Why Bitcoin’s future depends on whale accumulation

- Bitcoin’s rising whale accumulation amidst market volatility raised short-term prospects.

- Miners started selling their holdings as revenue declined.

The crypto market’s volatility hasn’t hindered whale behavior in terms of Bitcoin [BTC] accumulation. According to analyst Maartun, whales were on a buying spree as of 19 June.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Whales turn bullish

This surge in whale accumulation could improve BTC’s price in the short term, as their buying power could create upward pressure on the market.

Whales (?) are buying the orange coin (⚪) is going sideways. In my opinion, that is not too bad ?

Try it yourself? ?https://t.co/3tvFr4iYe0 pic.twitter.com/DZIUPMaMM5

— Maartunn (@JA_Maartun) June 18, 2023

However, an increase in whale accumulation also raised concerns about the dependence of BTC’s price on these large investors. If a high percentage of whales hold BTC, it could make retail investors vulnerable to sudden selling pressure from these influential players.

The actions of whales can sway market sentiment and trigger significant price fluctuations, potentially leading to increased market volatility.

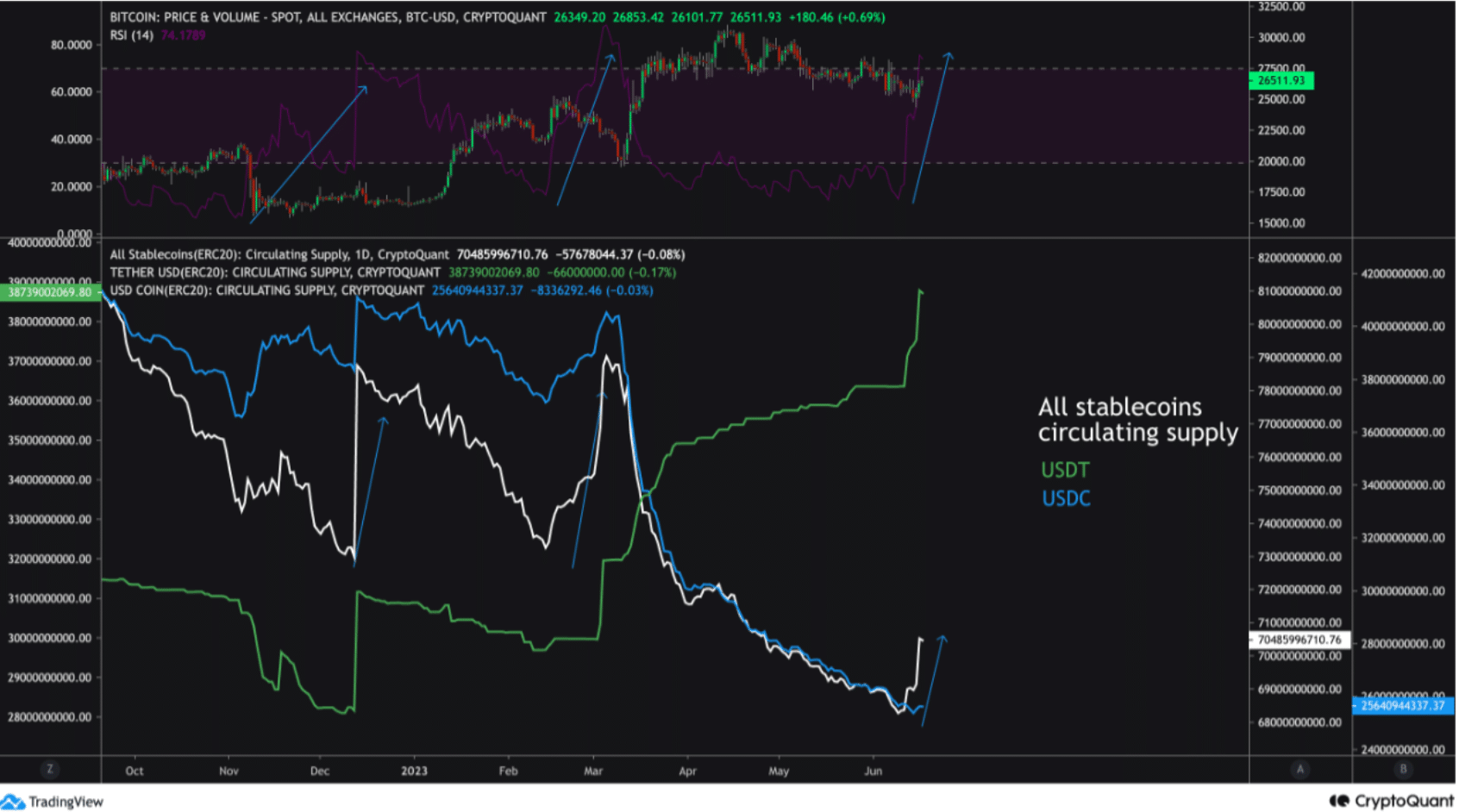

Another factor that could contribute to the growth of BTC’s price is the issuance of stablecoins. Notably, CryptoQuant analyst Crypto_Lion suggested that stablecoin issuance could lead to future price increases for BTC.

Interestingly, stablecoin issuance has shown a negative correlation with price movements, indicating that stablecoins have the most significant impact during periods of falling prices.

This inverse relationship suggests that stablecoins may act as a stabilizing force during market downturns, attracting investors seeking refuge from market turbulence.

Recent events such as the SEC lawsuits and FOMC panic have caused price depreciation in cryptocurrencies. However, stablecoins could potentially have a positive impact on the price of BTC in the future, as observed from historical data.

Bitcoin miners turn away

On the other hand, there are factors that might hinder the growth of BTC’s price. Glassnode’s data indicated that miner outflow has been increasing. This trend can be attributed to the decline in miner revenue, partly due to lower transaction fees.

If miners are unable to make profits, they may be compelled to sell their holdings, adding to the king coin’s selling pressure.

? #Bitcoin $BTC Miner Outflow Multiple (7d MA) just reached a 2-year high of 2.188

Previous 2-year high of 2.185 was observed on 03 April 2022

View metric:https://t.co/rUT3MENeWz pic.twitter.com/Q949GzMKug

— glassnode alerts (@glassnodealerts) June 19, 2023

Read Bitcoin’s [BTC] Price Prediction 2023-2024

At the time of writing, BTC was trading at $26,451. The MVRV ratio, which compares the market value of BTC to its realized value, suggested the presence of selling pressure from holders.

Additionally, the declining long/short difference indicated an increase in short-term holders. The rise in short-term holders raised concerns as they were more likely to sell their holdings, potentially impacting BTC’s price.