Why BlackRock thinks you should own 85% Bitcoin

- Blackrock’s new report revealed that firms strongly believe in keeping BTC in their portfolios.

- Retail investors showed interest, and reached an all-time high.

Large banking institutions and funds have been critical of Bitcoin[BTC] for a long time. However, the situation has changed recently. Not only are these funds supporting Bitcoin, but they are also recommending its addition to investment portfolios. This newfound support from influential financial entities could have significant implications for Bitcoin’s adoption going forward.

Read Bitcoin’s Price Prediction 2023-2024

Blackrock continues to be bullish

Recently, global fund manager BlackRock recently made headlines when cryptocurrency analyst and trader Michael van de Poppe shared a screenshot of a BlackRock document on social media.

Analysts at Blackrock state that an optimal risk portfolio includes 84% of #Bitcoin.

Yet, you think we’ll go to $12K.

I’ll just buy more. pic.twitter.com/3oHRSwppiR

— Michaël van de Poppe (@CryptoMichNL) July 26, 2023

The document, titled “Asset Allocation with Crypto: Application of Preferences for Positive Skewness,” revealed that BlackRock recommends an impressive 84.9% allocation of BTC in a risky portfolio. The study, conducted in April 2022, analyzed Bitcoin’s performance as an asset from July 2010 to December 2021 on a monthly basis.

According to BlackRock’s findings, for a 60-40 portfolio (60% equities and 40% bonds) the optimal allocation of BTC is 84.9%. This left the remaining 15.1% to be divided between equities and bonds in a 60-40 ratio. Although the study was written last year, it has recently gained significant popularity on Twitter.

This recommendation from BlackRock underscores the growing recognition of Bitcoin as a potentially valuable component of a diversified investment portfolio.

Will history repeat itself?

The study’s significance extends to its potential implications for BlackRock’s promotion of Bitcoin once the spot ETF receives approval from the SEC. It draws parallels to the first gold ETF story, which could repeat itself for Bitcoin.

Notably, after the introduction of the first gold ETF in 2004, the gold price soared fivefold. This impressive growth was attributed in part to BlackRock’s global financial advisors. They strongly advocated a 5% gold allocation as an essential component in every portfolio.

Is your portfolio green? Check out the Bitcoin Profit Calculator

Given this historical precedent, BlackRock’s support and promotion of Bitcoin through ETFs could play a crucial role in driving further adoption and potentially impacting Bitcoin’s market dynamics in the future.

Retail investors don’t shy away

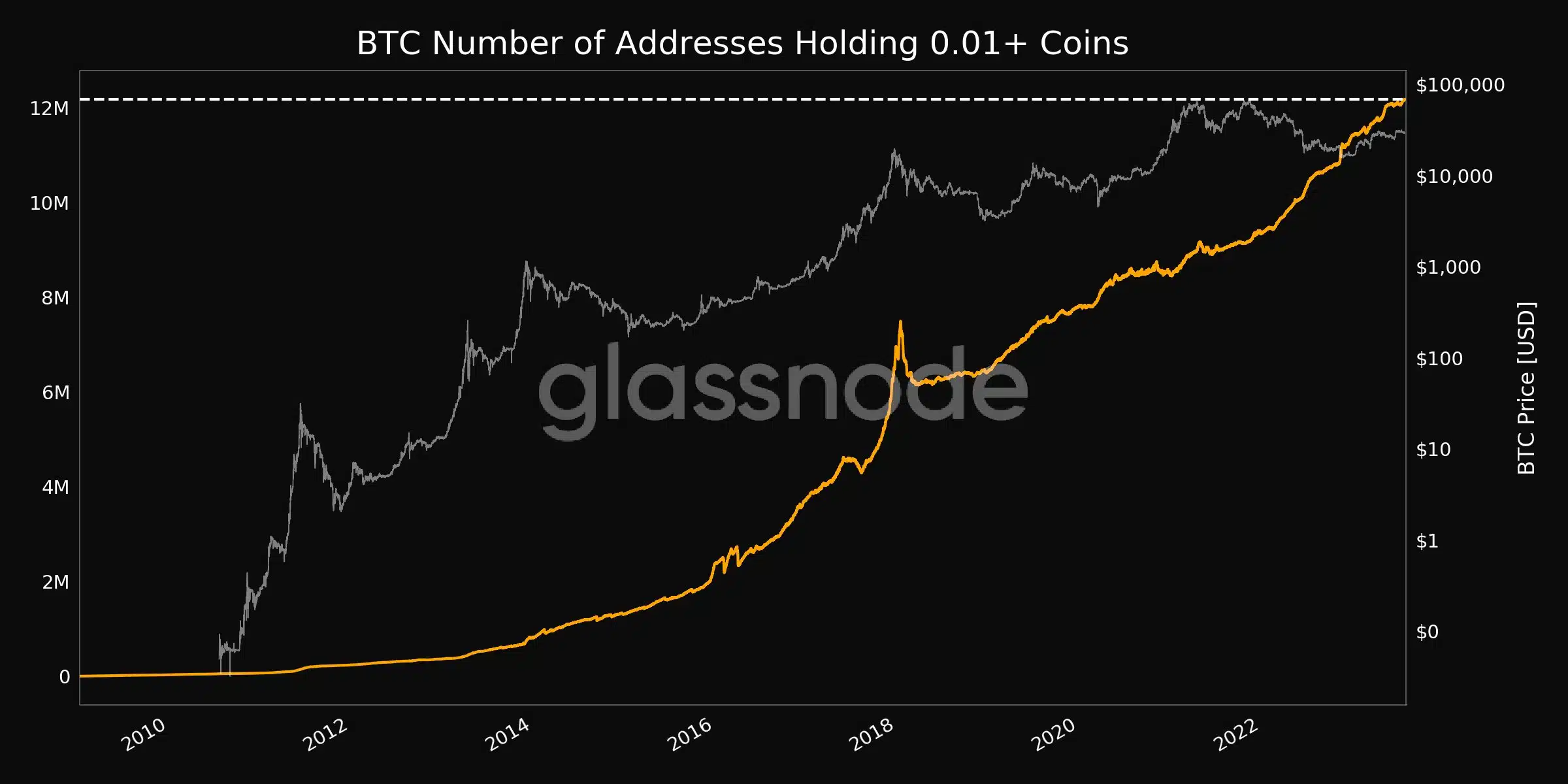

Not only were institutional investors showing interest in Bitcoin, there was optimism showcased by retail investors as well. According to Glassnode’s data, the number of addresses holding more than 1 Bitcoin had reached an all-time-high at press time.