What you should know about this ‘risky’ Bitcoin element

The month of August saw digital assets make a solid comeback after almost three months of consolidation and dips. In fact, Bitcoin and Ethereum were the real winners, in spite of the S&P 500 and Nasdaq Composite closing out the month at all-time highs.

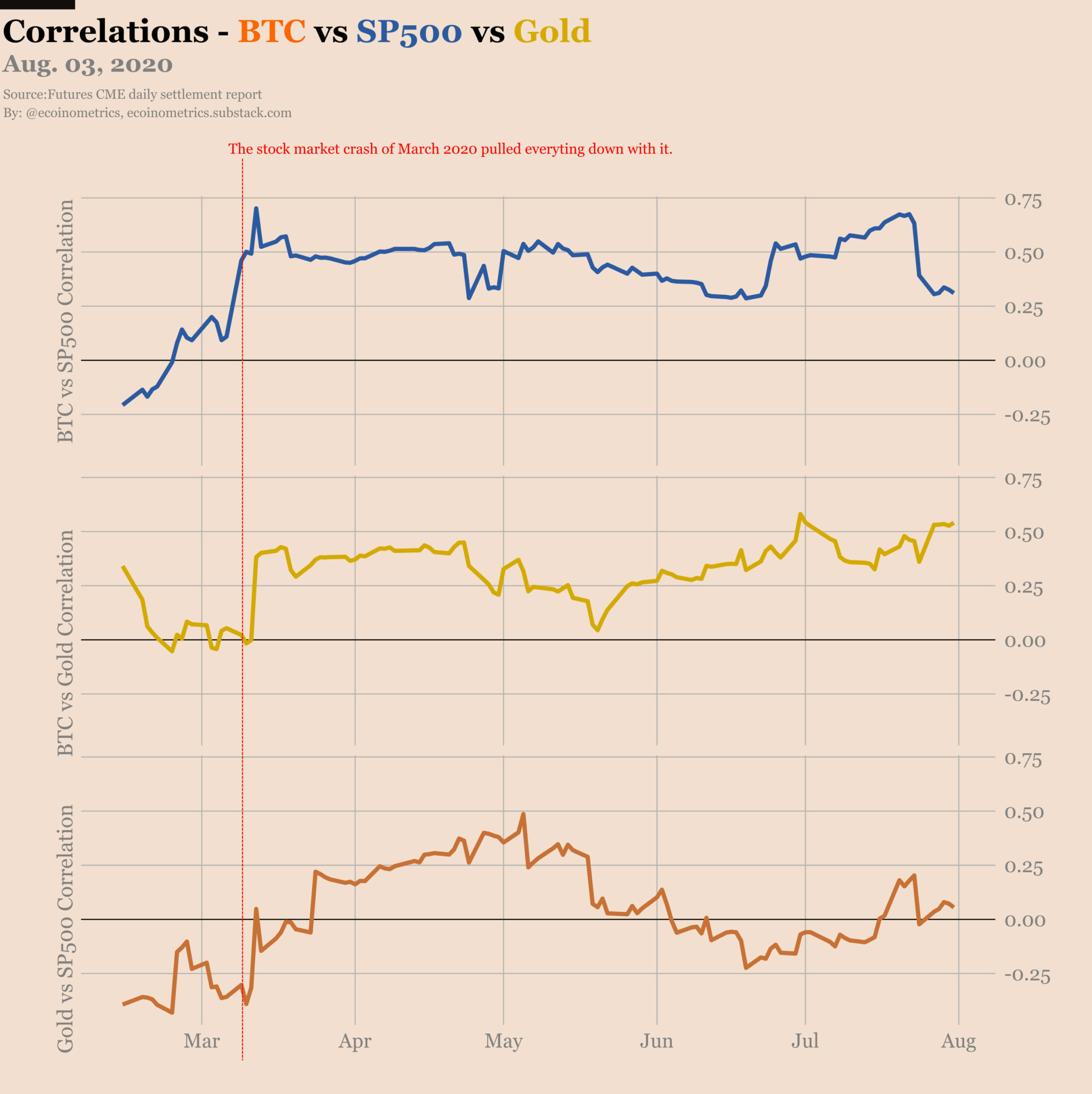

‘BTC and ETH v. stocks’ is an old and endless debate, and the correlation between the two over the years has been a rather general narrative now. While dissimilarities between the two classes have been well-noted in the past, a stark correlation between Bitcoin, other cryptocurrencies, and stocks is one narrative that has been overshadowed.

Bitcoin, crypto, and stocks- It’s all related!

The market has been flooded with reports and analyses of how Bitcoin would remain unaffected by the larger market. However, that’s not entirely true. Take the March 2020 price fall, for instance.

Bitcoin and almost every other cryptocurrency felt the brunt of the same. After COVID hit the United States, the stock market had a big correction, and so did gold and Bitcoin. At that time, the SP500 dropped from its previous top by almost 35%.

Source: Ecoinometrics

It is in this context that the findings of a recent Ecoinometrics report should be read.

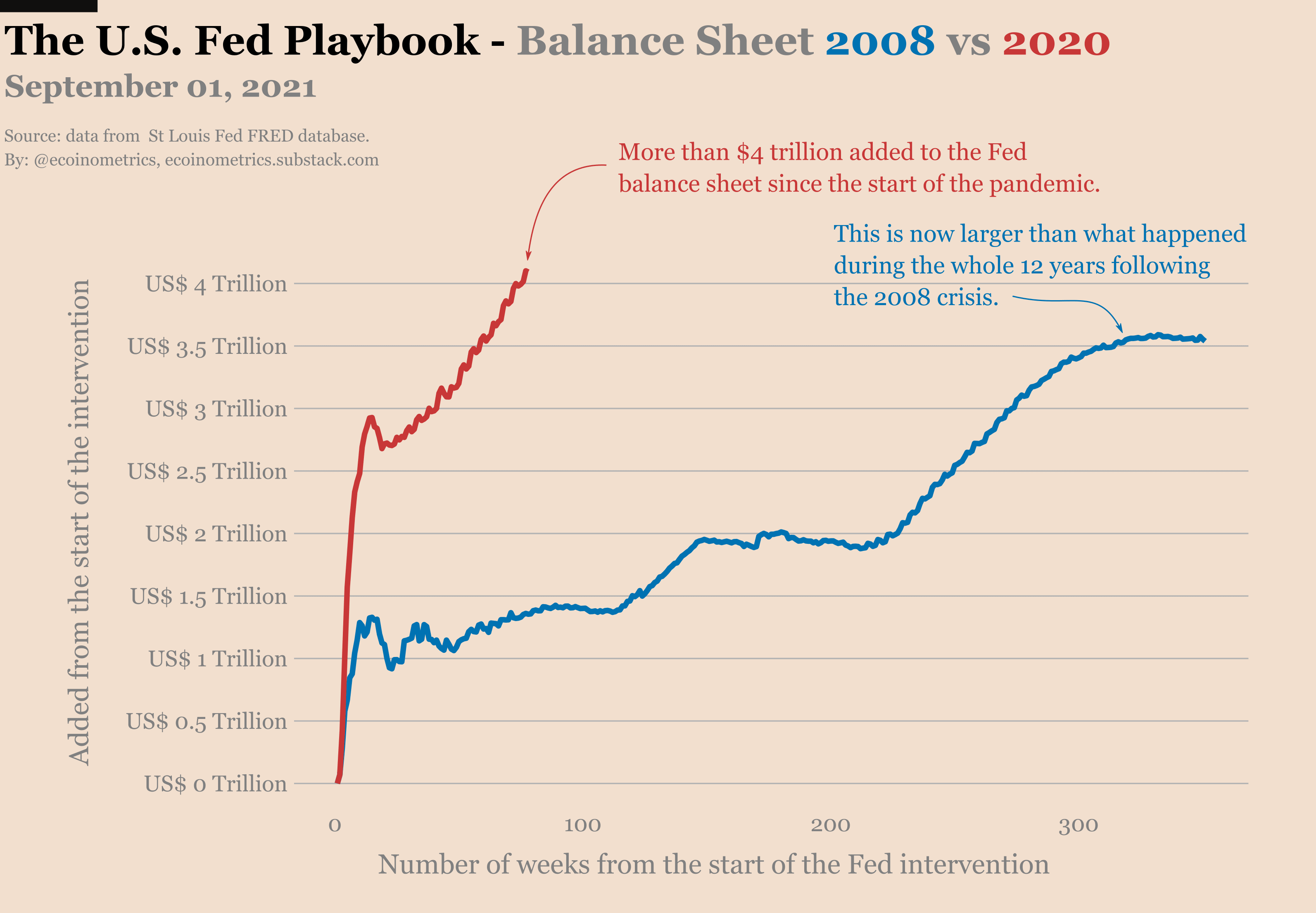

Since the pandemic began, more than $4 trillion has been added to the Fed’s balance sheet. This is more than they had in the 12 years that followed the 2008 financial crisis. In fact, almost $3 trillion was added to the Fed’s balance sheet in just a few weeks last year.

At the moment, while the figure is just above $4 trillion, it’s still counting.

Source: Ecoinometrics

The bothersome fact here is that this is more than they did in the twelve years that followed the 2008 financial crisis. As the financial markets were drowning in liquidity, the stock market was breaking new records.

For instance, the SP500 is up +34% from the top before the March 2020 correction. Now, in this case, if the Fed stops printing money, there could be another liquidity crisis and Bitcoin too wouldn’t be spared from it yet again.

Is Bitcoin becoming risky?

Now, according to the aforementioned report, if the “Fed is not flooding the market with always more liquidity, you are more likely to get bigger corrections.” Thus, since corrections larger than -10% are very likely to impact other markets, then that means if the Fed starts tapering, we increase the risk of seeing a negative impact on Bitcoin by 60%.

What this might imply is that if Bitcoin oscillates around $50k and the market suffers a >10% correction, it could take Bitcoin to low levels of $20k.

With inflation running a bit hot, it is likely that the Federal Reserve will try to taper their purchasing program at some point. When the Fed isn’t expanding its balance sheet, the stock market is 30% more likely to experience a drawdown larger than -5% and 60% more likely to experience a drawdown larger than -10%.

If that happens Bitcoin could see lower levels, leaving the entire crypto-market in a tizzy.

![Why Chainlink [LINK] and Polygon [MATIC] are more similar than you realise](https://ambcrypto.com/wp-content/uploads/2024/04/Chainlink_and_Polygon-1-400x240.webp)