Why Bitcoin [BTC] may climb a new bull ladder despite Fed’s resolve

- The SOPR ratio positioned closer to the market bottom as the TRIX signaled an incoming uptrend.

- BTC holders adhered to self-custody despite January’s profit-taking offer.

Bitcoin [BTC] showed immense prowess after the U.S. Federal Reserve Board raised interest rates by 25 basis points. Initially, the king coin led the crypto market decline, but this only lasted a few hours as bulls took back control.

Read Bitcoin’s [BTC] Price Prediction 2023-2024

With the FOMC aftermath reaction, it may seem that the usual expectation of falling prices amid rising interest rates may not always be the cause. Also, there have been new revelations about how BTC may fare in the coming weeks.

New status for the bulls

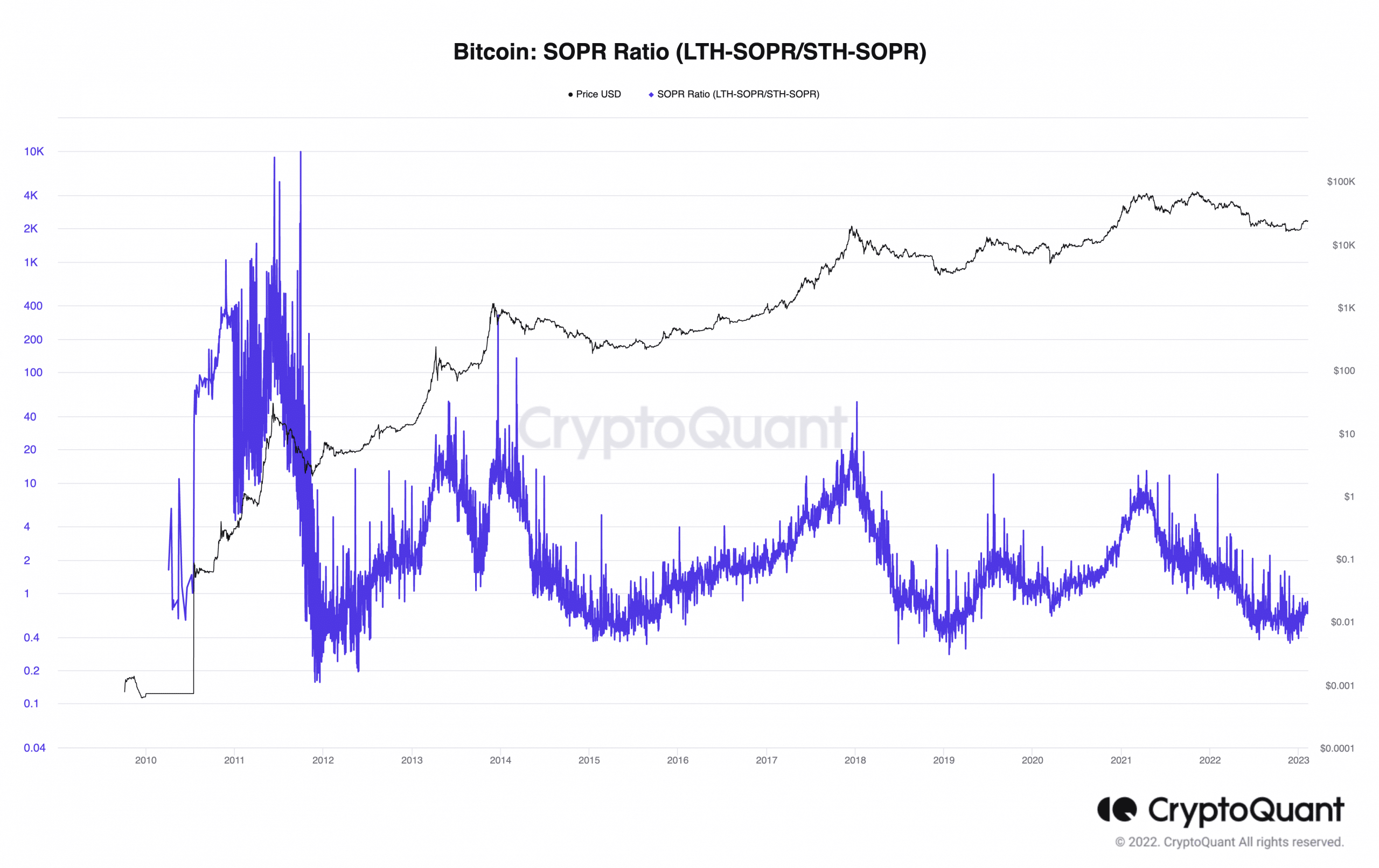

According to CryptoQuant analyst BinhDang, BTC’s short-term expectation could be void of a decrease. While pointing to the Spent Output Profit Ratio (SOPR) ratio, the analyst expanded that a crossover into a significant bullish region was close.

The SOPR evaluates the profit ratio of the entire market, but it differs from the ratio. Unlike the former, the SOPR ratio provides more insight into the market sentiment. The metric is calculated by dividing the Long-Term Holder (LTH) SOPR by the Short-Term Holder (STH) SOPR while reflecting the degree of all on-chain realized profits.

Based on the image above, the SOPR ratio was not a high value. So, it indicated that the market was not close to the top, thus offering possible buying opportunities and a potential for a BTC rally.

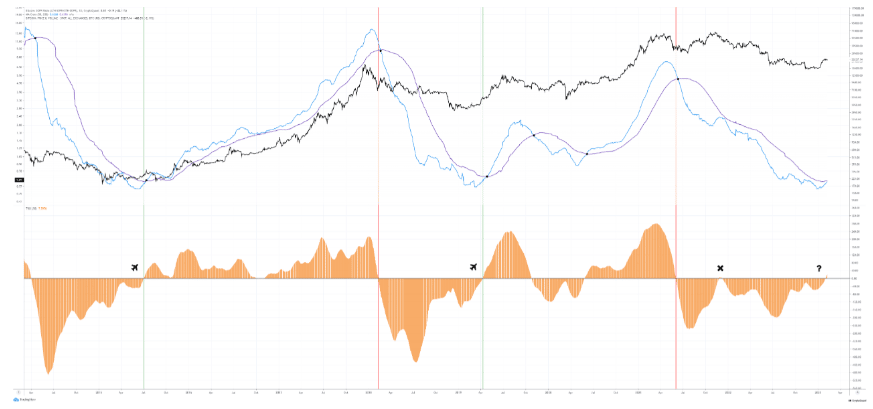

However, BinhDang also mentioned the historical view of the Triple Exponential Average (TRIX) over a 50-day period and the 50 to 200-day Moving Average (MA). In past cycles, the 50 TRIX crossing the median phase was accompanied by the 50-200 MA, creating an uptrend.

At the time of writing, the TRIX value was positive. So, there was a high chance of further bullish momentum, irrespective of rising inflation. On 1 February, the Feds chairman, Jerome Powell, insisted that there would be a need for more hike before the economy could become dis-inflationary.

Holders to keep oversight

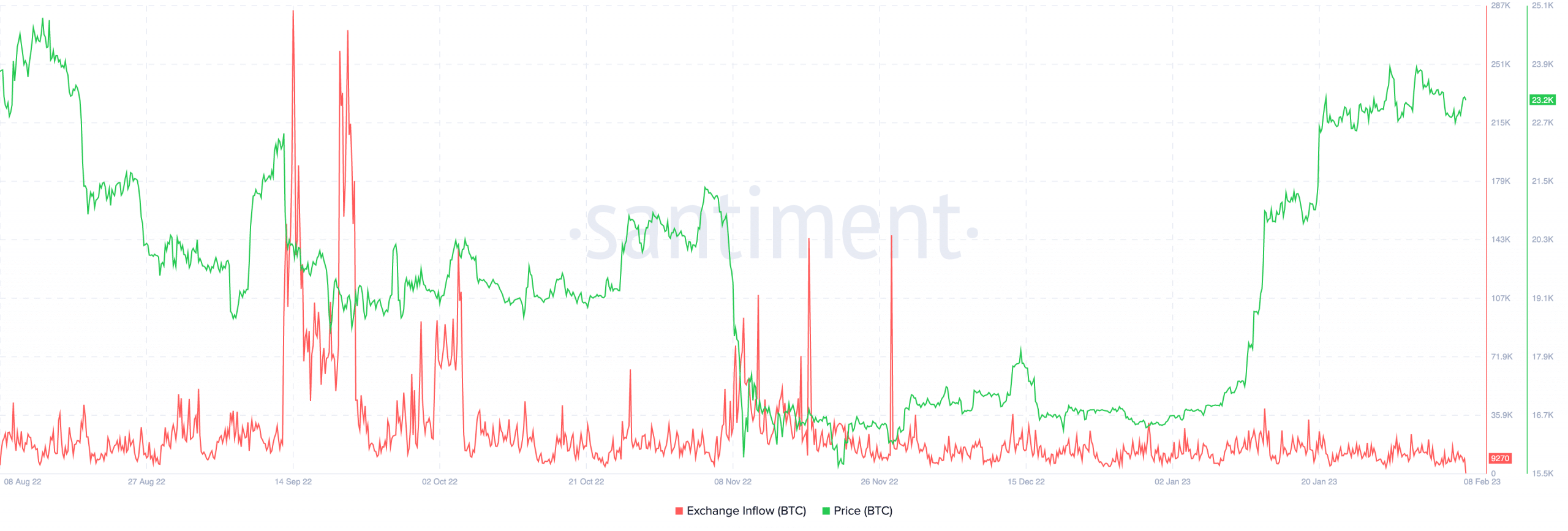

Amid the bullish projection, Santiment reported that BTC were still stuck with self-custody instead of bowing to exchange storage. According to the on-chain platform, over $416 billion worth of BTC were held off exchanges with fourteen times lower available on the latter.

? #Bitcoin's existing supply continues moving to self-custody as prices range at $23k here in early February. There is now $416.5B in $BTC sitting away from exchanges, and $29.2B in $BTC on exchanges. So there is 14.26x the coins off exchanges vs. on. https://t.co/MU4UAUY5Mv pic.twitter.com/oZYoSf6tgY

— Santiment (@santimentfeed) February 7, 2023

Realistic or not, here’s BTC’s market cap in ETH’s terms

Although the November 2022 FTX collapse might have played a part, one would have expected the January relief to change the tune. But this sentiment might also align with the hopes that holders still expected a notable uptick.

Meanwhile, information from Santiment showed that there had been a decline in exchange inflow. At press time, it was down to 9270. This could be a result of the BTC consolidation around $23,000 for several days. Hence, there has been a decrease in selling pressure.

![Pudgy Penguins [PENGU]](https://ambcrypto.com/wp-content/uploads/2025/05/Evans-54-min-400x240.png)