Why AVAX is unable to cross $14

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.

- AVAX faltered at its March low of $13.89.

- More long positions wrecked, offering sellers leverage.

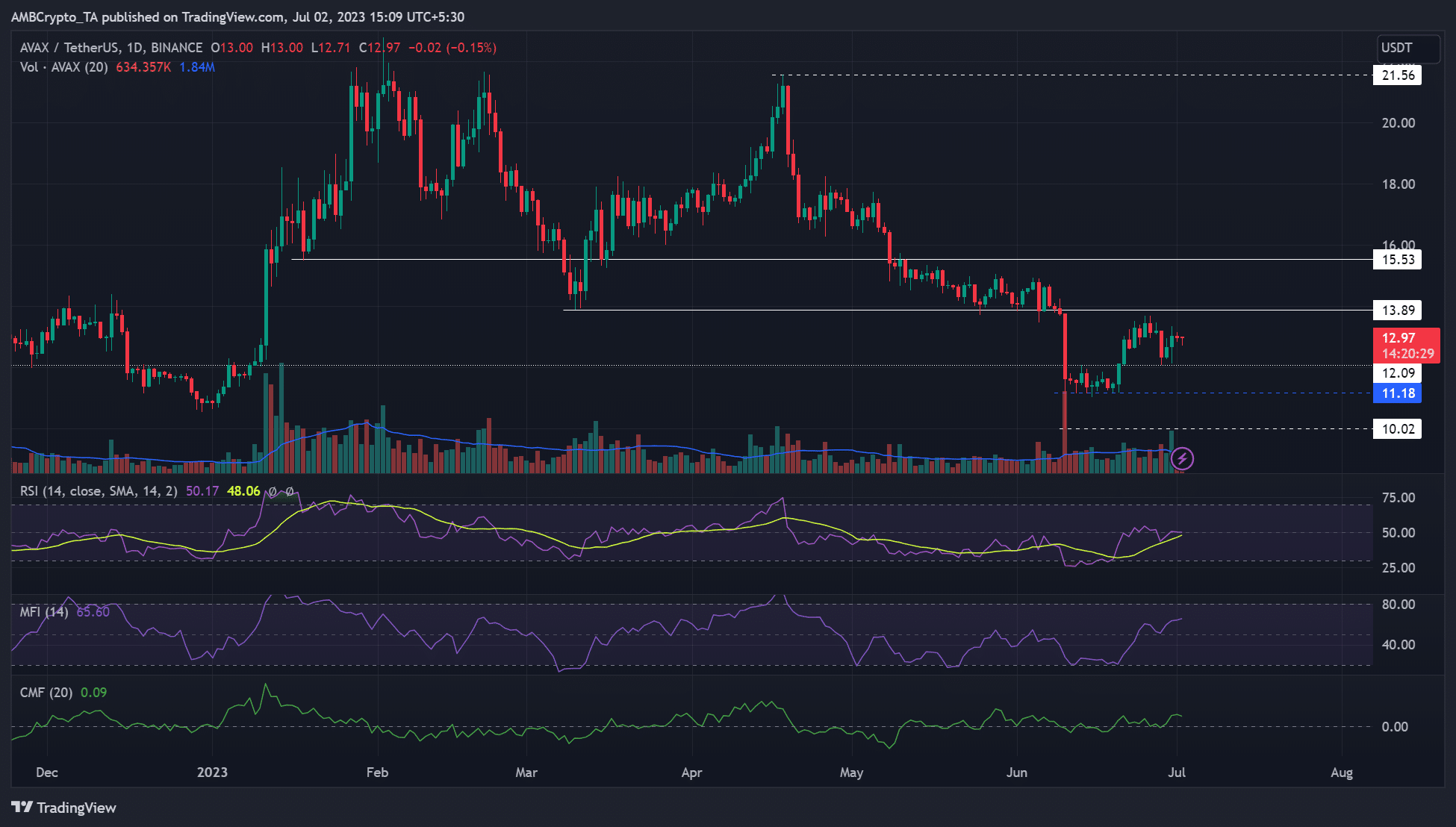

Avalanche’s [AVAX] long-term recovery seems far from sight, with price action firmly below March low and recent lower high. AVAX saw a downward drift from $21.56 in April to a low of $10 in mid-June. The recovery in mid-June faltered below the March low of $13.89, holding AVAX from crossing $14.

Is your portfolio green? Check out the AVAX Profit Calculator

A recent report established that Avalanche’s daily activity surged, with Trader Joe and Benqi, amongst the key drivers. However, such an impressive fete wasn’t a strong boost for AVAX to cross $14.

Is range extension likely?

The H4 and D1 market structures were firmly bearish, highlighting the sellers’ edge if key resistance is met. In this case, the key resistance is the March low of $13.9 – slightly above the recent lower high.

Overall, AVAX chalked lower lows since mid-April, denoting a strong downtrend. In the same period, the RSI remained below the neutral position or just slightly above it before retreating to lower ranges. It denotes buying pressure remained muted during the period.

At the time of writing, the RSI hovered along the neutral level. But the MFI crossed the medial level – suggesting recent buying pressure eased while volume was significant. The CMF was also above the zero mark – positive capital inflow.

So, AVAX’s range formation of $12.1 – $13.9 could extend in the coming days unless BTC takes a clear direction. The king coin has also been consolidating above $30k since 21 June.

A bullish or bearish breakout will invalidate the neutral thesis. On the upside, $15.5 will be the immediate target, while $10 and $11 will be key supports to watch out for in the south.

Longs discouraged

How much are 1,10,100 AVAXs worth today?

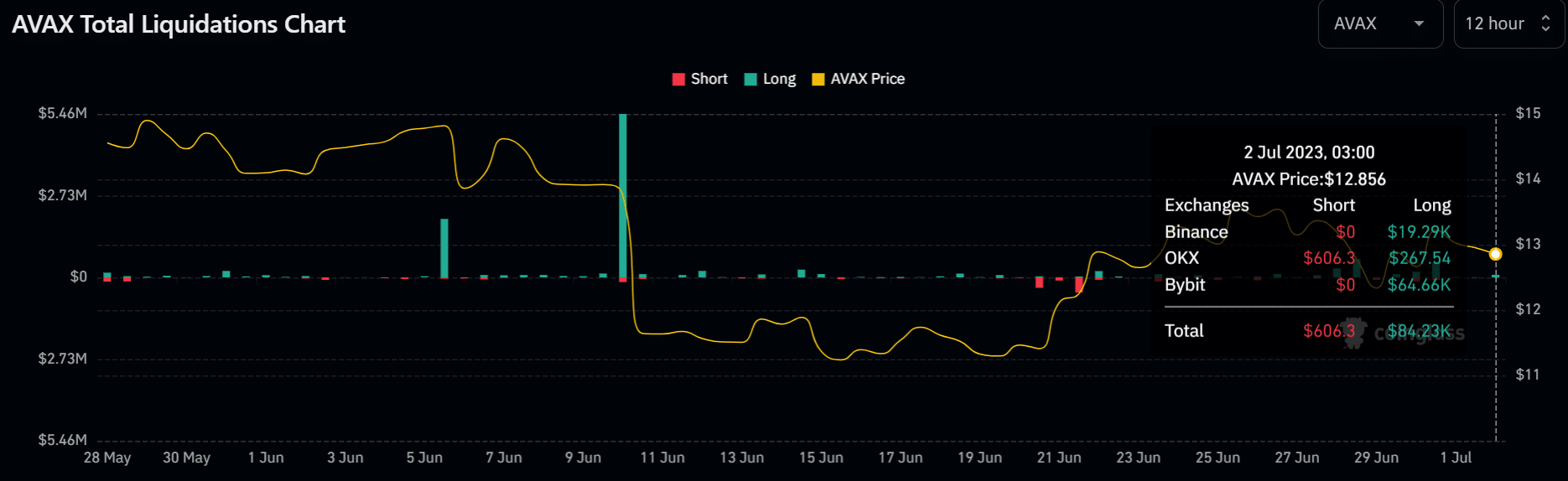

According to Coinglass, over $80k worth of long positions has been liquidated in the past 12 hours as of the time of writing.

In the same period, short positions suffered less than $1k liquidations, underscoring sellers’ leverage and the likely drop of AVAX towards the range-low of $12 before a possible rebound.