Why Algorand’s revenue dived in Q3

- Algorand’s revenue fell in Q3.

- This was due to the decline in the value of its native token during the same period.

Pure-proof-of-stake (PoS) blockchain Algorand [ALGO] experienced a decline in its quarterly revenue in Q3 2023, Messari found in a new report.

In the report titled “Algorand Q3 2023 Brief,” the on-chain data provider found that Algorand’s daily revenue denominated in USD closed the quarter at its lowest level in the last year, registering a quarter-over-quarter (QoQ) decline of 23%.

According to Messari, the revenue decline was due to the steady fall in the daily average price of the protocol’s native token, ALGO. Between the 1st of July and the 30th of September, the altcoin’s value plummeted by almost 20%, data from CoinMarketCap showed.

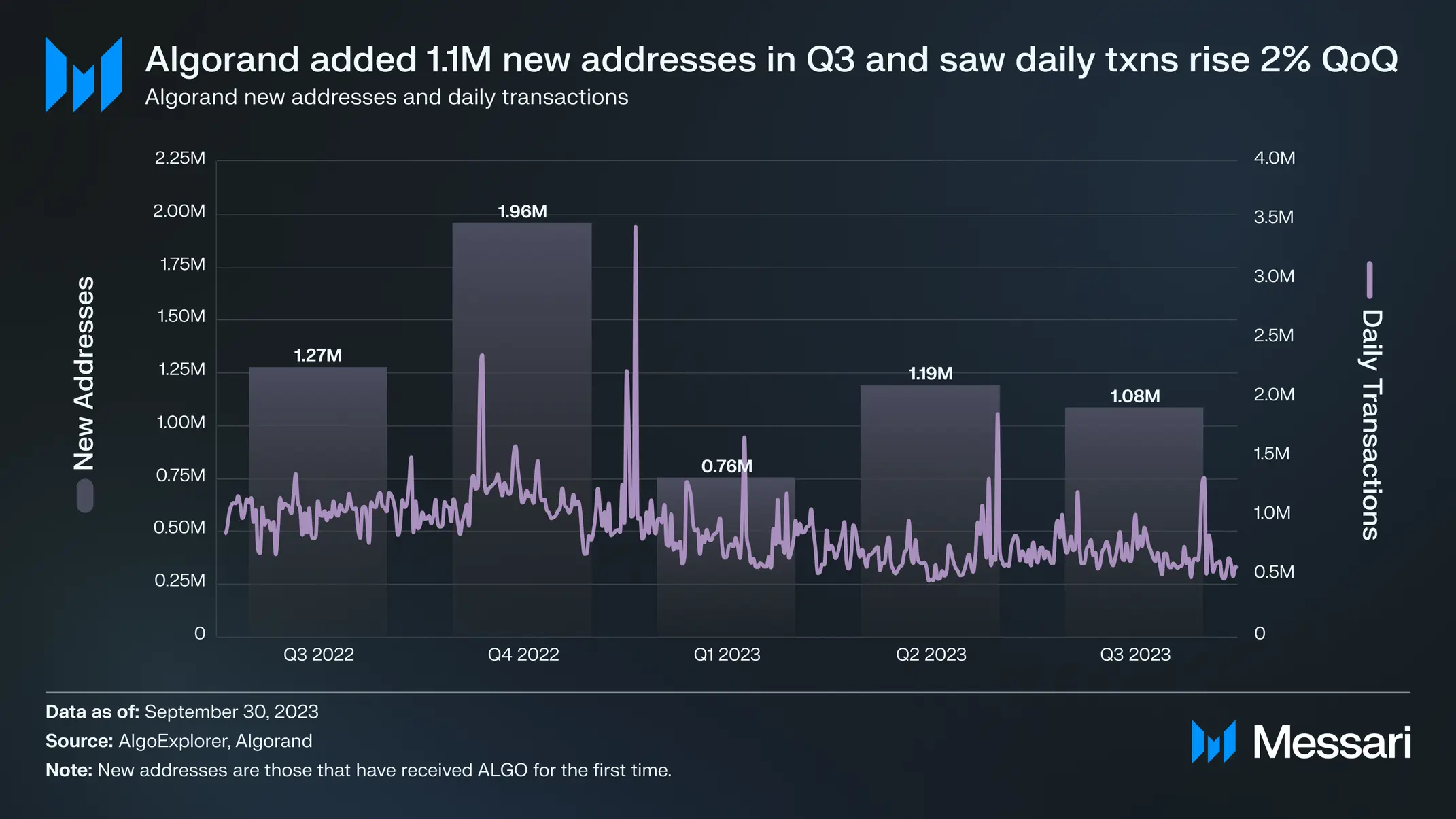

The decline in revenue occurred despite the growth in new demand for Algorand during the quarter under review. Messari found that between July and September, Algorand “added 1.1 million new addresses in Q3, growing its total addresses by 3% QoQ.”

Also, the PoS network saw its average daily transaction count climb by 2.2%. In Q3, it recorded an average count of 713,000 transactions daily. In Q2, this was 698,000. Messari added:

“This increase in transactions was likely driven by the number of transactions facilitated by NFT activity on Algorand in Q3. This metric jumped 321%, from 45,000 to 191,000.”

However, the steady decline in ALGO’s value during the quarter impacted network fees paid to process transactions on Algorand, hence the USD revenue decline.

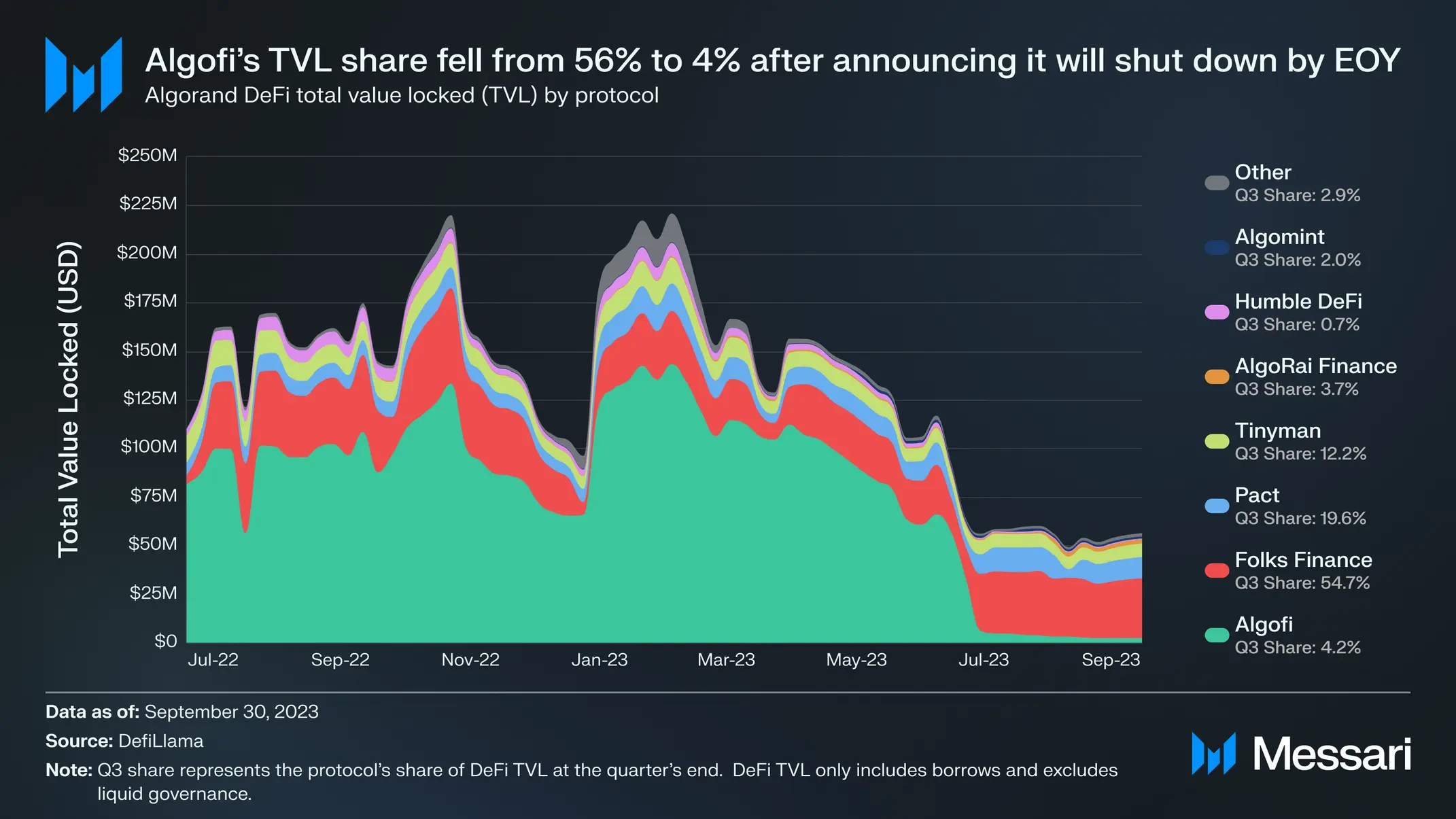

Regarding its decentralized finance (DeFi) vertical, Algorand’s total value locked (TVL) dipped by 48%. Messari attributed the cause of this to the protocol’s decision to shut down Algofi, which the research firm described as “its once largest DeFi protocol by TVL.”

On the 10th of July, Algofi announced its decision to sunset the platform due to “a confluence of events.”

At press time, Algorand’s TVL stood at $80.31 million, rallying by 35% since the beginning of October, according to data from DefiLlama.

Is your portfolio green? Check out the ALGO Profit Calculator

State of ALGO

As of this writing, ALGO traded at $0.1299, recording a 15% growth in price in the last week. The recent price action has resulted in a 14% uptick in the token’s open interest in its futures market.

Further, since the 23rd of October, the market has seen only positive funding rates, as market participants continue to place bets in favor of a sustained price rally.