Why BUIDL Fund’s $1.145B ETH stake signals faith in Ethereum’s future

- Ethereum’s price plunged 50% in three months amid massive ETF outflows.

- Institutional confidence grows as BlackRock’s BUIDL fund raised ETH holdings to $1.145B.

Ethereum’s [ETH] fortunes have taken a sharp downturn in 2025, with its price plunging nearly 50% in just three months—dropping from $4,100 in December 2024 to around $1,750 by March.

This steep decline has coincided with a wave of outflows from U.S.-listed ETH ETFs, which saw over $760 million exit in the past month.

Meanwhile, Bitcoin [BTC] continued to dominate investor interest, with Bitcoin ETFs attracting $785 million in fresh capital over just six days.

As Ethereum struggled to retain its footing, shifting market dynamics raised pressing questions about its long-term position in the digital asset ecosystem.

BlackRock’s BUILD funds hold over $1B in ETH

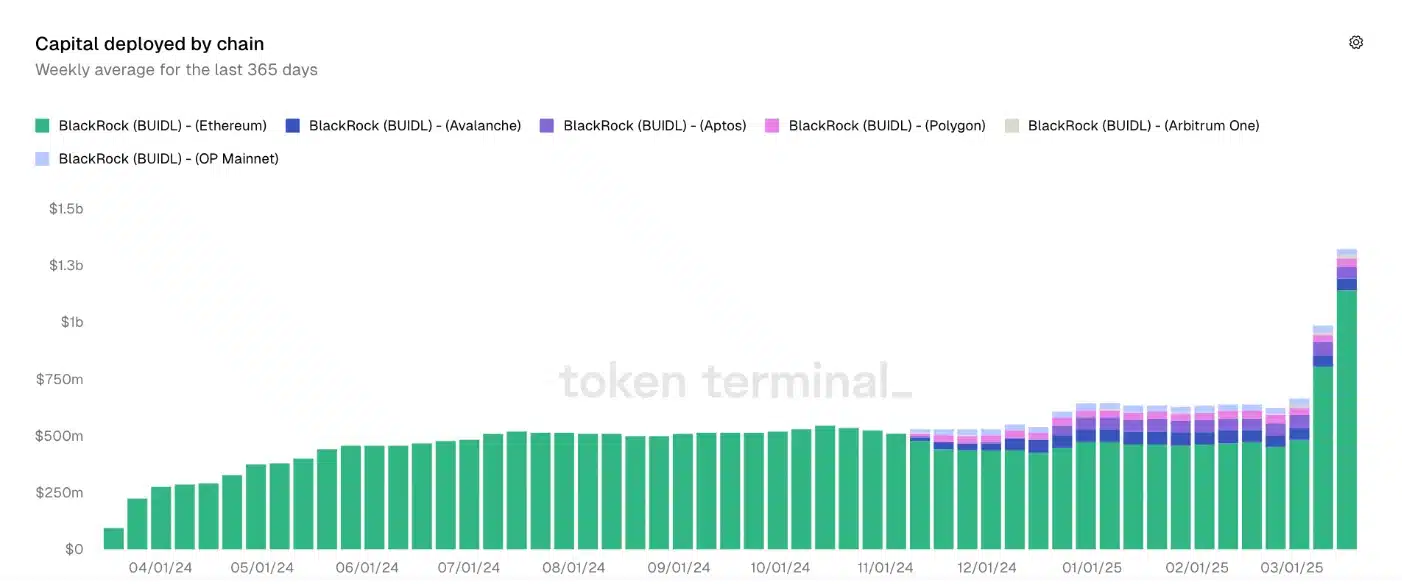

However, despite the price struggle, there has been a significant surge in institutional interest, as evidenced by BlackRock’s BUIDL fund increasing its ETH holdings to a record $1.145 billion.

This marks a substantial rise from the $990 million recorded just a week earlier, signaling growing confidence in Ethereum’s long-term value.

The fund, which focuses primarily on tokenized real-world assets (RWAs), continues to maintain ETH as its dominant base layer despite diversifying across networks like Avalanche, Polygon, Aptos, Arbitrum, and Optimism.

Additionally, the fund’s total assets under management surged by 15%, reaching $7.63 billion as of the 22nd of March, reinforcing the narrative that institutional players are doubling down on Ethereum’s potential.

Whale accumulation further strengths ETH’s bullish outlook

Ethereum’s bullish momentum is further reinforced by a surge in whale accumulation, signaling growing confidence among large investors.

On-chain data from Nansen Research reveals that since the of 12th March, wallets holding between 1,000 and 10,000 ETH have expanded their holdings by 5.65%, while those in the 10,000 to 100,000 ETH range have accumulated 28.73% more.

Although addresses with over 100,000 ETH have remained relatively unchanged, the broader accumulation trend highlights strong institutional and high-net-worth investor conviction.

This increasing demand among whales suggests that Ethereum’s long-term prospects remain robust, potentially setting the stage for a sustained upward trajectory.

Community reacts

Remarking on the same, an X (formerly Twitter) user-Belle noted,

“It’s obvious where $ETH is headed next.”

In conclusion, this X user put it best when he said,