Bitcoin

Why Bitcoin’s short-term holders are crucial for the next rally

Bitcoin’s short-term holders are essential to start a new rally, as they currently hold 88.3% of supply, as per Glassnode.

- 88.3% of BTC’s short-term holder supply was being held at an unrealized loss following last week’s decline in value.

- BTC’s price is at risk of further decline should short-term holders intensify coin distribution.

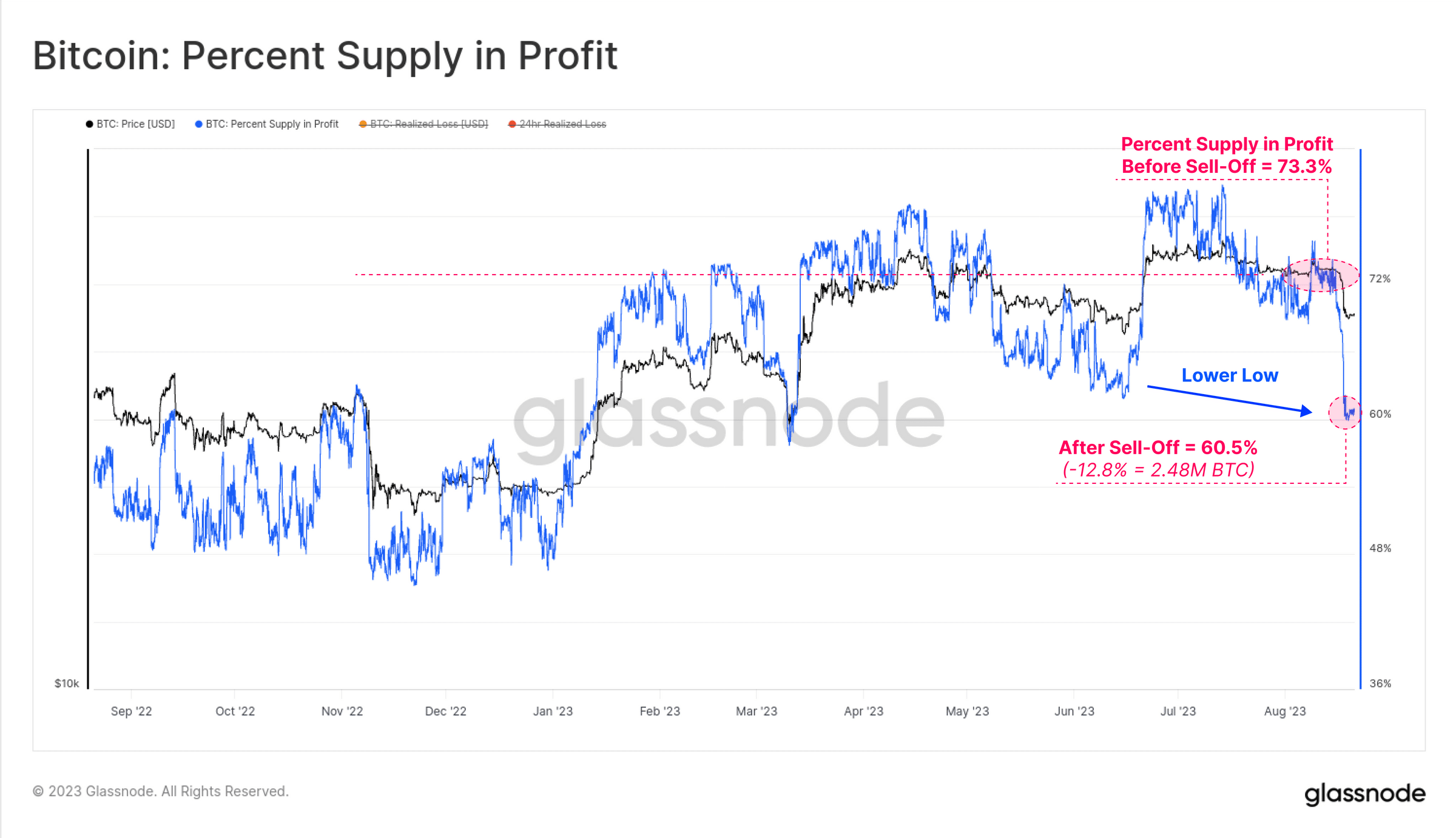

Last week’s deleveraging event in the Bitcoin’s [BTC] futures markets caused the king coin to record its most significant single-day sell-off of the year. As investors count their losses, short-term holders may face a gloomy future as 88.3% of short-term holder supply was being held in an unrealized loss,

Glassnode found in a new report.Read Bitcoin’s [BTC] Price Prediction 2023-2024

Short-term holders were the most exposed

According to the on-chain data provider, a large percentage of BTC’s supply previously held in profit fell sharply last week. This suggested that a sizeable number of investors that bought the leading cryptocurrency at high prices were plunged into losses.

Glassnode opined that this was due to a “top heavy market.” This refers to a market situation where many investors buy BTC at a price that is close to or above the current price. This means these investors would be in an unrealized loss position if the coin’s value fell.

Noting that this behavior was common among BTC’s short-term holders, Glassnode found that:

“Sharp upticks in STH Supply in Loss tend to follow ‘top heavy markets’ such as May 2021, Dec 2021, and again this week.”

“Out of the 2.56M BTC held by STHs, only 300k BTC (11.7%) is still in profit,” Glassnode added.

Further, Glassnode assessed the Profit or Loss Bias (dominance) of STH volumes flowing into exchanges and found the profit dominance of STH volumes flowing into exchanges has been on a consistent decline since BTC’s value began its uptrend in January.

This is because many investors that comprise the STH cohort of BTC holders have continued to buy the coin at “an increasingly elevated cost basis.”

Is your portfolio green? Check the Bitcoin Profit Calculator

With last week not being any different:

“We saw the largest loss dominance reading since the March sell-off to $19.8k. This suggests that the STH cohort are both largely underwater on their holdings and increasingly price sensitive.”

This tells us that the current BTC market is becoming more top-heavy. With STHs prone to more losses because they keep buying at the top, BTC’s price might struggle to grow in the meantime.

Pointing out that last week’s price fall was “one to keep a close eye on,” Glassnode found that loss momentum and dominance amongst BTC short-term holders have surged. When this happened in May and December 2021, it was followed by “more violent downtrends” in BTC’s value.