Why Bitcoin is in a speculative bubble

- Bitcoin’s blocks were reaching maximum capacity.

- Miner revenue declined while hash rate increased.

Since reaching the $30,000 price threshold, the price of Bitcoin [BTC] has been the subject of intense speculation. While many holders remain optimistic about the king coin’s future, there have been growing concerns regarding its stability.

From blocks to bubbles

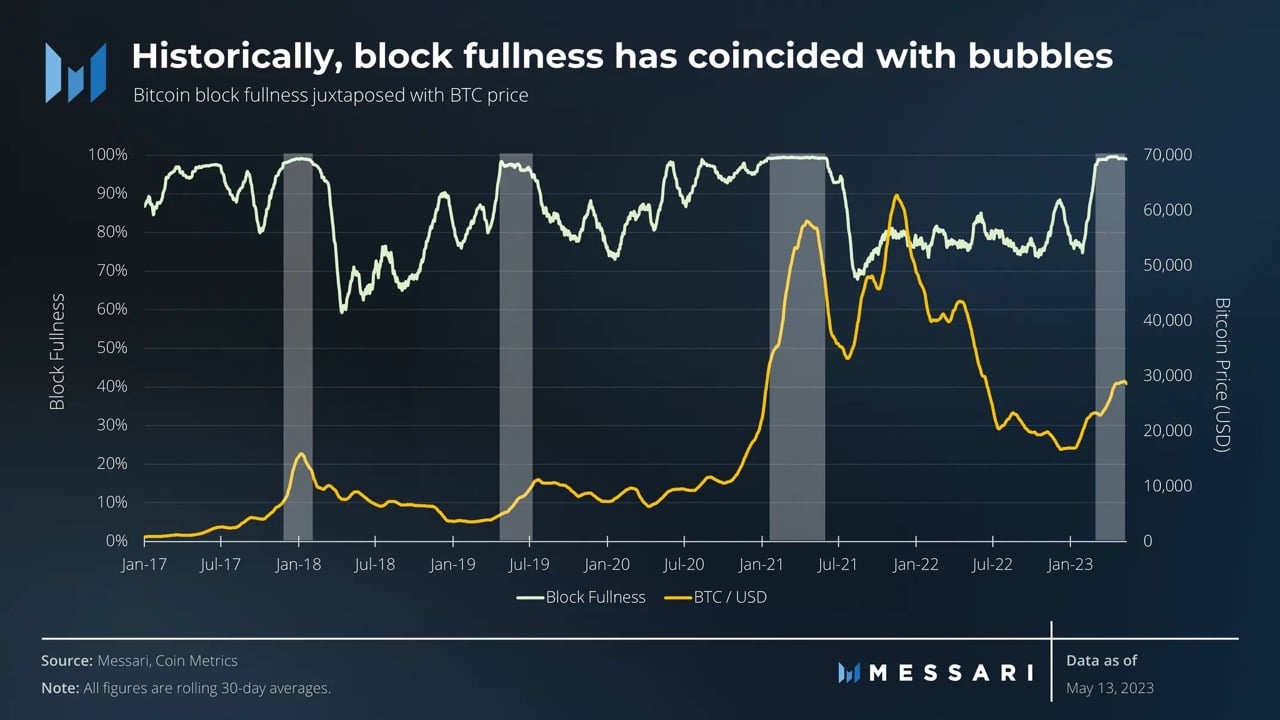

According to Messari, Bitcoin’s blocks were reaching their maximum capacity at press time, causing congestion and an inability to accommodate additional transactions.

This congestion has historically been observed during speculative bubbles in the Bitcoin market, where heightened transaction demand has overwhelmed the network.

However, a significant change has occurred in the composition of these blocks. In the past, blocks were primarily filled with transaction activity. But the blocks have been filled with Inscriptions ever since the NFT’s introduction.

The impact of this shift on the future price of BTC remains uncertain.

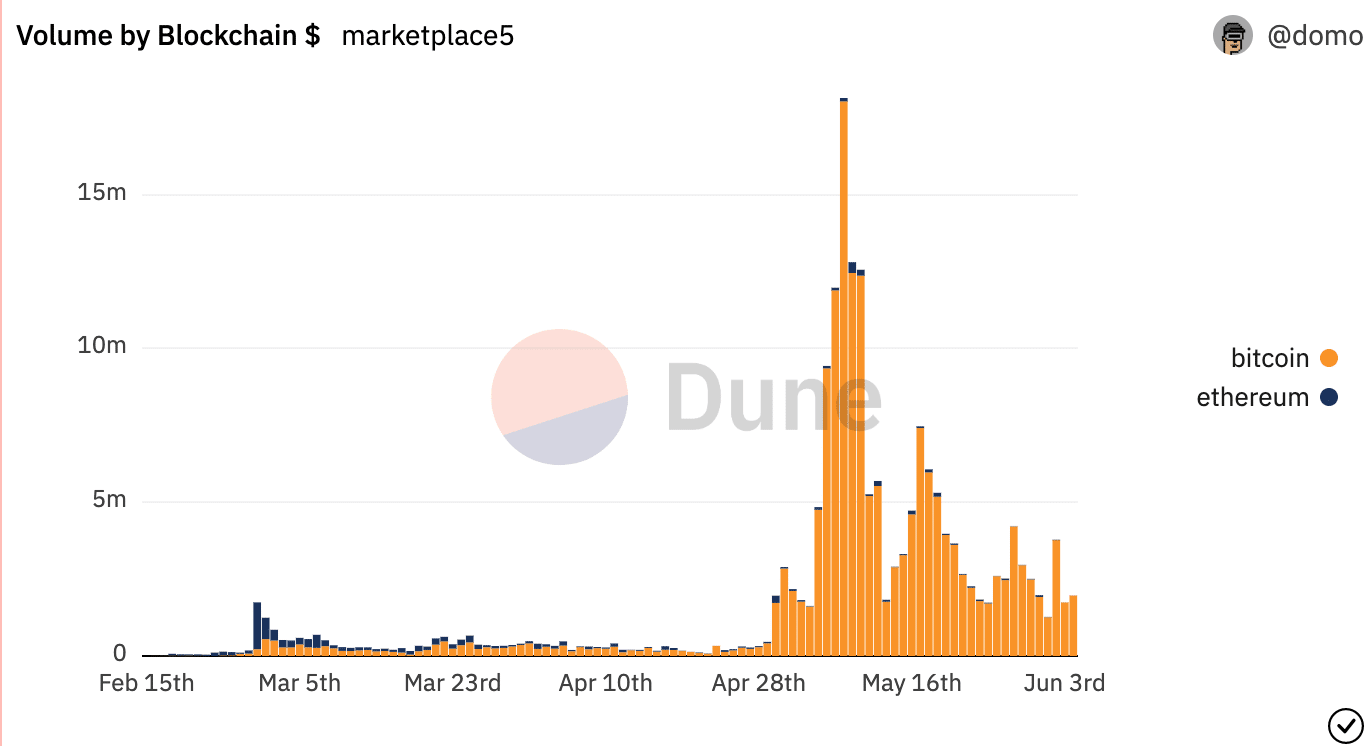

In recent observations, the volume of Ordinals being traded across exchanges had declined, as reported by Dune Analytics. This may have repercussions for miner revenue.

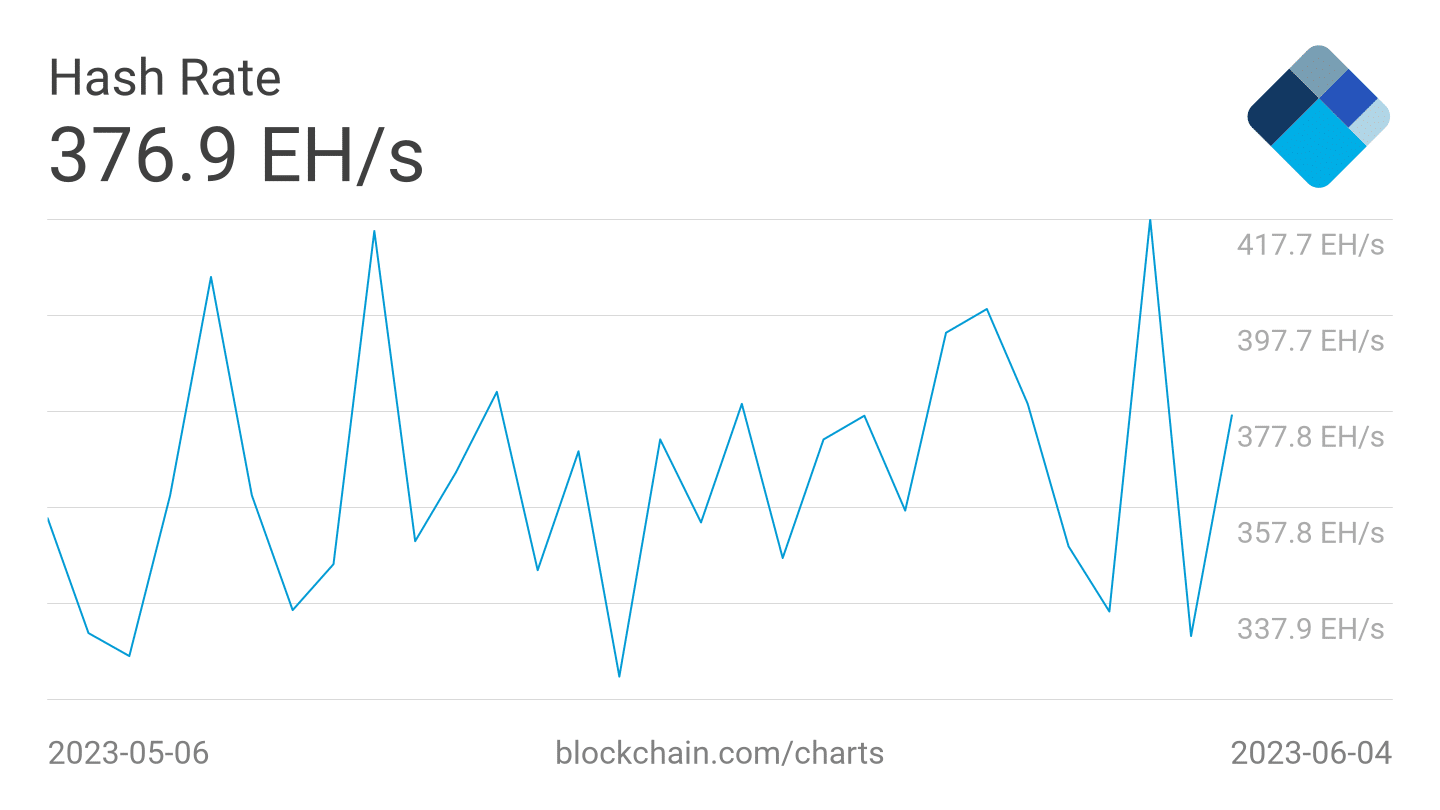

Notably, Blockchain.com’s data revealed that miner revenue decreased from $41.744 million to $26.178 million over the past month.

In parallel, the hashrate of Bitcoin witnessed an upward trend during this period. The growing hashrate positively influences the network’s security and efficiency.

However, it also leads to increased competition among miners, potentially impacting individual profitability and centralization concerns.

What are Bitcoin holders up to?

The behavior of Bitcoin holders showed interesting patterns. The number of holders on various exchanges rose, suggesting an increasing interest in acquiring and holding BTC.

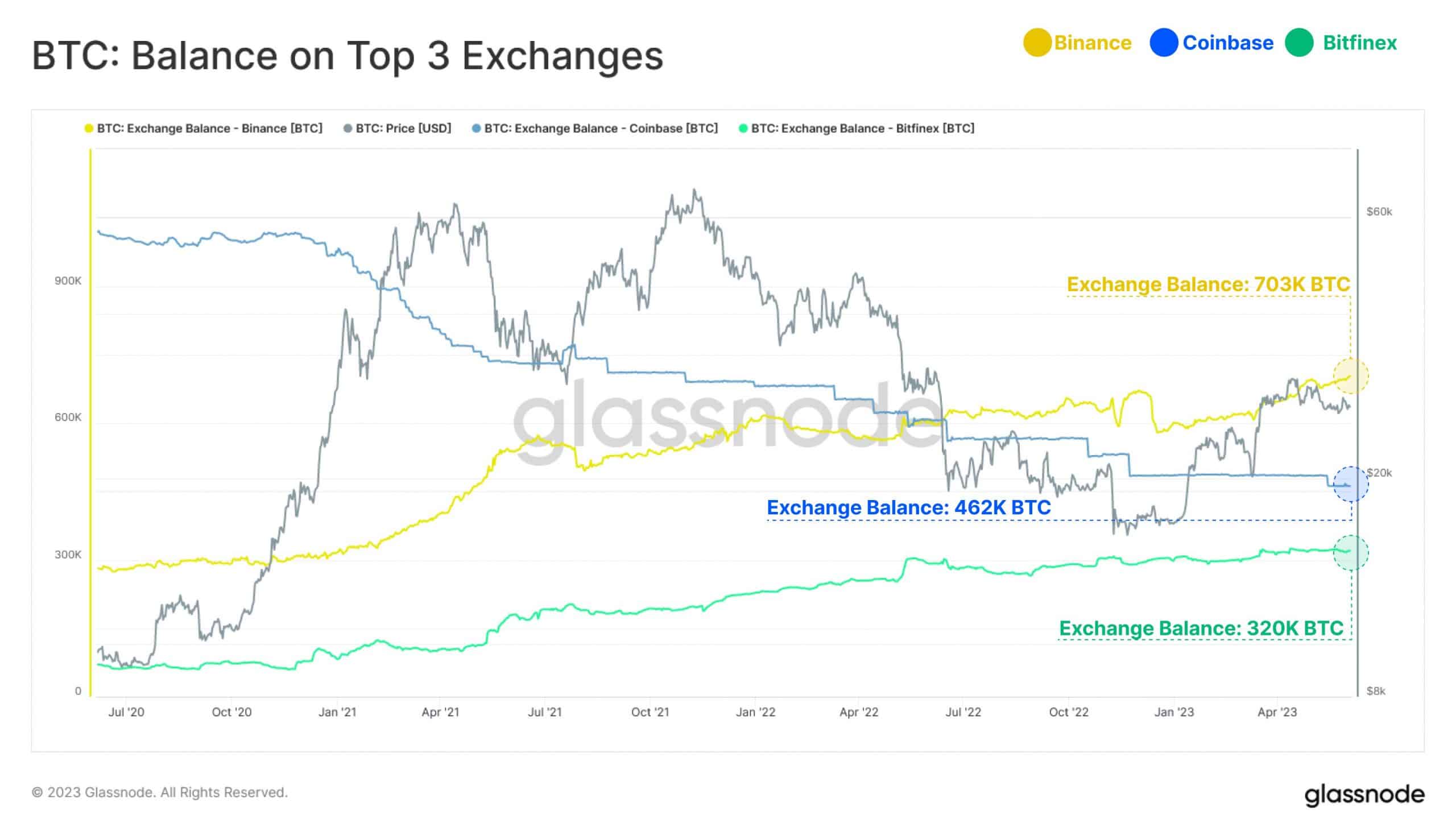

Glassnode conducted an extensive evaluation of cumulative Bitcoin holdings on the three leading cryptocurrency exchanges over the past three years.

The findings reveal significant growth in Bitcoin balances held by Binance and Bitfinex, with notable increases of 421,000 BTC and 250,000 BTC, respectively.

Is your portfolio green? Check out the Bitcoin Profit Calculator

In contrast, Coinbase experienced a decline in its reserves, observing a reduction of 558,000 BTC.

These shifts in holder behavior and the distribution of BTC among exchanges can have consequential effects on the overall Bitcoin ecosystem.