Why Bitcoin, Ethereum ETF volumes surged despite the crypto slump

- Bitcoin, Ethereum ETF volumes saw a surge to almost $6 billion.

- BTC and ETH have seen a slight rebound in the last 24 hours.

Bitcoin [BTC] and Ethereum [ETH] experienced notable price declines during the last trading session, breaking through key support levels.

Despite this price downturn, there was a contrasting surge in activity within their respective Exchange-Traded Funds (ETFs), where trading volumes reached impressively high numbers.

Bitcoin, Ethereum ETF volumes hit record

Recent data from Coinglass highlighted a significant surge in trading volumes for Bitcoin and Ethereum ETFs. These assets collectively neared a substantial $6 billion in the last trading session.

Bitcoin ETFs accounted for most of this volume, amassing $5.70 billion, with BlackRock’s Bitcoin ETF leading the way at nearly $3 billion.

This figure underscored BlackRock’s dominant position in the market.

On the Ethereum side, ETFs also saw considerable activity, recording over $715 million in volume.

Grayscale’s Ethereum Trust emerged as the top contributor, with over $261 million in trading volume, highlighting its prominence among Ethereum investment products.

These volumes in Bitcoin and Ethereum ETFs during the last session are particularly noteworthy, as they occurred amidst overall market volatility and price declines for both cryptocurrencies.

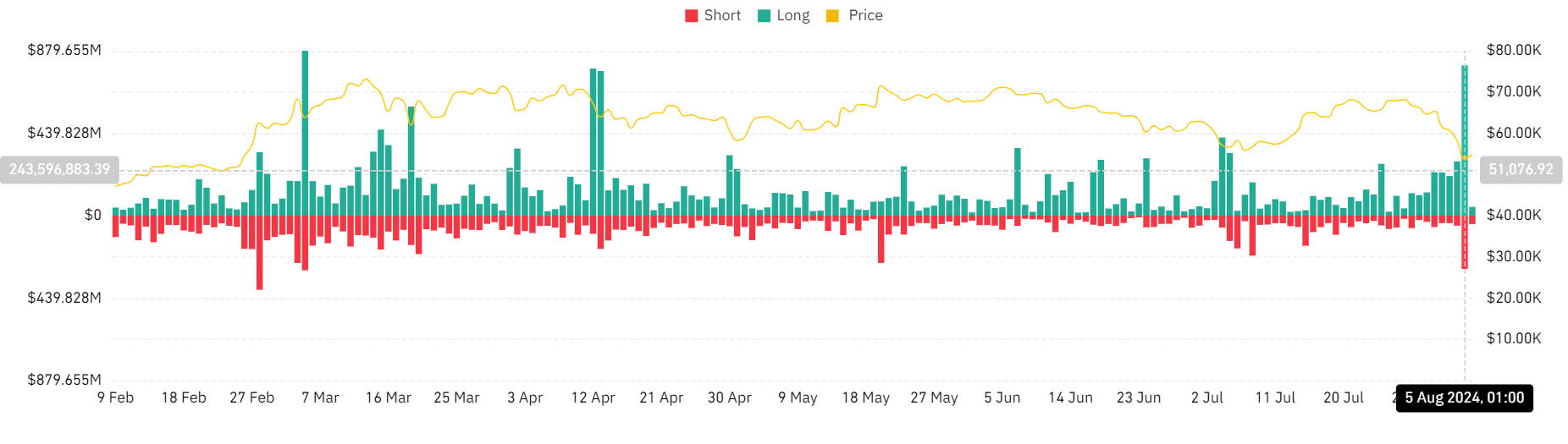

Market liquidation amidst ETF spike

The broader saw a dramatic spike in liquidation volumes amid a notable surge in Bitcoin and Ethereum ETF volumes. This surge in liquidations reached levels not seen since March.

Data analysis revealed that the total market liquidation volume surpassed $1 billion on that day. A closer look at the breakdown of these figures showed that long positions bore the brunt of these liquidations.

The record showed over $801 million in long liquidations compared to $284 million in short liquidations.

Focusing on individual cryptocurrencies, Bitcoin accounted for over $408 million of the total liquidations, with long positions again seeing a higher volume.

Ethereum also saw substantial liquidations, totaling almost $280 million, with long positions similarly dominating. BTC and ETH liquidations constituted more than half of the entire market’s liquidation volume.

BTC and ETH see slight recoveries

According to AMBCrypto’s analysis, Bitcoin and Ethereum’s price trends reveals modest daily recoveries. Bitcoin was trading at approximately $55,600 at press time, reflecting a more than 2% increase.

Is your portfolio green? Check out the ETH Profit Calculator

This followed a 6% drop in the previous session, which had reduced its price to around $54,000.

Meanwhile, Ethereum was priced at around $2,466, marking an increase of over 1% from the $2,421 recorded in the prior session, after a decline of more than 9%.