Why Bitcoin might see a correction despite the recent surge

- Bitcoin surged by 7.96% over the past week.

- Market fundamentals suggested that Bitcoin could experience a market correction soon.

As expected, Bitcoin [BTC] has experienced a strong October. While the month started on a low note, the crypto has made significant gains outweighing the previous losses.

Since hitting a low of $58867, BTC has made a strong upswing reaching July levels of $69k.

In fact, as of this writing, Bitcoin was trading at $69028.This marked a 7.96% over the past week, with the crypto gaining 9.52% on monthly charts.

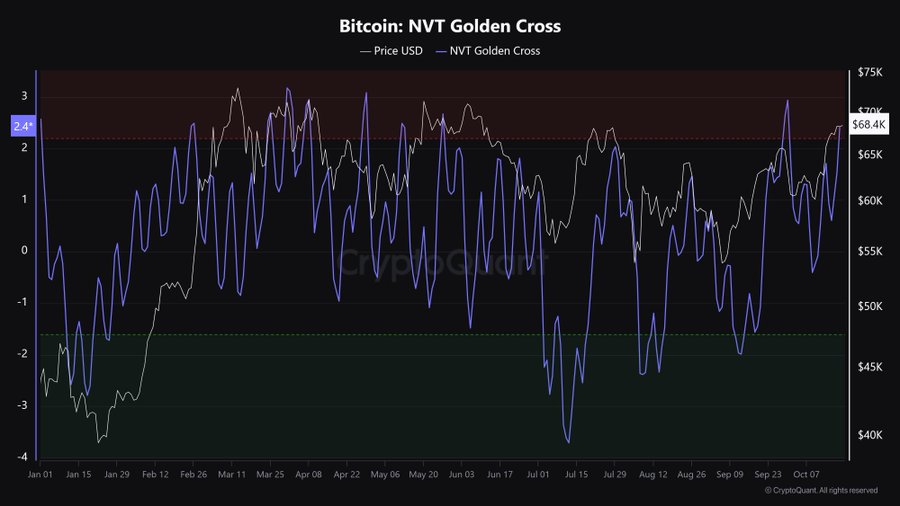

The recent upsurge has left analysts both optimistic and pessimistic in equal measures. For instance, CryptoQuant analyst Burak Kesmeci suggested that Bitcoin might see a market correction, citing the NVT golden cross.

Market sentiment

In his analysis, Kesmeci posited that Bitcoin’s NVT Golden Cross has entered a hot zone in the short term.

According to him, the market will eventually experience correction before attempting another uptrend.

For the uninitiated, the NVT Golden Cross reaching the hot zone suggests that BTC is currently higher than what its network activity justifies.

Thus, it has become overvalued relative to the amount of value being transferred on the blockchain.

This suggests a potential overbought condition where price growth is not supported by the fundamental usage of the network.

These conditions often precede a price correction, where the market adjusts and brings the price back to align with the network fundamentals.

Based on this analogy, Bitcoin will experience a pullback in the near term.

What BTC’s charts say

As observed by Kesmeci, the current fundamentals don’t support a sustained rally and could drop to meet the demand.

Therefore, the question is, how sustainable is the current rally, and what do market indicators suggest?

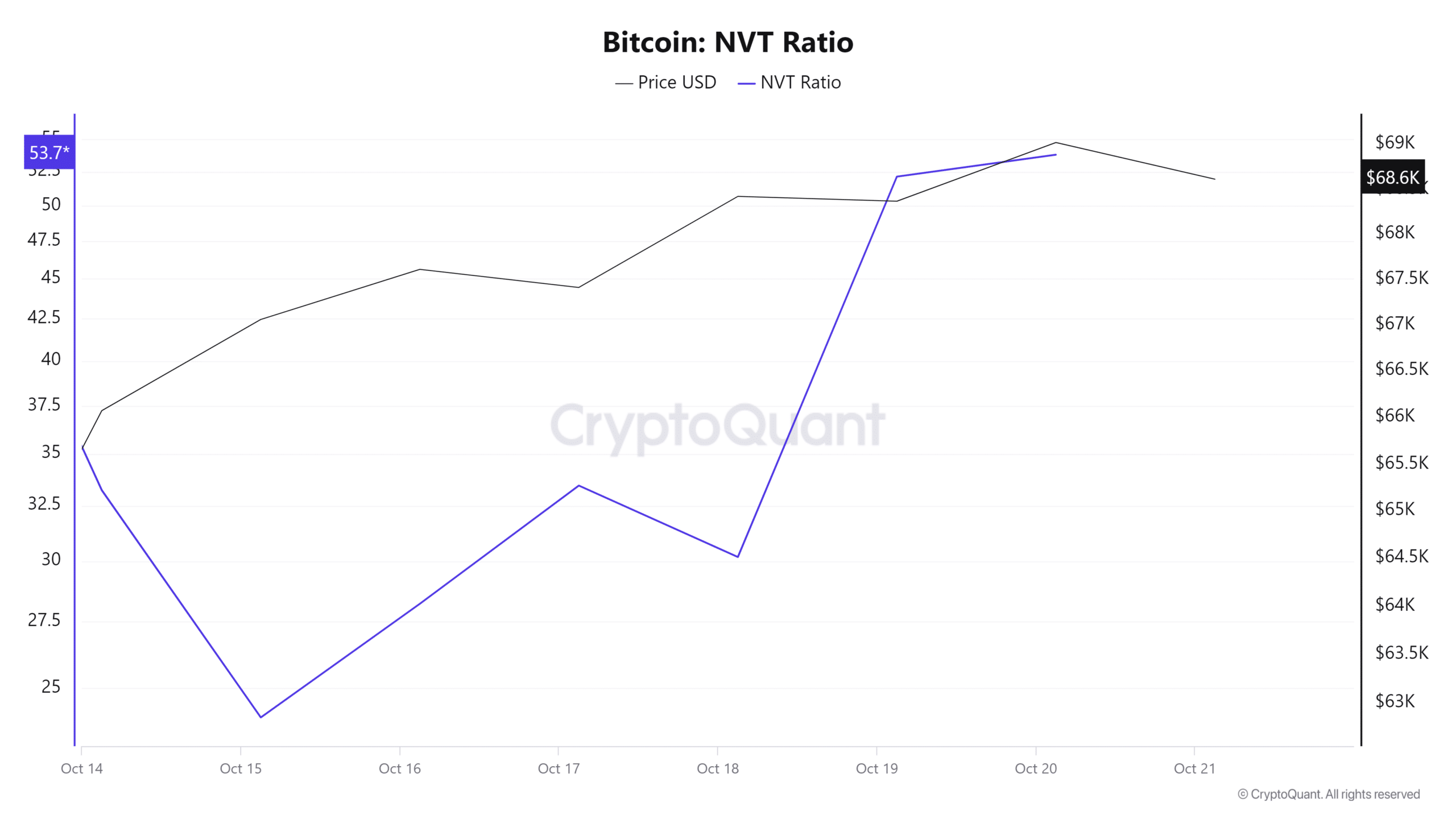

The first indicator to consider is Bitcoin’s NVT Ratio, which measures network value to transaction.

According to CryptoQuant, the NVT ratio has been rising over the past week. This increase implies that BTC is overvalued compared to actual utility and network activity, thus prices are unsustainably high.

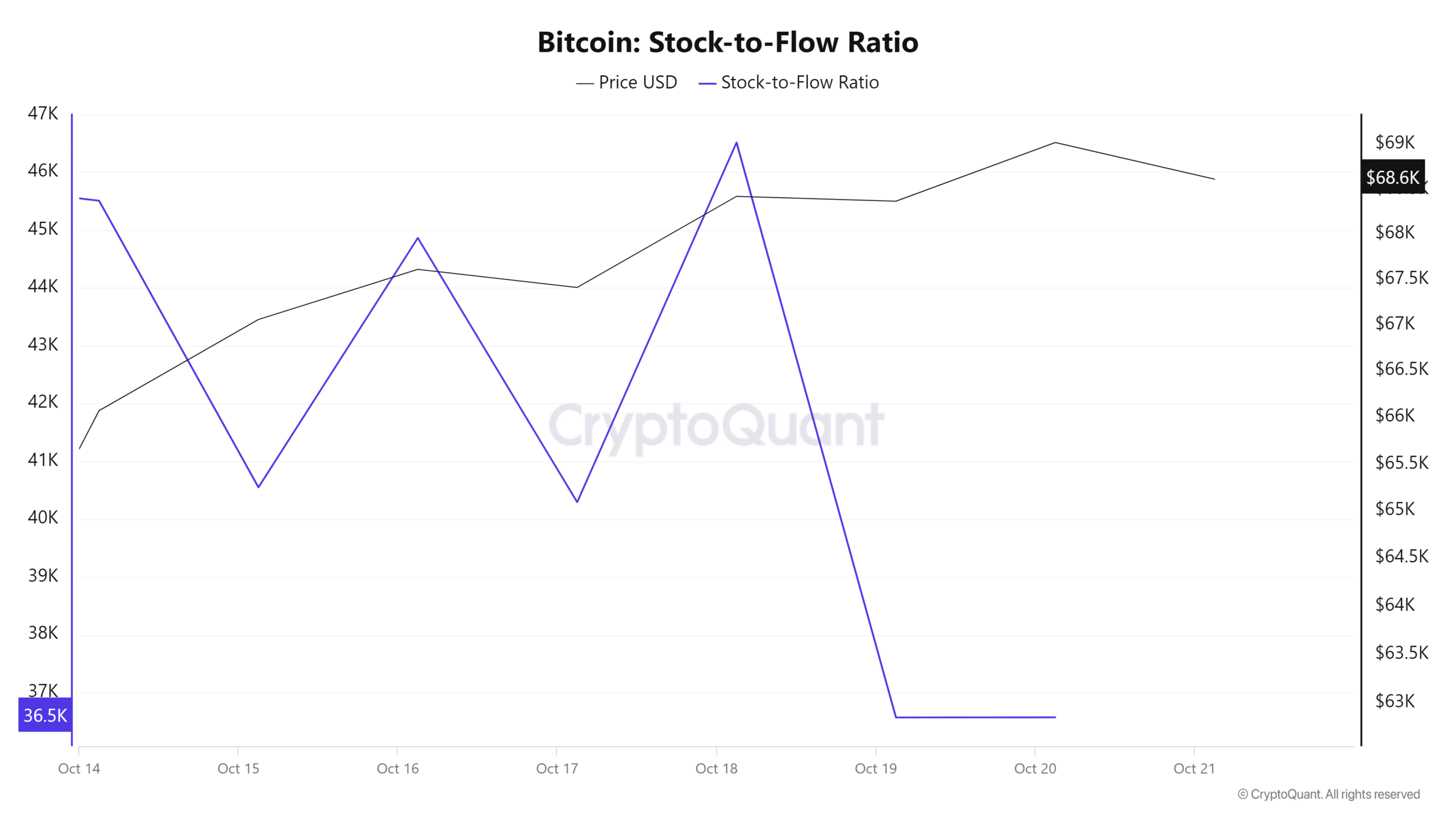

Additionally, Bitcoin’s Stock-to-Flow Ratio has declined over the past week, suggesting a rise in supply. The increased availability of BTC tends to turn the market into bearish, especially if the demand is not growing.

Source: Santiment

Finally, Bitcoin’s Price DAA divergence has remained negative throughout the past week. This indicates that there’s an unsustainable price increase.

When the Price DAA is negative, it suggests the current rally is driven by speculation or short-term demand.

Read Bitcoin’s [BTC] Price Prediction 2024 – 2025

Simply put, although BTC has surged to a recent high, the market fundamentals suggest a correction is imminent. As such, the current rally is mostly driven by speculation and not supported by demand.

A correction will see Bitcoin drop to the $65872 support level.