Why Bitcoin might soon reverse its June losses

- Analyst identifies a Bull-Flag pattern suggesting Bitcoin could soon reverse its June downtrend.

- MVRV ratio and exchange stablecoin ratio provide key insights into Bitcoin’s market conditions.

Bitcoin [BTC], the flagship cryptocurrency, has shown signs of a potential reversal from its recent downtrend, sparking discussions among market analysts and investors alike.

After a challenging month that saw prices dip as low as $58,000 earlier this week, Bitcoin has made a modest recovery, trading at around $61,516, at the time of writing.

This recovery includes a brief surge above the $62,000 mark earlier today, signaling to some experts that a more significant breakout could be on the horizon.

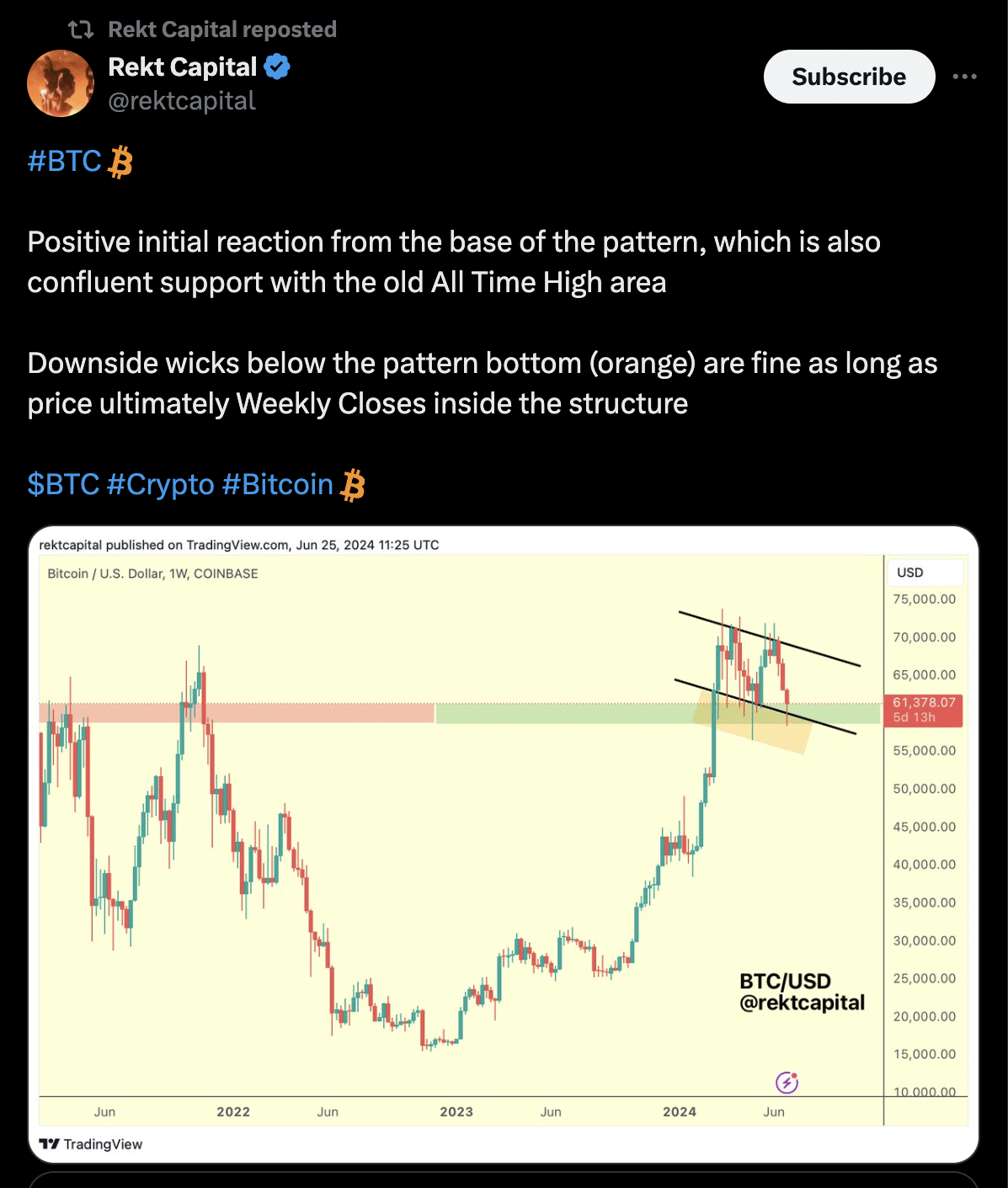

Notable market analyst Rekt Capital has gone so far as to suggest that the ongoing downtrend that characterized June might soon come to an end, spurred by emerging patterns in Bitcoin’s daily trading data.

Bitcoin bull-flag emergence

Rekt Capital points to the formation of what appears to be an early-stage Bull-Flag pattern in the daily price charts. This pattern, if fully realized, could indicate that Bitcoin is gearing up to challenge and potentially break out from the downtrend it has been experiencing.

Such technical formations are closely watched by traders for signs that the current price action might translate into a major move upward.

Rekt Capital noted,

“Let’s see if this current price action on the Daily continues to form this small, early-stage Bull Flag,”

Furthermore, Rekt Capital has recently disclosed that the recent retracement in Bitcoin’s price is approaching the common 22% correction observed throughout various market cycles. This adjustment is initially met with positive responses that correlate with support levels previously seen at all-time highs.

Rekt Capital stresses the importance of Bitcoin’s price closing above the pattern’s lower boundary on weekly charts to sustain this critical support level, even though brief dips below are considered tolerable.

Are there signs of a bullish breakout?

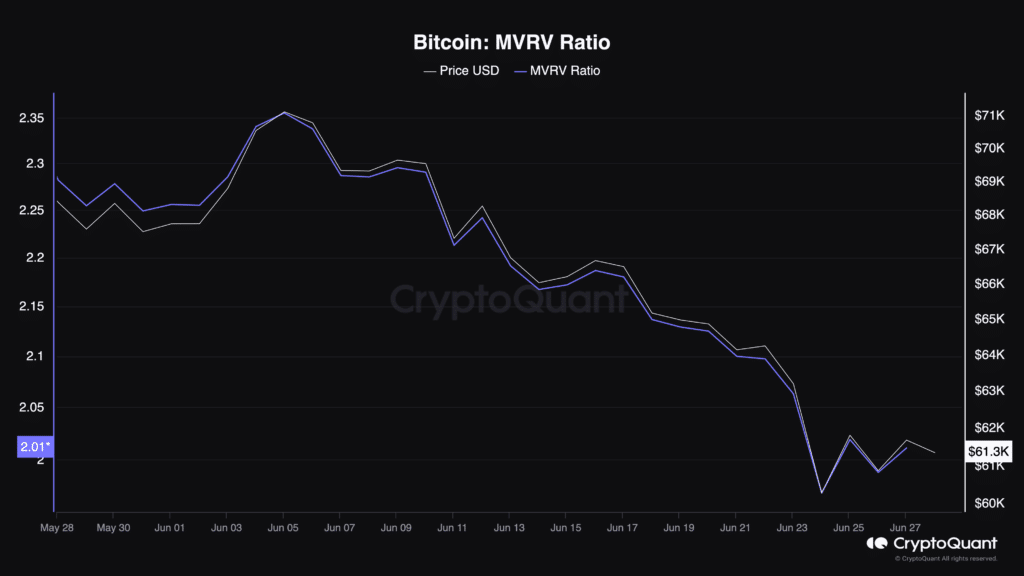

Despite the optimistic technical analysis from Rekt Capital, it’s crucial to consider Bitcoin’s core market indicators to understand whether the crypto is indeed poised for a bullish breakout. One such indicator is the MVRV ratio, which currently stands at 2.01.

Source: CryptoQuant

The Market Value to Realized Value (MVRV) ratio compares the market cap of Bitcoin to its realized cap, providing insights into whether the asset is undervalued or overvalued compared to its historical price norms.

A ratio above 2.0 typically suggests that Bitcoin is in a zone where selling pressure might begin, as holders might start seeing profits as attractive enough to liquidate some of their holdings.

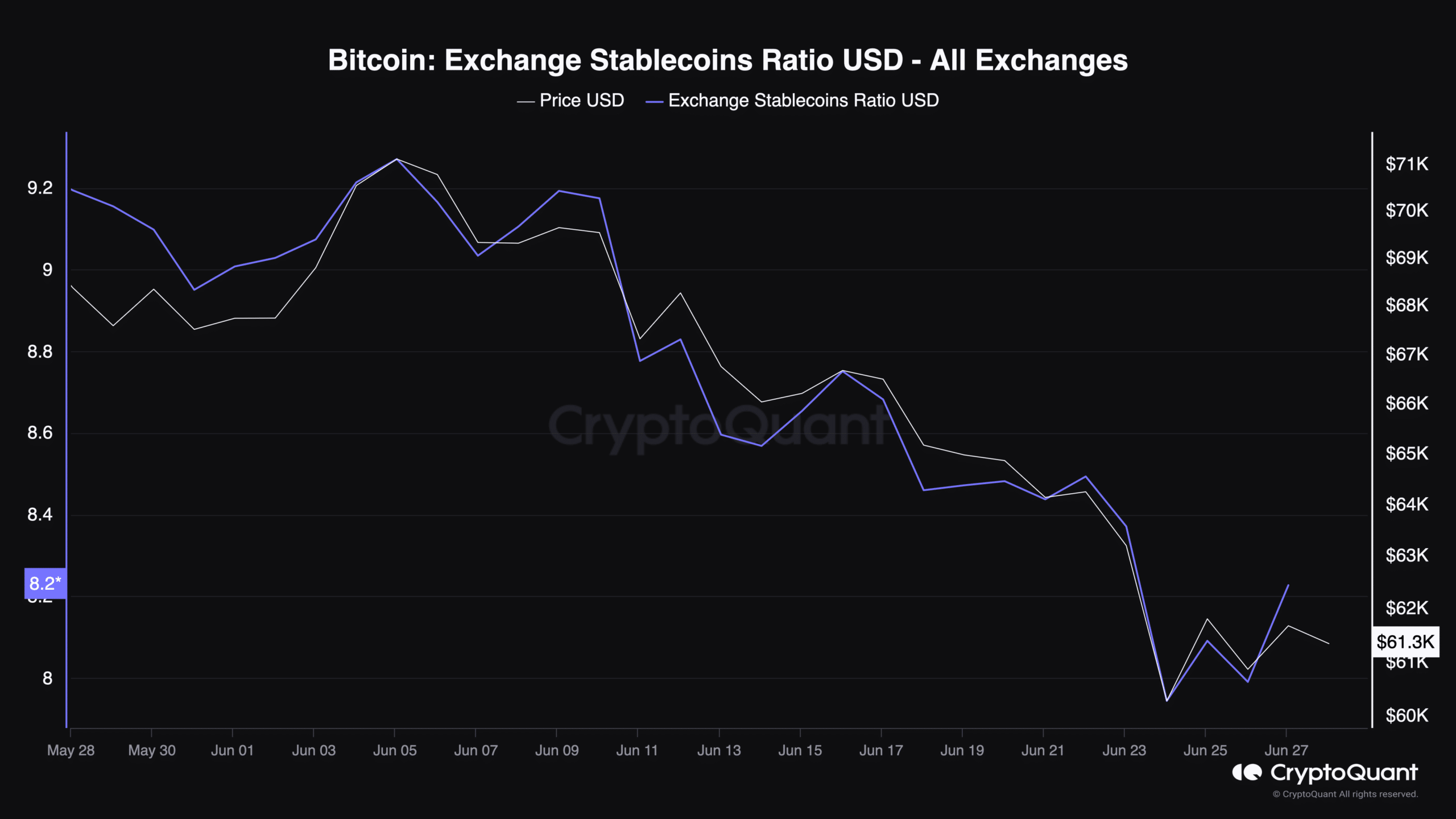

Additionally, the exchange stablecoin ratio has seen a spike of 2.33%, now at 8.22. This metric, which compares the total stablecoin supply held in exchanges to Bitcoin reserves, can indicate whether there is potential buying power to push prices higher.

Read Bitcoin’s [BTC] Price Prediction 2024-25

A higher ratio suggests that traders might be poised to convert stablecoins into Bitcoin, potentially driving up prices.

However, the crypto market remains divided with other prominent analysts like Willy Woo signaling caution, noting that Bitcoin bears are still in control, as recently reported by AMBCrypto.