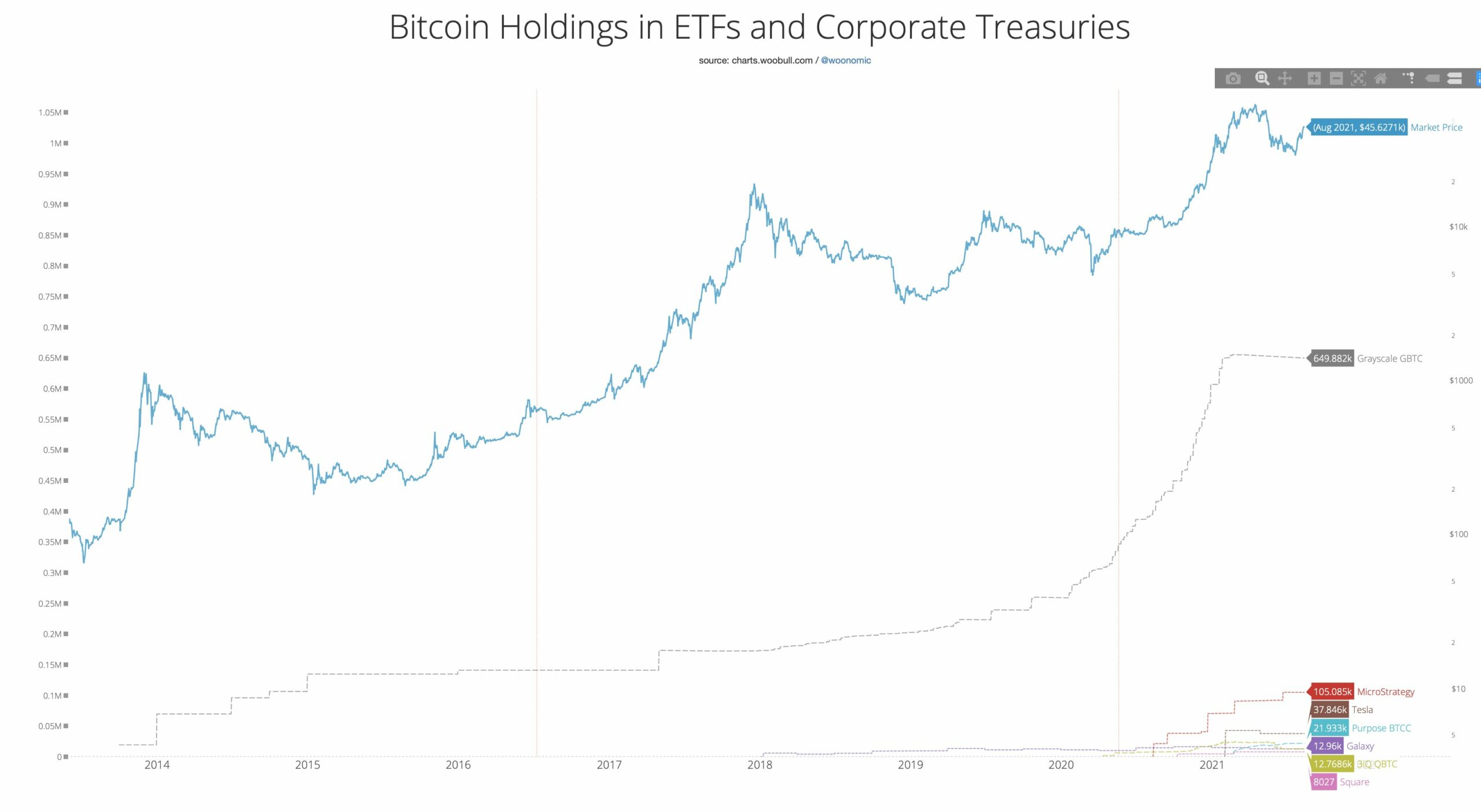

In the light of declining Grayscale premium, it is interesting to take a look at BTC held by shareholding. Recently, Bitcoin analyst Willy Woo highlighted that 0.9% of the supply is inside corporate treasuries while 3.7% is inside ETFs. Here, ‘shareholding’ is what’s “generally available” to the public, i.e. Grayscale and publicly tradeable companies and ETFs.

Woo further highlighted that, ‘It now carries locked-up oversupply from the lucrative arbitrage trade. It is now on a slow bleed due to that over-supply and fees burn.’ He also said:

“Grayscale Trust remains the large outlier. Note their holdings are reducing due to their 2% management fees eating into the balance. To put that into perspective, while Square has accumulated 8027 BTC since October. Grayscale has deducted more than that in fees.”

These bullish signs can’t be ignored

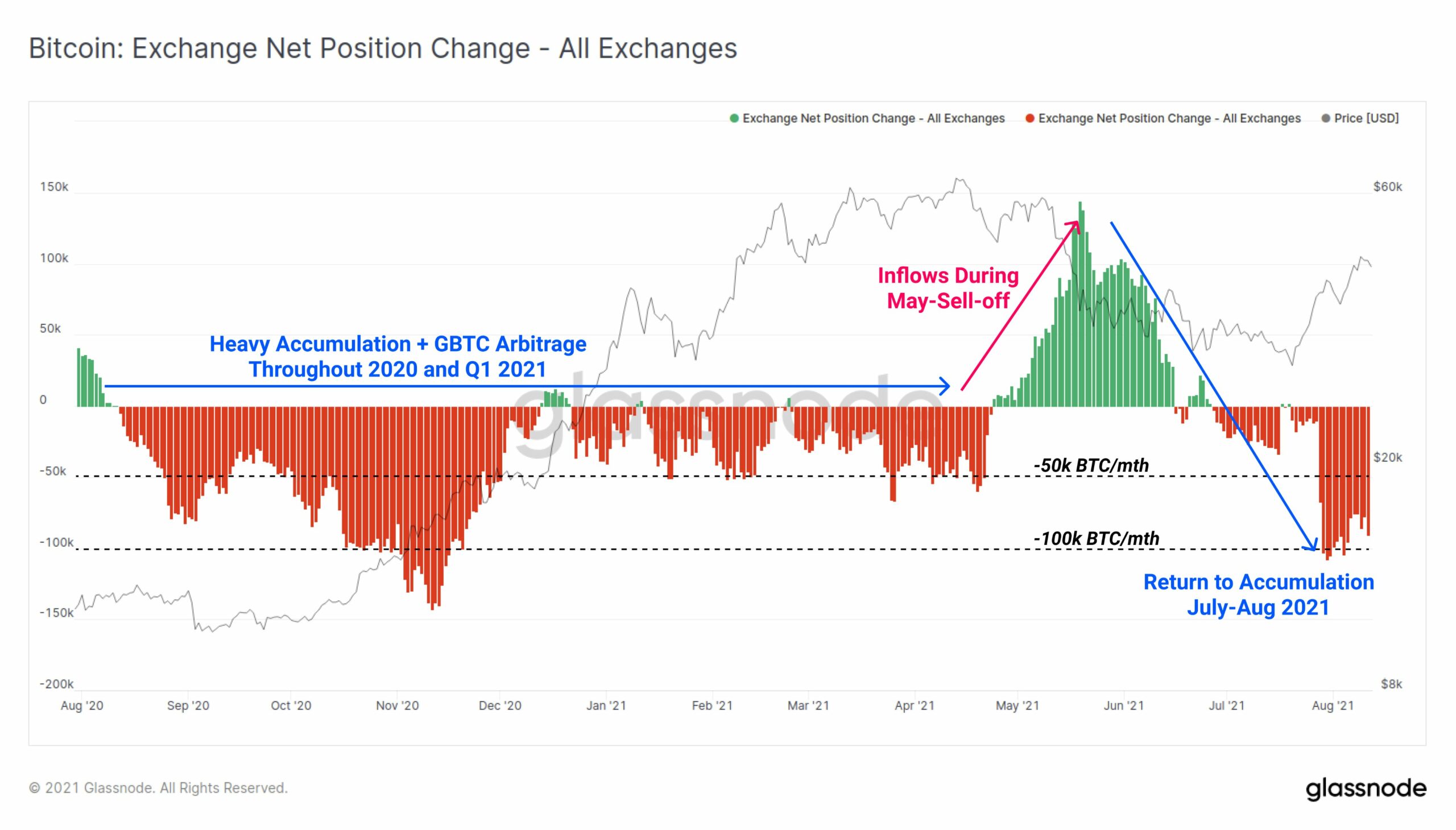

Even though GBTC premium acts as a catalyst for price growth it’s not the sole metric that dictates Bitcoin’s price. In conjunction with that, it was also notable that Bitcoin continued to flow out of exchanges in August at a rate between 75k and 100k per month. Analytics site, Glassnode pointed out that this magnitude of outflow is similar to the period between 2020 and Q1 2021, where heavy accumulation and the GBTC arbitrage trade dominated.

It’s important to note a higher GBTC premium for an ideal rally. That being said, Bitcoin’s network growth was growing faster than ever as 1.2million users were added in just the last 30 days, which pointed to the constantly growing network in spite of the falling prices.