Why Bitcoin investors need to ‘restrain their bullishness’ for now

Bitcoin has been the best performing asset out of all the top 10 coins in the market this week. It has once again justified its king coin status. But as the king, it also faces a lot of threats from altcoins sometimes.

However, in this particular instance, the threat comes from its very own investors. And that too not in the form of selling but actually buying.

Bitcoin on a roll

Bitcoin has been flying high for more than 10 days now. From falling to $42k at the end of September to rising back up to $55k, the recovery has been quick and strong.

However, it is important for investors to be cautious during such a quickly rising market. In such a case, usually the chances of trend reversal rise as quickly as the asset does.

Bitcoin price action | Source: TradingView – AMBCrypto

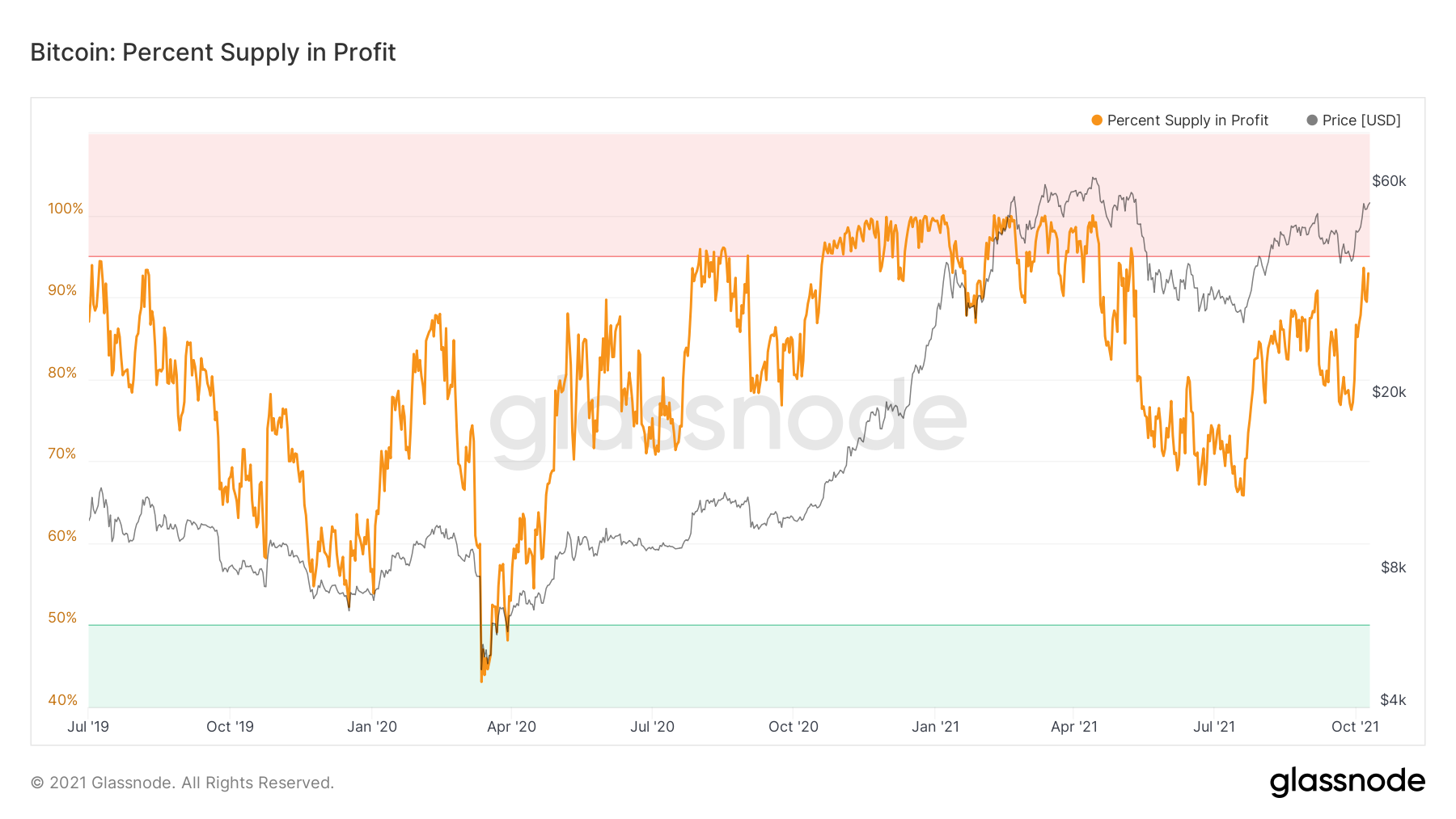

At the moment the total supply in profit is at 92.92%, only 2% away from creating a market top. In just 12 days about 16% of the coins that were in losses during September, have returned to profit already.

Bitcoin supply in profit | Source: Glassnode – AMBCrypto

So what’s the harm?

On the basis of a technicality, a market top is followed by a price fall. Further, the 17% price rise we have seen this week combined with the fact that BTC is still going up, could lead to the market top occurring soon.

Now there have been instances in the past when this didn’t happen, such as during the April all-time high bull run. But then again, when Bitcoin reached the same 95%+ zone in May, we witnessed a sell-off. Not that the next reach would trigger a sell-off, but we can never be certain about what will happen, so it’s better to be safe than sorry.

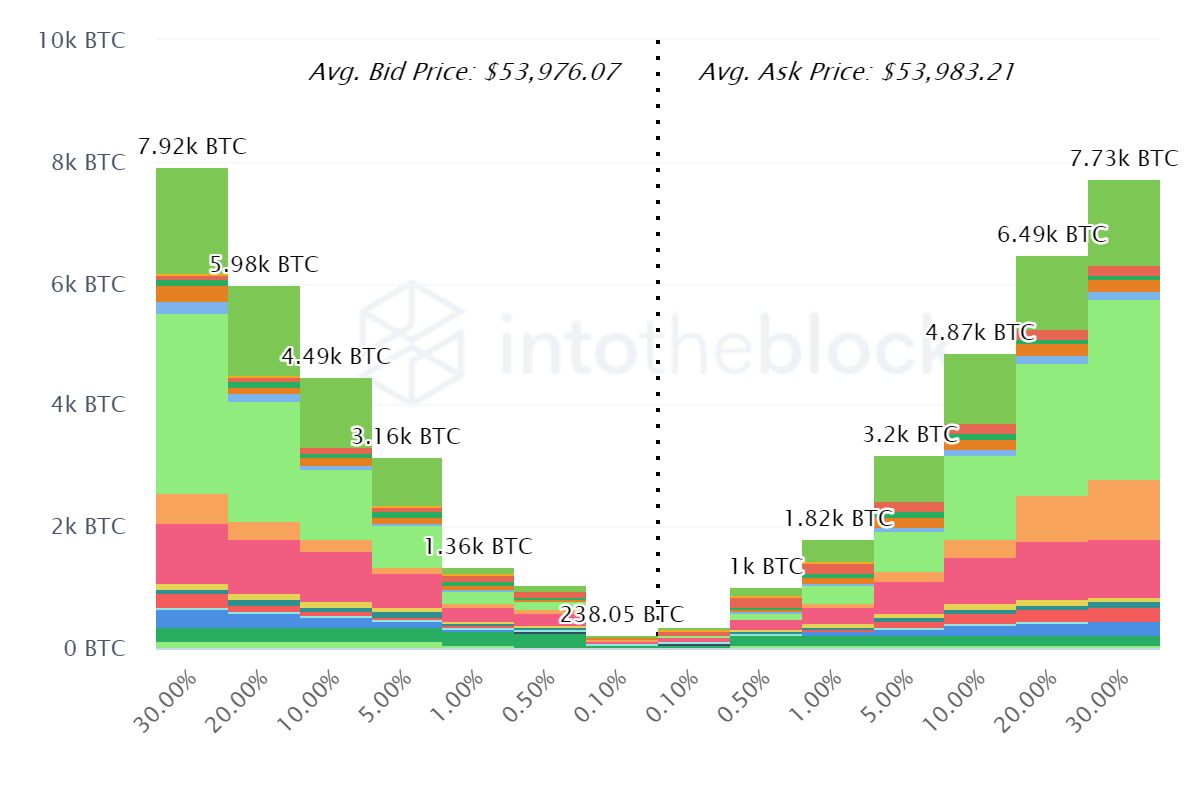

Thus, in order to ensure that there are no significant negative impacts, Bitcoin investors should for a while restrain their bullishness. Because even at press time, buying orders had dominance over sell orders, and that too by almost $1.1 billion (20k BTC).

Bitcoin buy and sell orders | Source: Intotheblock – AMBCrypto

Again, this is an interpretation of on-chain data and not in any ways investment advice. So at the end of the day, it is also suggested that investors do their own research as well and invest accordingly.