What you should know about Ethereum’s make or break moment

May-June has passed by the crypto-space in a flash and the 2nd quarter of 2021 is reaching its conclusion. However, there is still one major event left for Ethereum, and it could essentially change the course of its price action going forward into Q3. Within the next 24 hours, Ethereum Options will be undergoing its 2nd Quarterly Expiry, and Options worth over $1.5 billion in Open Interest will be executed.

A week back, with the price position, there was a higher possibility of a bullish reversal for the asset but in light of its press time value, the Options Expiry might, in turn, confirm the bearish market. Here’s why –

June 25th – Clock is ticking against Ethereum?

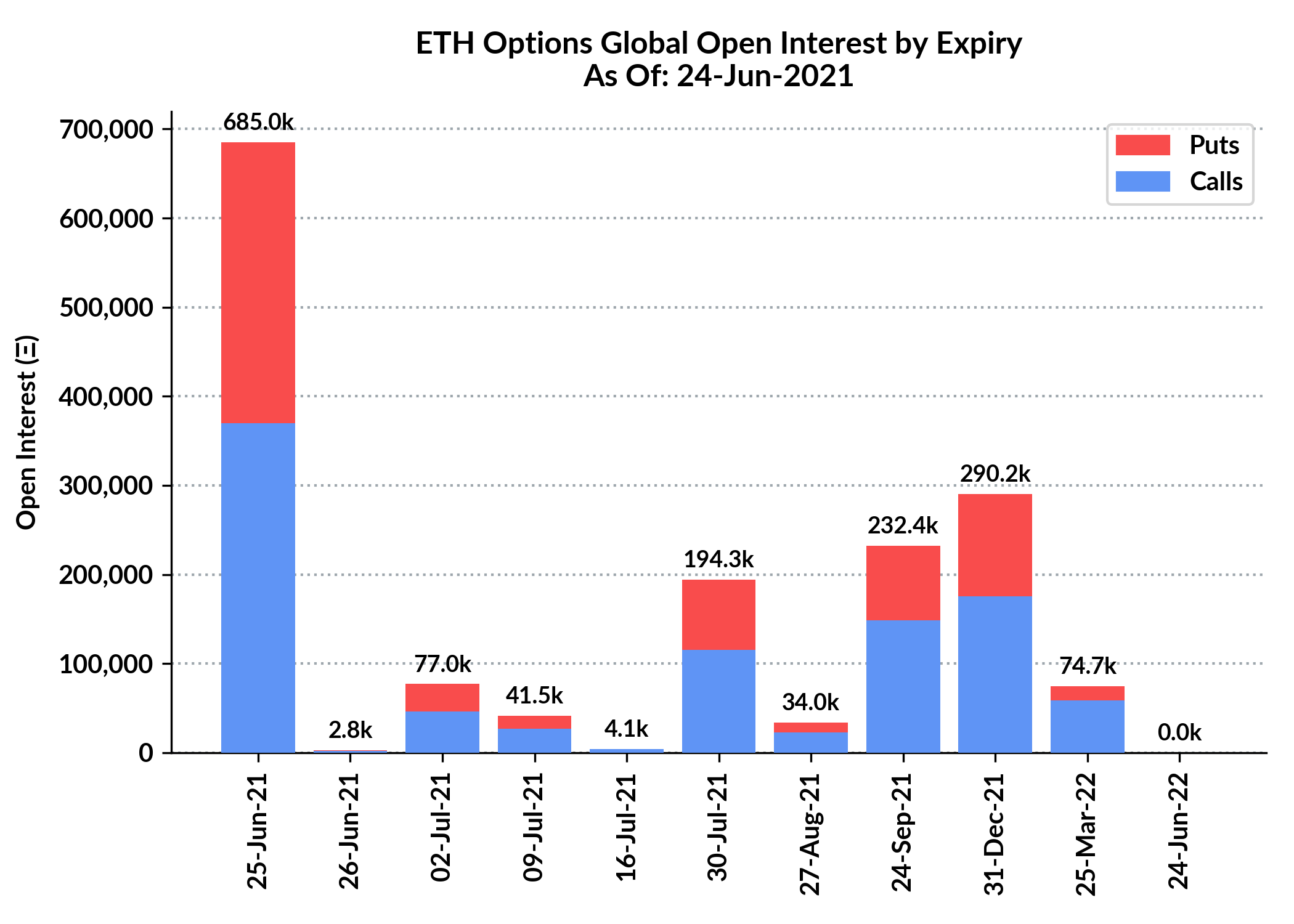

In a previous article, we had indicated that close to 650K ETH were heading towards expiry on 25 June. At press time, the global Open Interest had increased, as indicated by the chart below.

According to Skew, at press time, 685,000 ETH were heading towards expiry in the next 24 hours, worth close to $1.35 billion (the value had decreased from 17th June due to price decline). However, the pretense remains the same. In a previous article, we had mentioned that the expiry may act as a bullish catalyst if the price action of Ethereum is able to consolidate its position above $2,200 on or before the expiry.

Right now, approximately, 101k call options are into play at that particular price, and these are heading towards being worthless.

With more than 80k put options at strike prices of below $2,100, it is possible the bearish pressure will be extended after the expiry. As mentioned in the aforementioned article, the 2nd quarterly expiry is 30% larger than the 1st expiry. And, the 1st Options execution fueled a 60% rally for Ethereum.

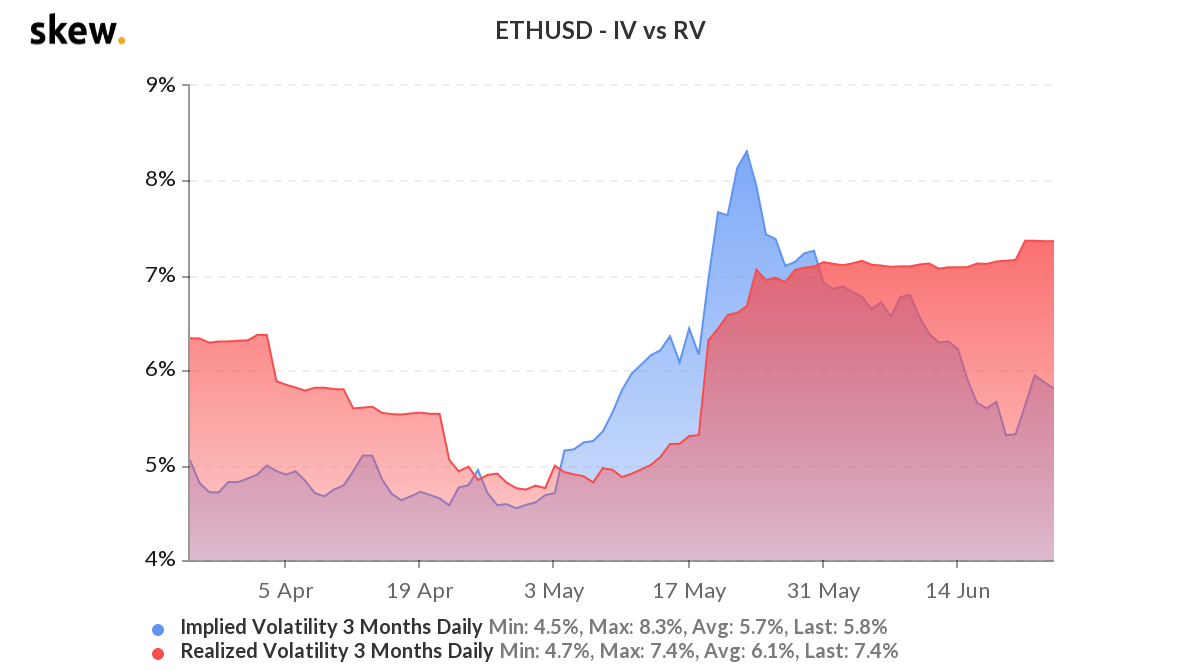

With respect to Implied Volatility as well, the chances of a bullish recovery are bleak. The chart above underlined the fact that rising Implied Vol has been a key factor for the price to break above during the Q1 period. Right now, Realized Volatility is leading Implied on the charts, indicating that any sharp price movements aren’t being expected by the traders any time soon.

At press time, Implied Volatility had reached a low last seen at the beginning of May.

Reversal Dilemma?

Yes, both Ethereum and Bitcoin have recovered relatively well after the drop, but here is the reality – A position has to be defined above $36,000, with a daily candle close to even consider the idea of a bullish realm, while for Ethereum, its threshold remains above $2,500.

The expiry can hurt Ether’s bullish case. Hence, it is plausible that the 2nd Quarterly Options expiry might inevitably kick off a strong bearish cycle.

![Solana [SOL] gains on Ethereum [ETH] but faces sell-off risks](https://ambcrypto.com/wp-content/uploads/2025/04/5B92B32E-5F8B-49F6-94A3-D0086EF6CCA2-400x240.webp)