Where does Ethereum stand as far as zkEVM adoption is concerned

- zkEVM advancement could trigger an improvement in acceptance in 2023

- Despite the potential, the TVL of ZK rollups could hold Ethereum back

For most of 2022, several Ethereum [ETH] scaling solutions rose to the occasion to help out the blockchain’s lagging transaction speed. This happened without compromising its security and decentralization. And yet, it was for this reason that Optimistic roll-ups including Optimism [OP] and Arbitrum have been able to gain widespread adoption.

Is your portfolio green? Check out the Ethereum Profit Calculator

Roll-ups can’t go past Optimism

Zero-knowledge (ZK) rollups have been part of the scaling solutions developed to solve the inherent scalability issue. Unfortunately, this group has not been able to gain attention like its Optimistic counterparts, despite the plethora of ZK Ethereum Virtual Machines (zkEVMs)

For context, the zkEVMs help to execute smart contract transactions in a compatible way with zk proofs existing on the Ethereum infrastructure. Therefore, this leads to customizable off-chain and on-chain scaling.

Bankless, in its recent newsletter, highlighted the possibility of zkEVMs replicating the optimistic rollup 2022 performance. But, why do these projects have the potential? According to the blockchain insight platform, ZK rollups have the potential to become Ethereum’s mainstream scaling platform because it could increase the transaction speed by 6500%.

However, there are limitations if these rollups can reach their potential. The most notable is the Total Value Locked (TVL) factor. The TVL describes the amount of underlying supply secured completely by a protocol.

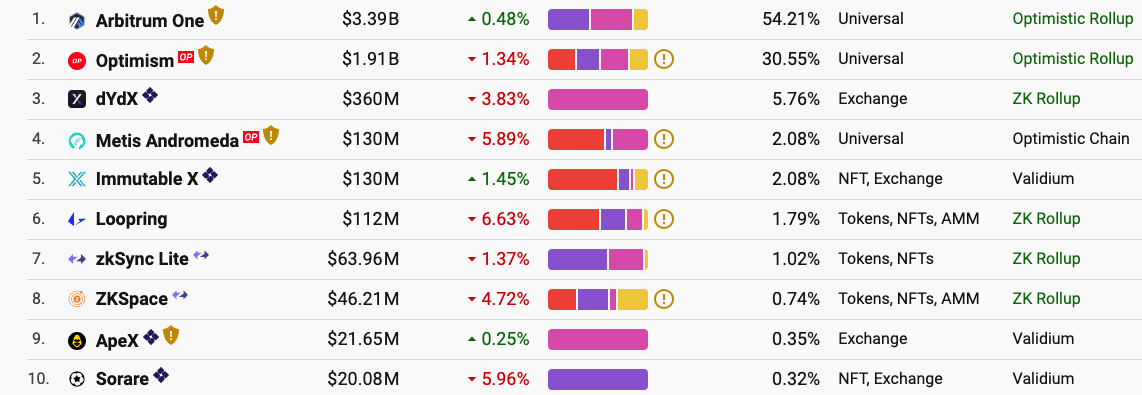

At press time, L2BEAT revealed that none of the ZK rollups had been able to overthrow either Arbitrum or Optimism as per this metric. The biggest ZK rollup dYdX had only a TVL of $360 million. This was far below the Optimistic leaders which run into billions of dollars. This implied a struggle in unique liquid deposits to ZK rollups.

Read Ethereum’s [ETH] Price Prediction 2023-2024

zkEVMs to the rescue?

However, on the brighter side, zkEVMs seem ready to balance the Optimistic dominance with the layer-one (L1) projects. This, because there have been new developments that could change the course of the scaling race. Notably, type 1 to type 4 zkEVMs are not holding back in their quest for compatibility with Ethereum applications.

The likes of Starknet are already at stage 3 of the process. zkSync has already launched its Mainnet for developers in February. And, more may be on the way as Polygon [MATIC] has already set 27 March for its Mainnet Beta launch.

Here, it’s worth noting that Bankless admitted that it might take some time before these EVMs catch up with the ground gained by the layer-two (L2) protocols.

In conclusion, there’s no certainty that Ethereum would upgrade to zkEVM on-chain scaling. However, the possibilities cannot be written off as Starknet, Polygon, and other EVM advancements could drive intense adoption later in the year.