Why Bitcoin’s HODL theory may be long-gone; BTC investors should watch out for…

Bitcoin [BTC]’s HODL narrative has been losing steam in the last few months. The market has shifted in favor of short-term profits and this has had a toll on Bitcoin’s performance. Especially its ability to reach medium to long-term targets.

Bitcoin’s price action failed to hit its mid-term targets and has been relegated to the lower range in the last six months. This is despite it’s the sharp discount during that time, and heavy accumulation during the dips. Its upside has been relatively limited, followed by more downside.

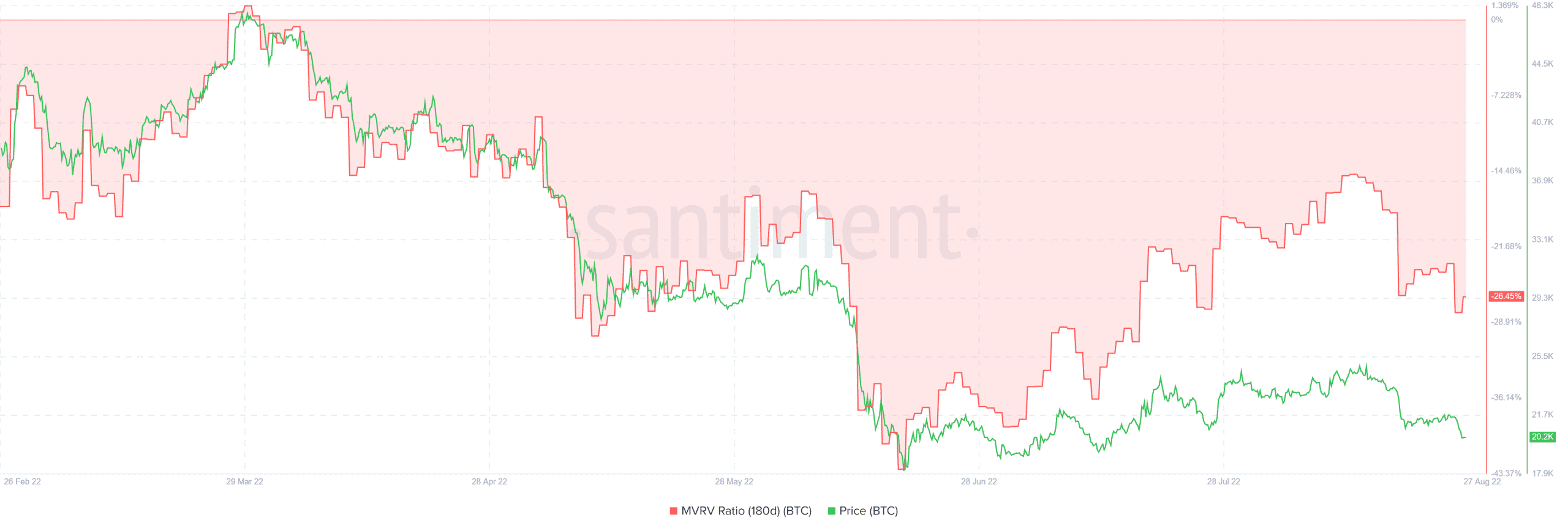

Long-term holders have consequently been unable to remain in profit. This outcome is demonstrated by Bitcoin’s 180-day Market Value Realized Value (MVRV) ratio, which has remained in negative territory for the last six months.

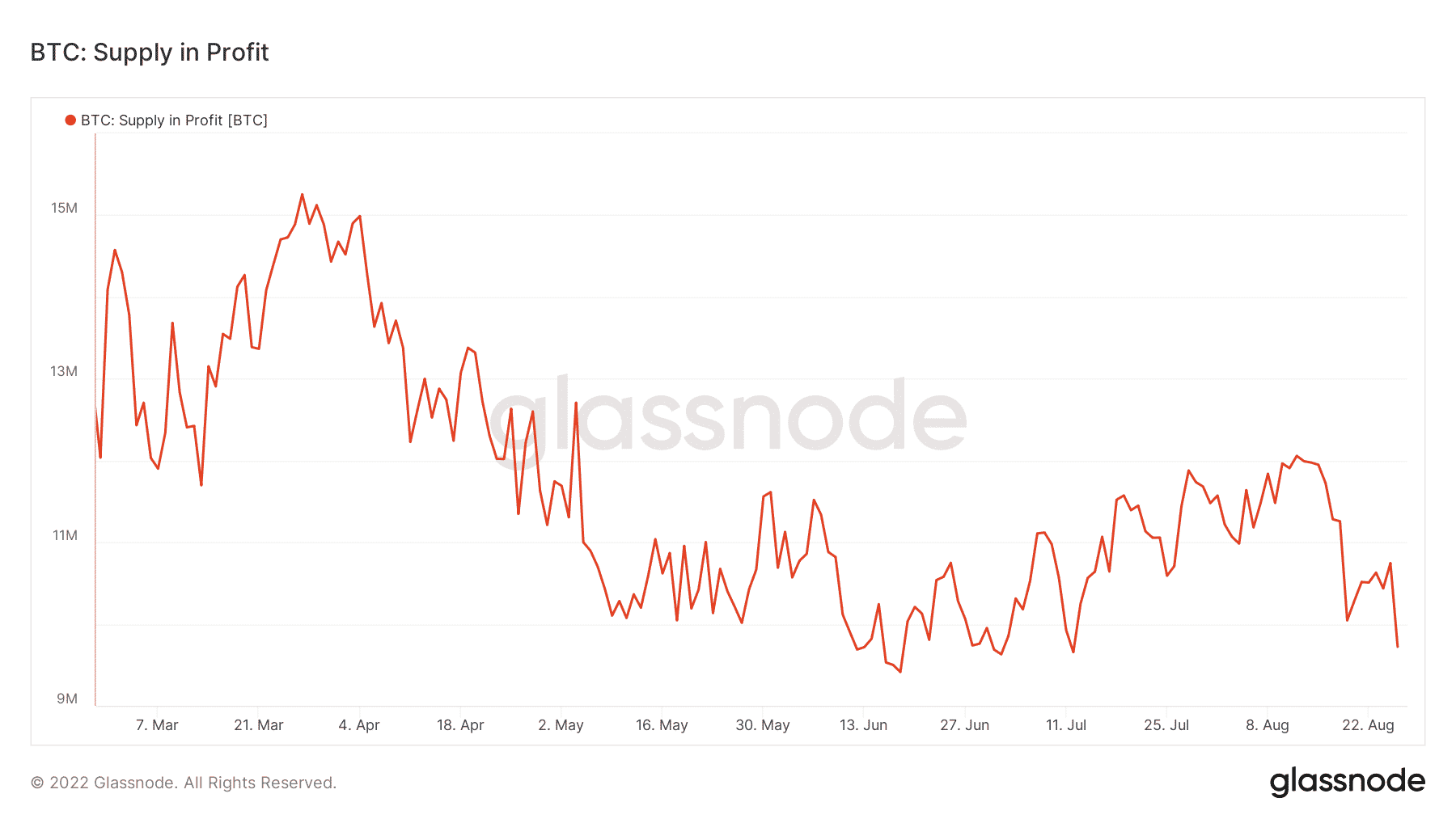

Bitcoin’s six-month total supply in profit is currently in its lower range. The drop during this period confirms that HODLers who bought BTC earlier on are still out of the money. It also supports the short-term profits narrative where investors that bought more recently near June lows enjoyed some profits.

The common narrative when it comes to Bitcoin’s profitability is that short-term gains have been more preferable. This outcome subsequently means that any strong buying pressure in the last few months was relegated to limited upside.

An unusual advantage

Bitcoin’s current pursuit of short-term profitability means it has become easier to predict sell pressure and price floors. For example, the retest of 2017 highs has demonstrated strong demand near the $20,000 price range. Bitcoin has enjoyed strong comebacks after every dip, and this might have contributed to the strategy shift in favor of short-term opportunities. This outcome also reflects Wyckoff accumulation and distribution.

Macro-economic factors have a heavy hand in the current preference for short-term profits. The crypto and commodities markets have been facing pressure from hawkish stance by regulators. The prospects of a major bullish recovery in the short-term have consequently been watered down.

It’s only short-term then

Many investors are still loading up in anticipation of long-term recovery despite short-term profit-taking. Long-term hodlers are still dollar-cost-averaging into the market. Especially now that the bear market is approaching its tail end. Bitcoin might also be near its current cycle’s floor price because holding at lower prices will limit its downside.