Solana hits a roadblock, one it can get past by…

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

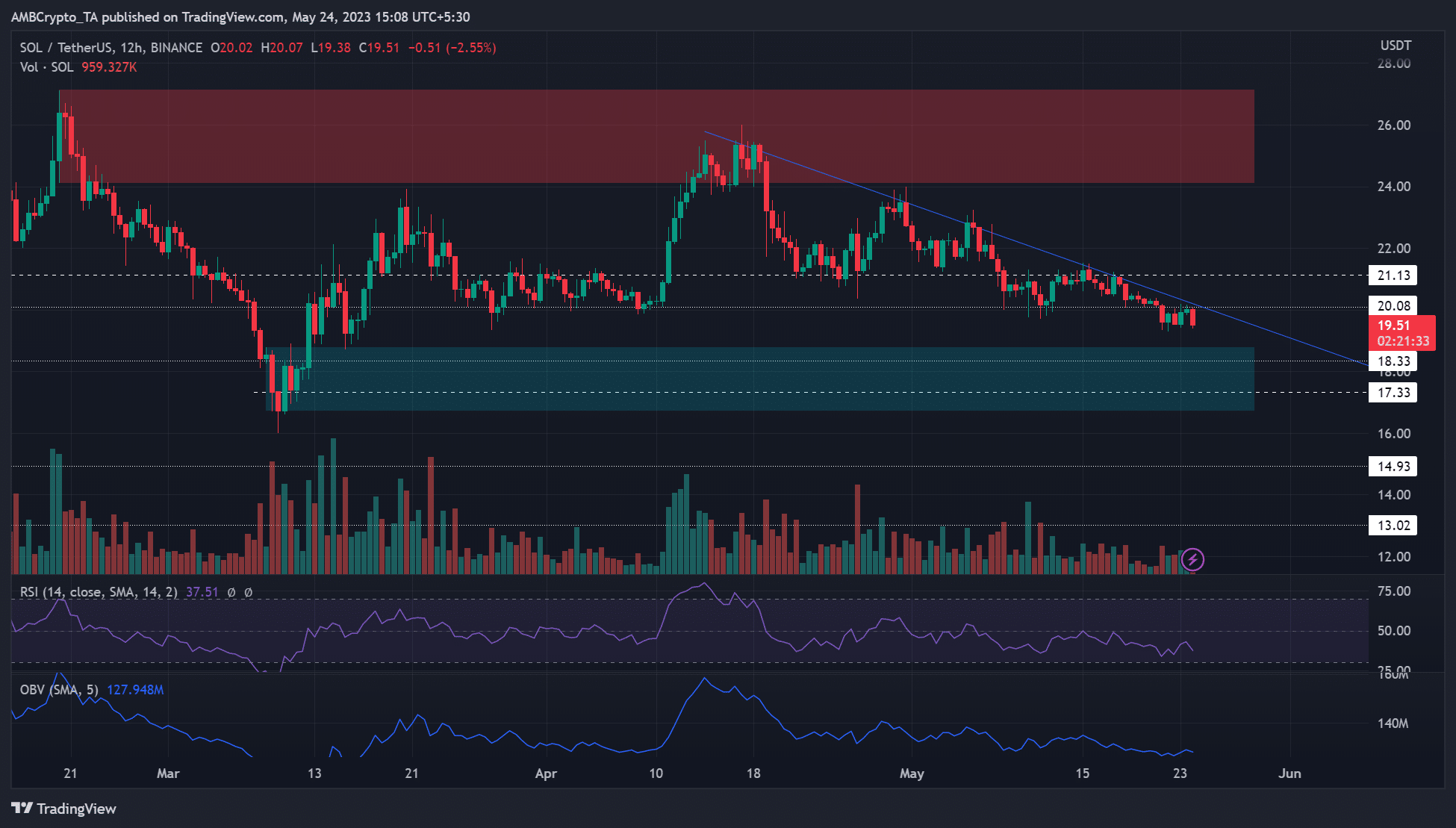

- Trendline resistance has become a key obstacle.

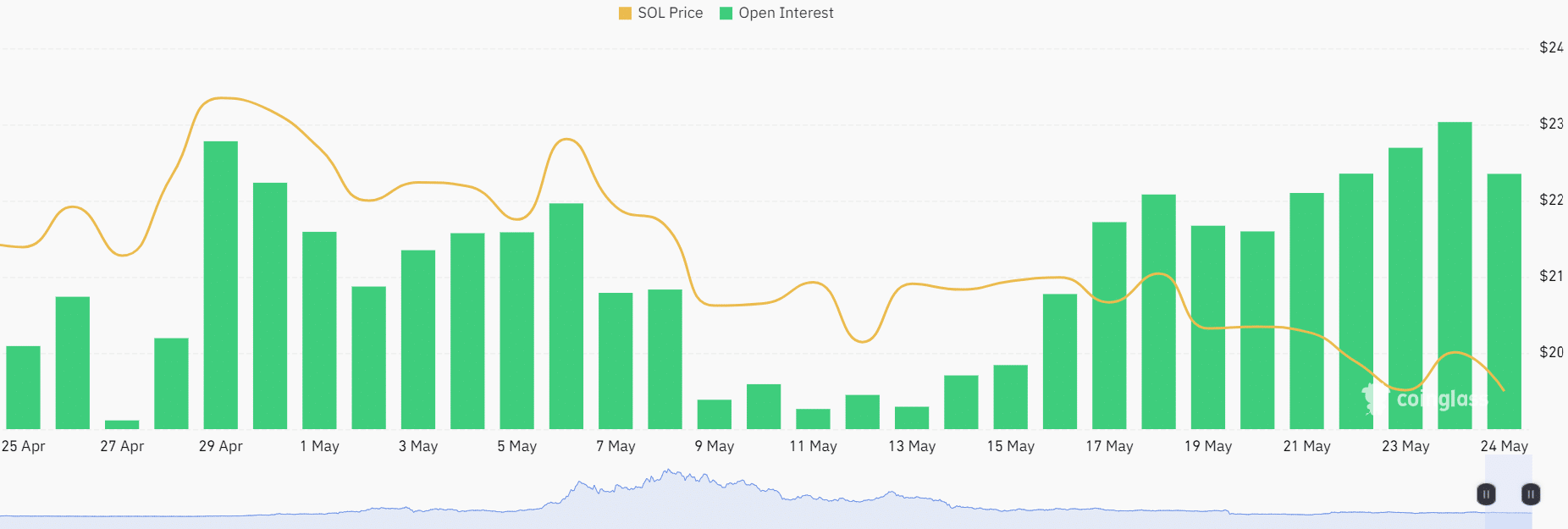

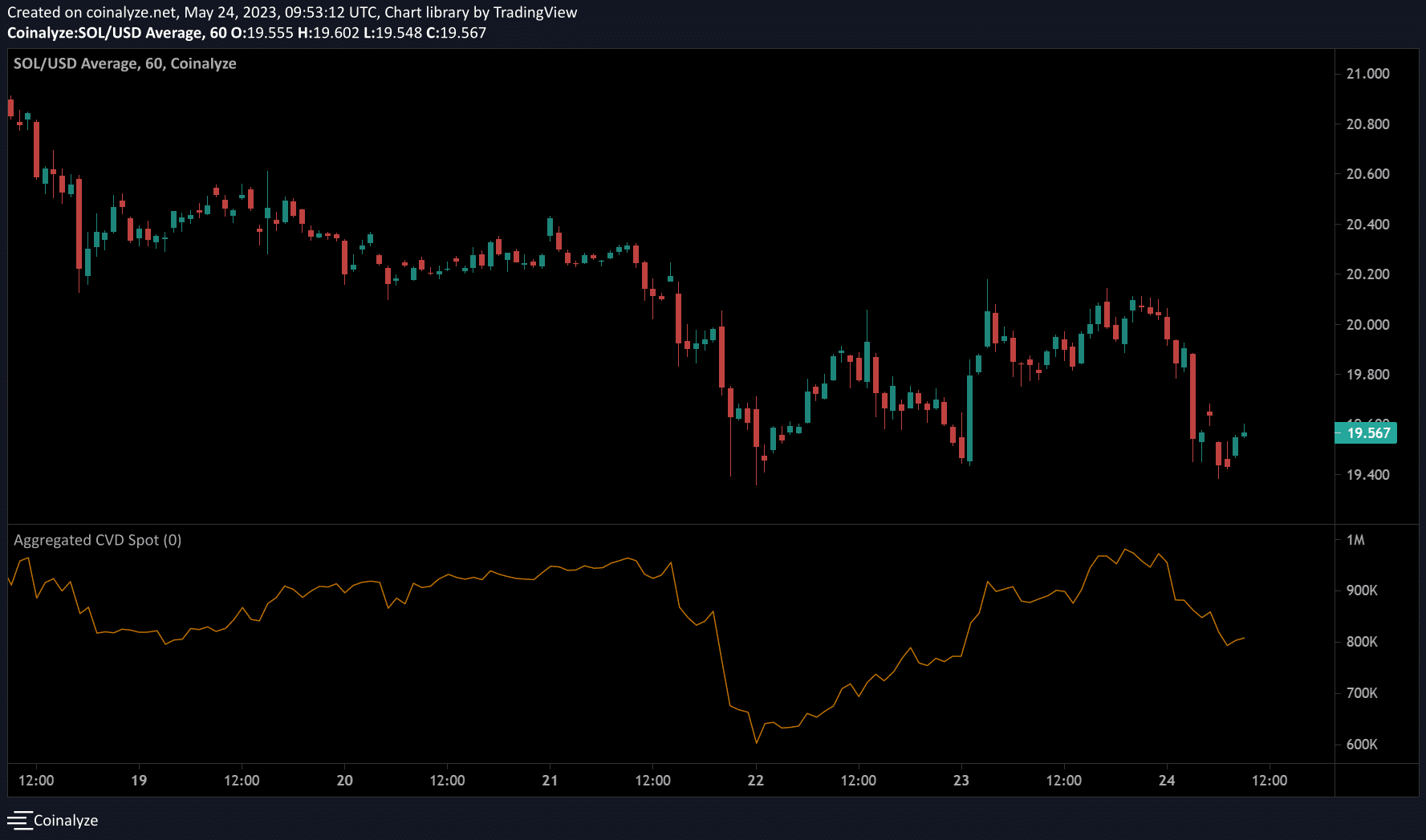

- OI increased since mid-May; CVD turned negative.

Solana [SOL] market structure weakened as Bitcoin [BTC] struggled to stay firmly within the $27k price zone. Bears recently breached the $20 psychological level, exposing SOL to more selling pressure.

Is your portfolio green? Check out the SOL Profit Calculator

Despite the ongoing bearish pressure, the “Crypto Fear and Greed” was “neutral” at press time. Meaning SOL’s price could either recover or sustain more losses. Now, which way for SOL?

SOL’s trendline resistance hurdle

Price action from late April has faced rejection at a key trendline resistance level (blue line). At press time, another price rejection was witnessed at the above obstacle, making it a key blockage for bulls.

Meanwhile, the Relative Strength Index dominated lower ranges for most of May, reiterating declining buying pressure in the past few weeks. Similarly, On Balance Volume declined in the same period – limiting a strong revival opportunity.

A weakening BTC could continue to keep SOL below the trendline resistance. As such, bears could sink SOL to the daily chart bullish order block and support zone (cyan) of $16.7 – $17.8.

Alternatively, SOL bulls could smash the trendline resistance if BTC reclaims $27k and surges. However, this depends on market conditions amidst the ongoing U.S. debt ceiling. The next target for bulls will be $21.

OI improved while CVD declined

How much are 1,10, 100 SOLs worth today?

According to Coinglass, SOL saw positive growth in the open interest rate from mid-May after stagnation between 9-13 May. The OI rose from about $230 million on 15 May to over $300 million on 23 May, underscoring bullish sentiment.

The above period also corresponded with a rising Cumulative Volume Delta, indicating buyers were gaining the upper hand. However, the metric declined slightly from 23 May, highlighting sellers were back in the game.