Why Bitcoin might fall before it flies high again

- Experts have outlined several factors indicating BTC’s potential for a long-term rally.

- Prevailing data suggest an imminent drop in price before any upward movement.

Following a recent plunge to the $58,000 region, Bitcoin [BTC] has suffered a 1.33% loss over the past month. Short-term analyses predict further declines as trading progresses.

Despite these fluctuations, some analysts remain optimistic, viewing the current downturn as a brief setback. They maintain a positive long-term outlook for the cryptocurrency.

Bitcoin shows promising long-term potential

Analyst Mister Crypto highlighted that BTC is currently forming a bullish flag pattern, similar to its positioning in 2023, which preceded a new all-time high.

If this pattern holds, BTC is anticipated to experience a major surge, potentially reaching a new all-time peak.

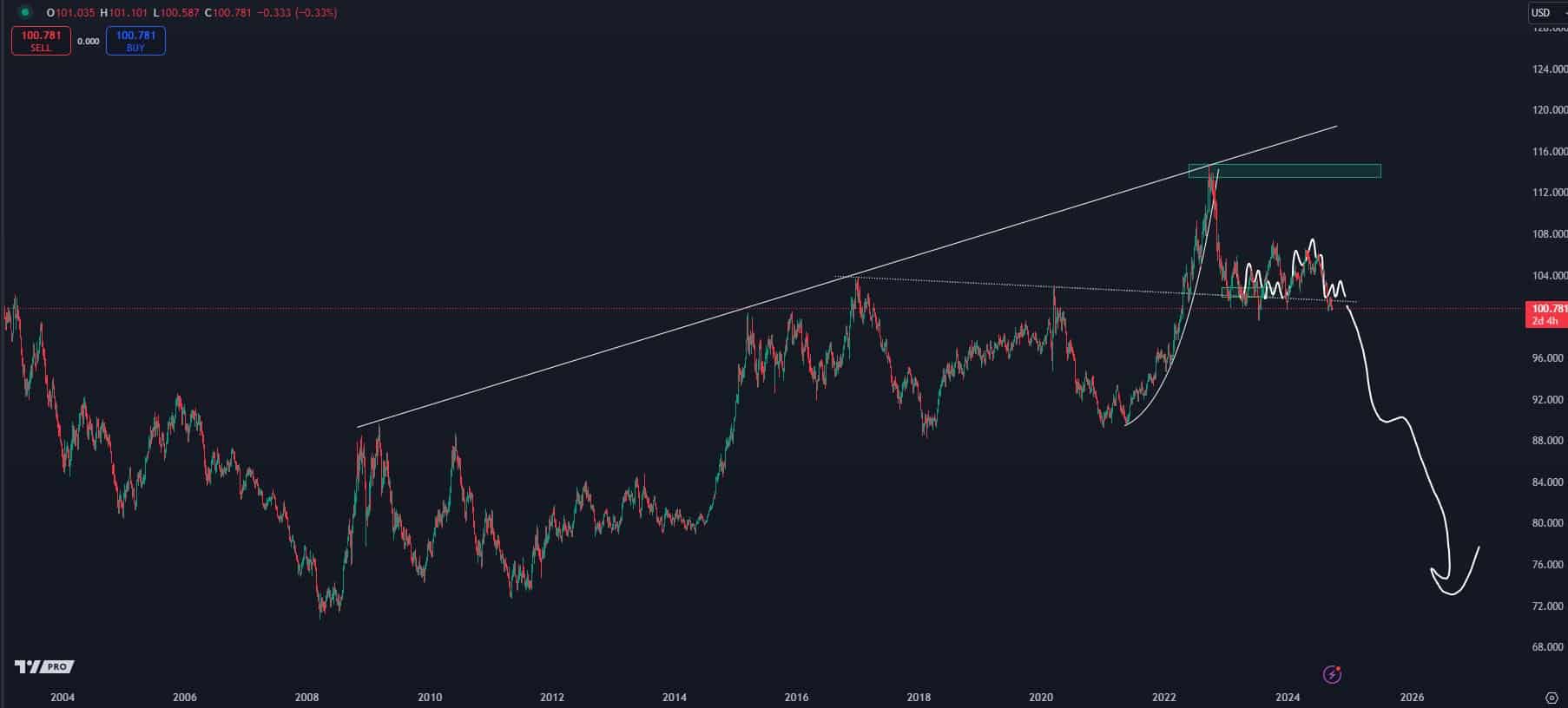

Another analyst Crypto Kaleo, who has monitored BTC’s movement against the DXY (U.S. Dollar Index) for over 19 months, noted that the correlation has been consistent. The DXY chart tracks the U.S. dollar’s value relative to a basket of foreign currencies.

Kaleo predicts a decline in the DXY, which is expected to catalyze a Bitcoin rally, as these charts typically move inversely. Such a development could propel BTC to major levels.

Despite this optimistic outlook, AMBCrypto has observed that some traders and investors are currently opting to sell in the short term.

Traders are backing out of BTC

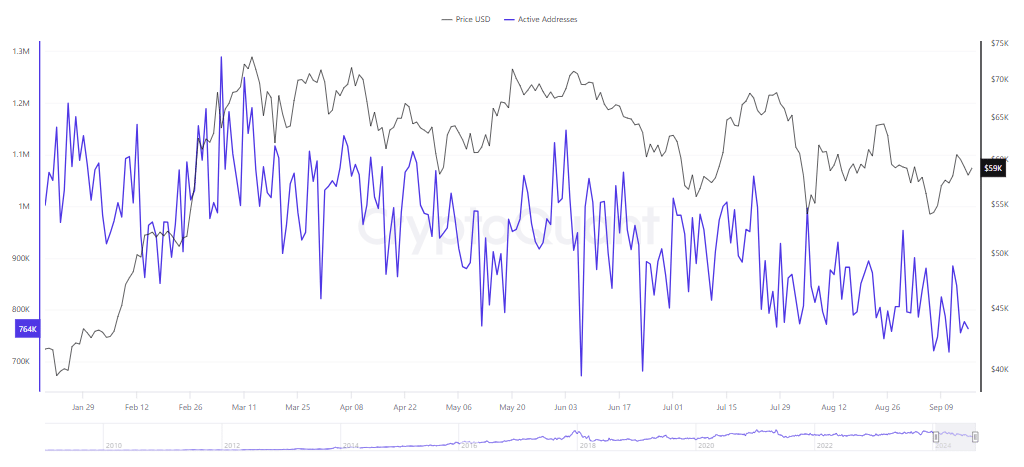

Traders are showing reduced interest in BTC, indicated by a noticeable decrease in trading activity.

Current data reveal a drop in the number of active BTC addresses—from 885,329 to 764,033—suggesting a bearish sentiment among participants.

Additionally, there has been a noticeable increase in the BTC exchange supply, which represents the total number of assets available across various exchanges.

The available BTC has risen to 2.58 million, which could potentially lead to a price drop if not matched by corresponding buyer interest.

Such trends point to a potential short-term decline in BTC prices unless there are changes in the market situation.

The bears are still present

A more bearish short-term outlook for BTC is emerging as recent liquidation data from Coinglass reveals unfavorable outcomes for traders anticipating a rise. At the time of reporting, over $23.96 million worth of long positions have been forcefully liquidated.

Liquidation data contains the details concerning the forced closure of trading positions, triggered when traders fail to meet margin requirements or when their trades move substantially against them.

Read Bitcoin’s [BTC] Price Prediction 2024-25

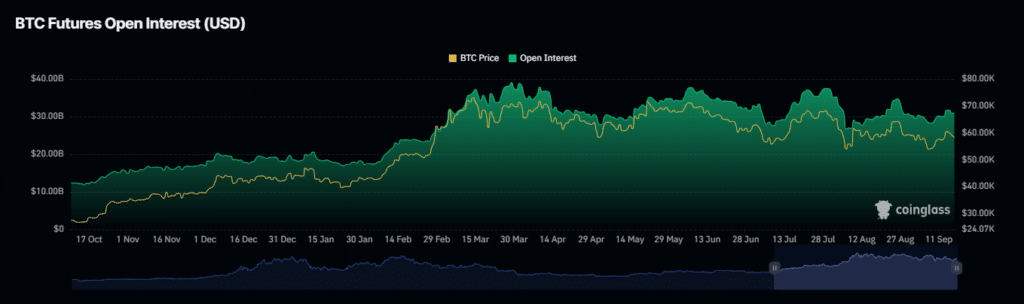

Furthermore, open interest—a metric indicating investor interest in an asset—has decreased by 0.44%, as reported by Coinglass.

If these trends persist, a continued decline in both metrics could further depress BTC prices in the short term.

![Bonk Coin [BONK]](https://ambcrypto.com/wp-content/uploads/2025/06/Gladys-19-1-400x240.webp)