Why Bitcoin remains the most preferred digital asset

- BTC’s inflows year-to-date have exceeded $500 million.

- Leading alt ETH saw outflows despite the surge in the value of the coin.

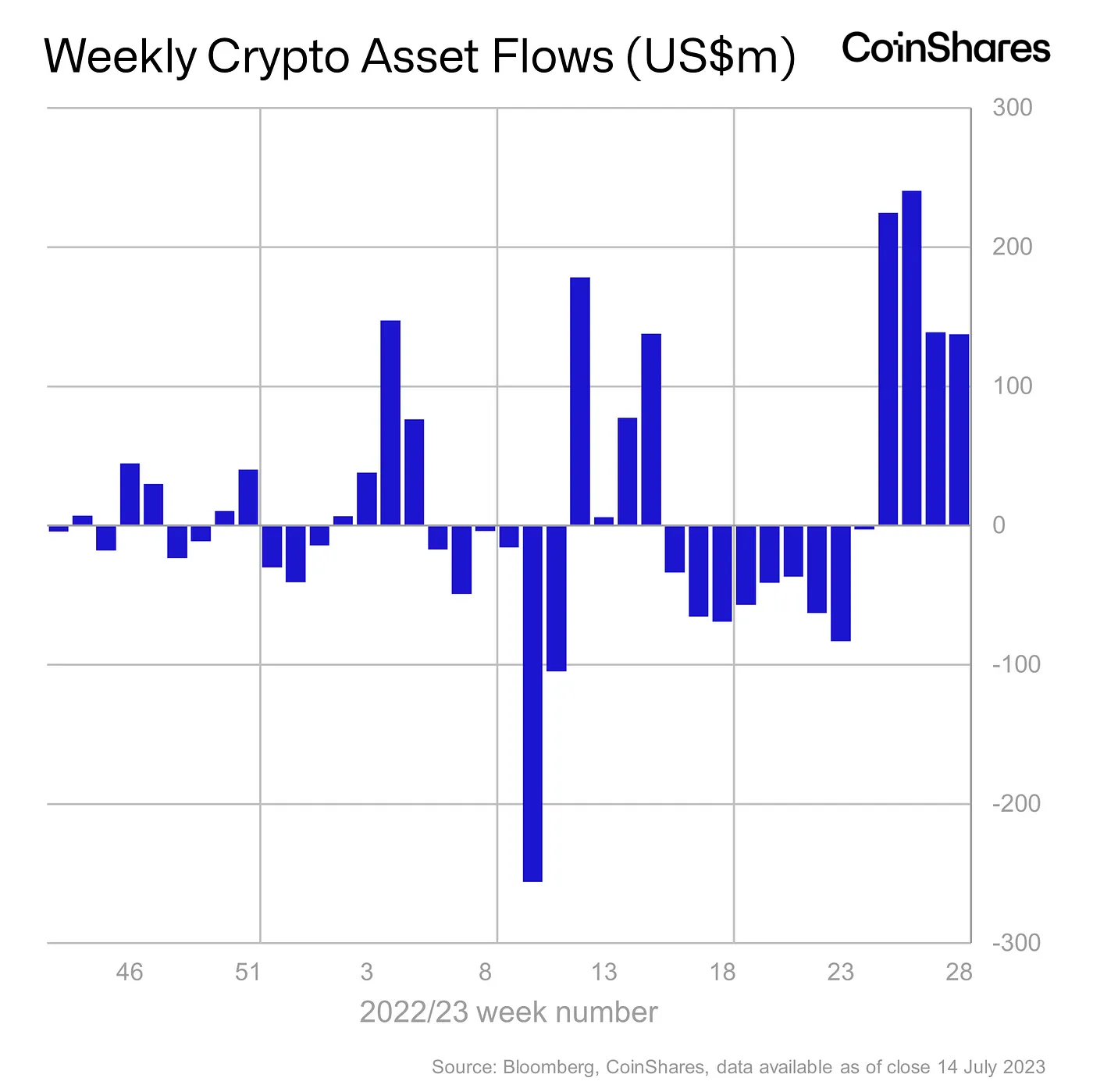

Inflows from digital asset investment products totaled $137 million last week, bringing the fourth consecutive week of inflows to $742 million, CoinShares found in a new report.

According to the digital assets investment firm, the total inflows recorded in the last month represented the largest run of inflows since the final quarter of 2021.

Despite the year average trading volume for investment products being around $1.4 billion, CoinShares noted that last week’s trading volumes for these products surged to a total of $2.3 billion, surpassing the average by a considerable margin.

CoinShares added,

“The volumes are currently making up a far greater proportion of total crypto volumes, comprising 11% last week compared to the 2% average.”

Investor sentiment favors Bitcoin

For the fourth consecutive week, “investors maintain(ed) focus on Bitcoin” as the king coin logged inflows that totaled $140 million last week. This accounted for 99% of the total inflows recorded during that period. While BTC’s price trended downwards after trading briefly at a two-month high of $31,693 on 13 July, the king coin saw its inflows grow by 5% during that period.

The additional $140 million in inflows brought the leading coin’s YTD net inflows to $571 million, with its assets under management (AuM) valued at $25 billion. This represented the third week of BTC logging a net inflow YTD, having been in a net outflow position of $171 million a month ago.

On the other hand, short-bitcoin investment products saw an outflow of $3.2 million last week, representing 12 weeks of consecutive outflows. According to CoinShares:

“A combination of recent price appreciation and outflows have seen short bitcoin total assets under management fall from their April US$198m peak to just US$55m.”

However, despite the continued bearishness for short-bitcoin, it remained the second best-performing asset in terms of inflows YTD at $55 million, albeit in a steady decline, data from the report showed.

ETH leads from the back

With an outflow of $2 million logged during the period under review, leading altcoin Ethereum [ETH] emerged as the “asset with the most outflows year-to-date.”

While the alt’s price saw some growth in the last week, the price growth failed to translate into any inflows for ETH, CoinShares found.

As for other altcoins, Solana [SOL], Polygon [MATIC], and Litecoin [LTC] saw minor inflows of “between US$0.5m, US$0.5m, and US$.3m, respectively.”

![Sei [SEI]](https://ambcrypto.com/wp-content/uploads/2025/06/Erastus-2025-06-29T145427.668-1-400x240.png)