Where USDT, USDC, BUSD stand as stablecoin race accelerates

- USDT led the stablecoin market after recent market volatility.

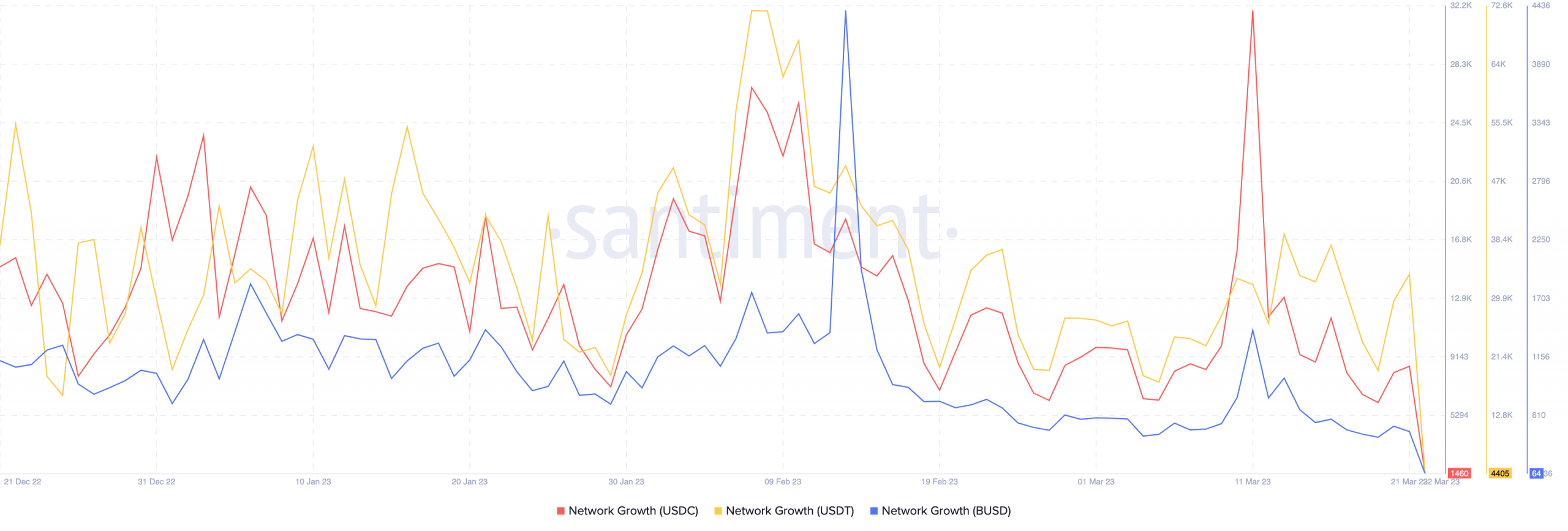

- Despite recovery, network growth of all stablecoins declined.

Due to the recent events surrounding SVB and Circle, the stablecoin market witnessed a lot of volatility over the past few weeks. After the dust settled, Tether [USDT] emerged on top, when compared to other stablecoins.

USDT reigns supreme

According to a 21 March tweet by CZ, USDT has been making progress in terms of market cap compared to Binance USD [BUSD] and USD Coin [USDC]. Despite BUSD’s fiat asset backing, and regulatory compliance, its growth has stopped. In contrast, USDT’s status has continued to improve despite market volatility.

#BUSD, the most fiat-backed stablecoin, audited by big audit firms, regulated by the NYDFS, was forced to wind down (no new minting).

USDC is shrinking in market cap too due to bank closures.

USDT is growing. pic.twitter.com/q5OYQdpAtW

— CZ ? Binance (@cz_binance) March 21, 2023

A sign of the expansion of USDT would also be the significant number of USDT that Tether was minting.

According to data from Lookonchain, Tether has minted $1 billion USDT on the Tron [TRX] network and $5 billion USDT on the Ethereum [ETH] network at press time. This significant increase in the supply of USDT suggested that there is a strong demand for the stablecoin, and the addition of such a large amount is unlikely to have a negative impact on it.

Tether minted 1B $USDT again on #Tron just now.

Tether has minted a total of 5B $USDT on #Tron and #Ethereum in the past 7 days.https://t.co/cGSfpbzTbJ pic.twitter.com/LqXn1paym2

— Lookonchain (@lookonchain) March 21, 2023

Circling back

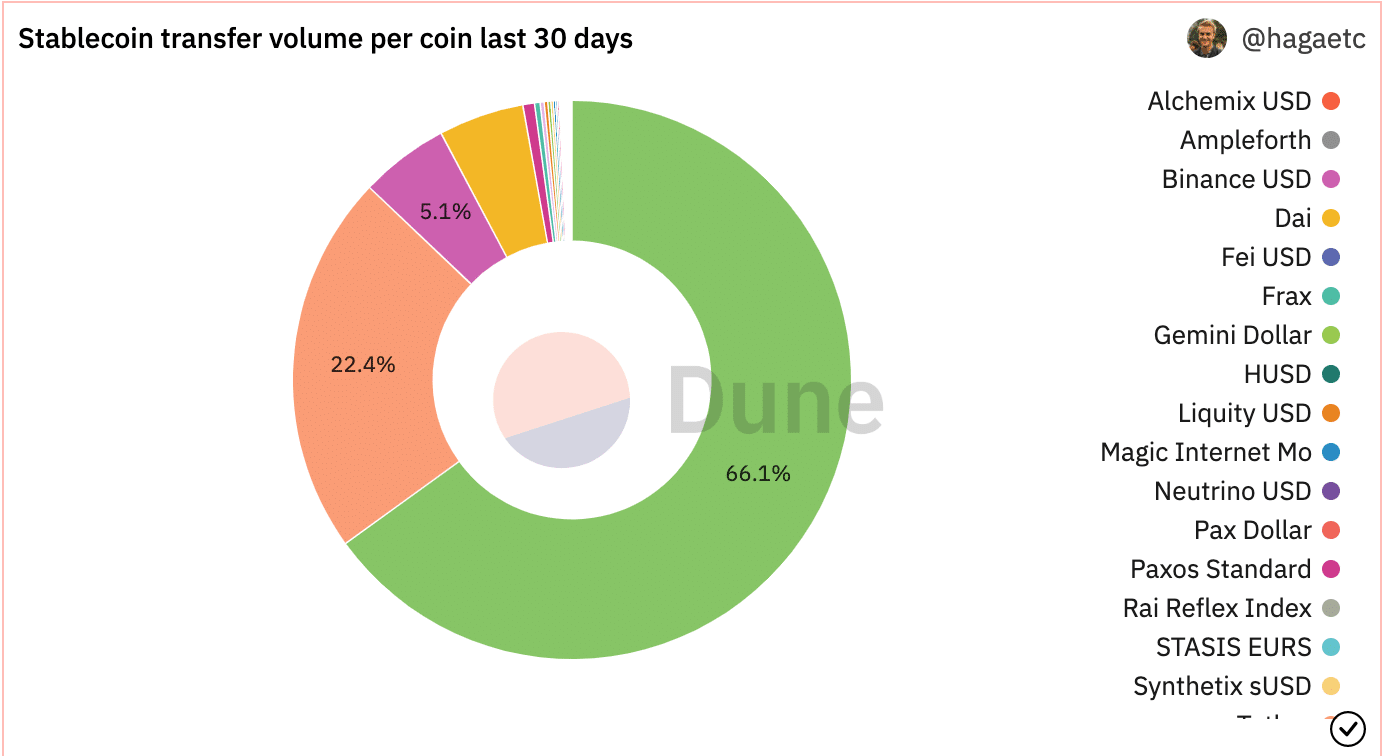

Despite this, USDC still captured a large part of the market in terms of volume distribution, as it was responsible for 66.1% of all stablecoin volume at press time. This dominance may play a role in USDC’s resurgence after the SVB fiasco.

Circle, the issuer of USDC, has started focusing on the European market.

Circle, on 20 March, issued a statement regarding its thoughts on Europe’s MiCA regulations. MiCA is a policy framework that aims to unify EU crypto regulations that can help in further institutional adoption of crypto. Circle’s EU director believes that major European banks will roll out crypto assets soon.

Circle EU Director: With MiCA launched, I expect major European banks will roll out crypto-asset services in the next 48 months, be it custody, exchange, or the issuance of e-money tokens or asset-referenced tokens, colloquially referred to as stablecoins.…

— Wu Blockchain (@WuBlockchain) March 21, 2023

If Circle makes progress with these banks in terms of collaboration, it would improve USDC’s situation immensely.

The stablecoin sector still has a long way to go. Even though these stablecoins may have recovered from the recent market volatility, their declining network growth suggests that there’s still room for improvement.