Altcoin

What you need to know as 8.5 mln Lido tokens enter the market this week

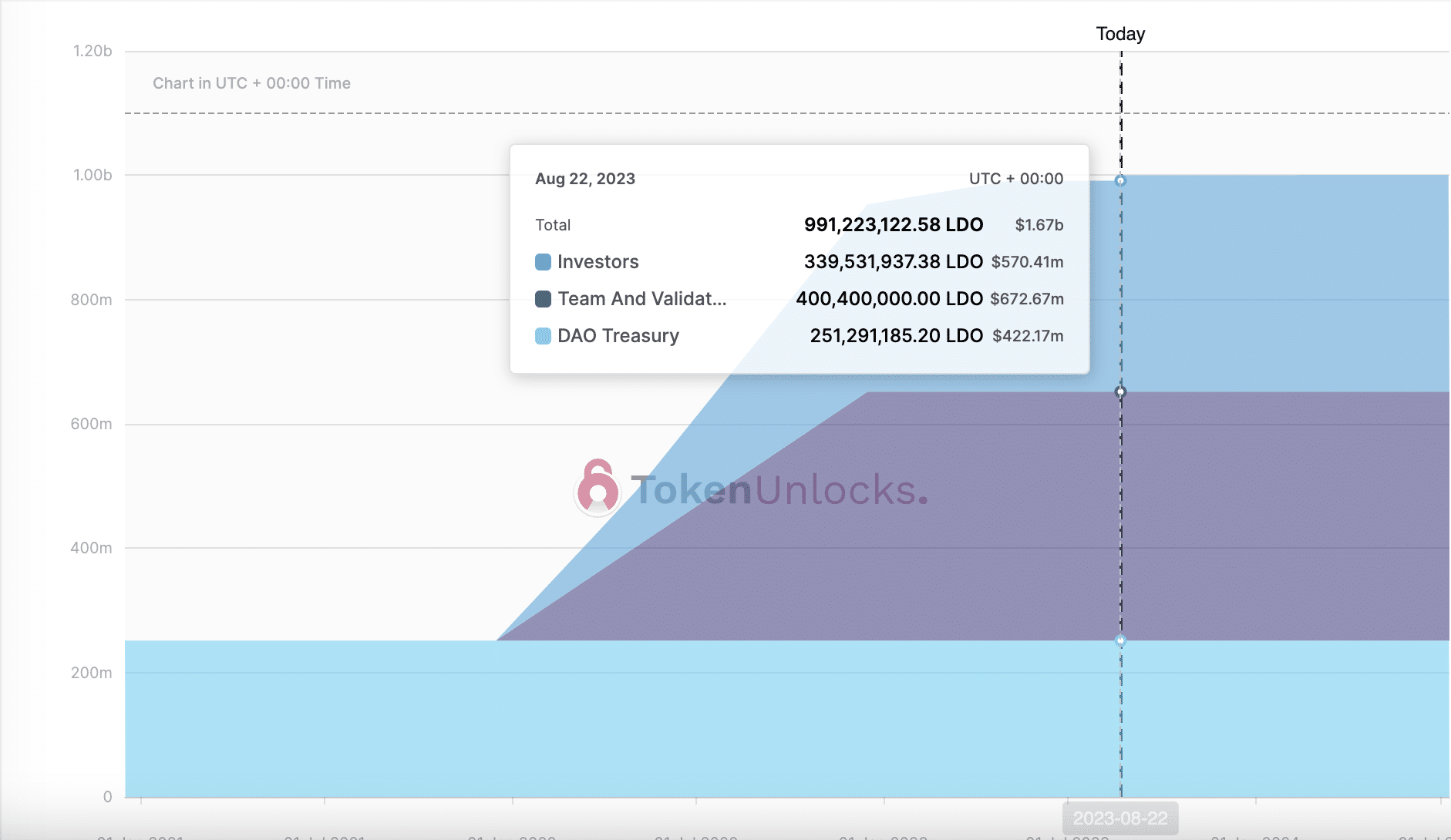

Lido is preparing to release the remaining 0.88% of its previously-locked tokens to investors on 25 August. This will bring LDO’s circulating supply closer to its 1 billion total supply peak.

- Lido’s final cliff unlock will be conducted on 25 August.

- This will see the distribution of the last batch of its locked tokens to its investors.

Multi-platform staking solution provider Lido [LDO] will conduct the final cliff unlock of its tokens on 25 August, according to information retrieved from Token Unlock.

The event will see the unlocking of 8.50 million LDO tokens, which is about 0.97% of the total supply and worth $13.86 million.

Realistic or not, here’s LDO’s market cap in BTC’s terms

According to Token Unlock, the tokens will be released to investors who participated in the Lido DAO token sale. This cohort of LDO holders currently holds 339.53 million LDO tokens worth over $570 million.

LDO has a total supply of 1 billion tokens, with 879.19 million tokens currently in circulation. This represents 88% of the total supply. Upon completion of the token unlock event, 100% of all previously locked LDO tokens will have been released.

Lido is lonely at the top

The liquid staking platform ranks as the leading decentralized finance (DeFi)protocol in terms of asset value. According to DefiLlama, Lido’s total value locked (TVL) was $13.89 billion at press time.

In January, Lido replaced MakerDAO [MKR] to become the number one DeFi protocol as increased Ether (ETH) staking activity in expectation of Ethereum’s Shanghai Upgrade drove traffic to the protocol.

Within six months, Lido’s TVL doubled while Maker dealt with the aftermath of the momentary depeg of its DAI stablecoin. This occurred in March following the unexpected collapse of Silicon Valley Bank, which temporarily caused USDC to lose its parity to the dollar.

In the last week…

A look at the protocol’s performance in the last week revealed a 7.35% decline in Lido’s TVL during that period. The drop in asset value was due to the decline in the tokens’ prices following last week’s deleveraging event in the Bitcoin [BTC] market.

Despite the TVL decline, a look at Lido’s stETH APR on a 7-day moving average revealed a jump, primarily due to the increase in execution layer (EL) rewards. stETH APR refers to the annual percentage yield that users earn by staking their ETH through Lido.

According to Dune Analytics, stETH APR was 4.12 as of 21 August.

On Layer 2 (L2) platforms, the tokenized version of staked Ether wrapped stETH [wstETH] saw some growth in the last week. Per Dune Analytics, wstETH saw an increase of 2.04% over the past seven days on the Arbitrum. On Polygon, the value of wstETH grew by 15%. On Optimism, however, a minor drop of 0.24% was recorded.

Regarding the protocol’s native token LDO, downward market pressure caused its price to slide by 10% in the last week. At press time, the altcoin exchanged hands at $1.64, according to CoinMarketCap.