Why CME Group’s latest update might be the first step towards an XRP ETF

- CME Group added XRP to its crypto benchmarks

- According to Ripple’s CEO, Spot XRP ETFs are one step closer now

After a long battle with the SEC, Ripple is now reporting significant milestones one after the other. For example, it is in the news today after CME Group and CF benchmarks announced the launch of XRP reference rates and real-time indices.

CME group announced its launch of XRP reference rates and live indices on its official X page. The firm announced,

“Starting 29 July, benefit from transparent pricing on two new cryptocurrencies as CME CF Internet Computer-Dollar and XRP-Dollar Reference Rates and Real-Time Indices are added to our expanding suite of benchmarks.”

The move left CEO Brad Garlinghouse excited and optimistic about the future. He, like many, is viewing the launch as the first step towards institutional recognition and even spot XRP ETFS. According to the exec,

“Nice to see @CMEGroup and @CFBenchmarks collaborate on this for an XRP index. The market has spoken.”

Notably, the move is a sign of growing demand for reliable price feeds among investors, especially institutional ones. Providing reliable and transparent pricing highlights shifting market trends with institutions’ interest in cryptocurrencies. The offering plays a crucial role in fostering trust and confidence, encouraging greater crypto usage and adoption.

After the launch on 29 July, the real-time indices for XRP will be updated on major exchange platforms such as Kraken, Coinbase, and Bitstamp.

SEC’s XRP is a Security controversy

United States’ Securities and Exchange Commission has had a long legal battle with Ripple. The SEC accused Ripple of selling XRP in unregistered offerings. Equally, the agency has long viewed XRP as a security. However, Judge Torres ruled that XRP by itself is not a security.

Contradicting this federal ruling though, last month’s judgment by a California judge has left the altcoin’s status and future hanging in the balance.

For their part, Ripple’s executives and legal advisors have long expressed a different opinion. According to them, XRP is not a security under the present definition of the law.

XRP ETFS Possible Soon With SEC’s previous stand?

The legal status of whether XRP is a security has left everyone speculating whether it can affect the possibility of spot ETFs. However, Ripple’s CEO believes that XRP is on the right path towards institutional investment. Responding to CME Group’s launch of reference rates, he claimed,

“The first step towards institutional crypto products is to have a trusted benchmark reference rate.”

The speculation over spot XRP ETFs has persisted for the last 3 months now. Garlinghouse, among others, remains confident about the possibility though, even arguing recently that such an ETF is inevitable. In fact, in a recent interview, he even said that such a product “makes sense.”

Impact on XRP’s price charts

At the time of writing, XRP was trading at $0.517 following an 18% hike the last 7 days. Similar stats were seen over the last 24 hours too, with its trading volume climbing by over 52%.

As per AMBCrypto’s analysis, XRP is witnessing a strong uptrend right now. And, sustained momentum would result in a short-term rally on the charts.

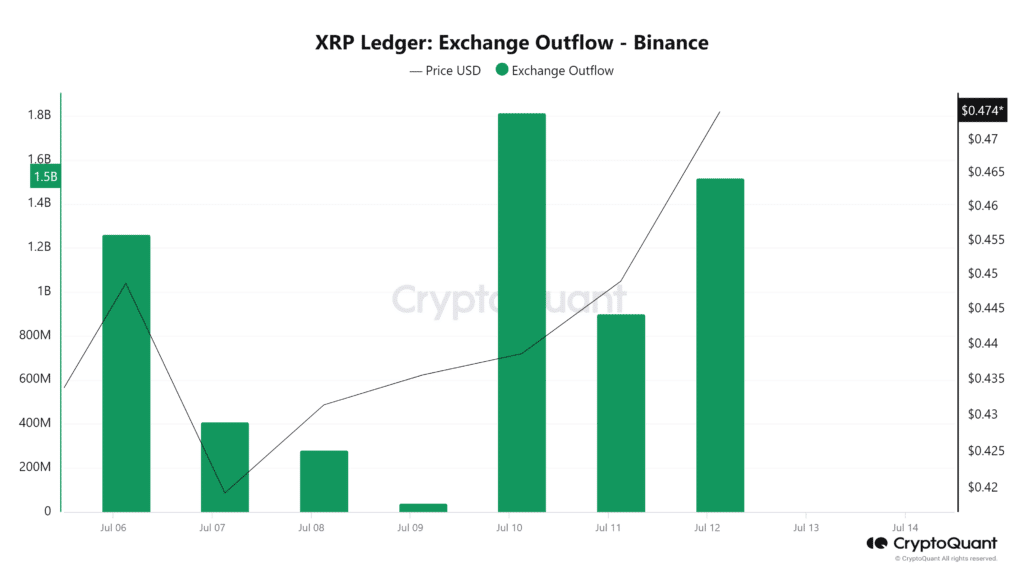

Additionally, our analysis of CryptoQuant revealed that XRP saw rising exchange outflows from a low of $40.6M to $1.5B. What this means is that investors are holding for the long term, reducing selling pressure and thus, spurring the price on the charts.

Source: CryptoQuant

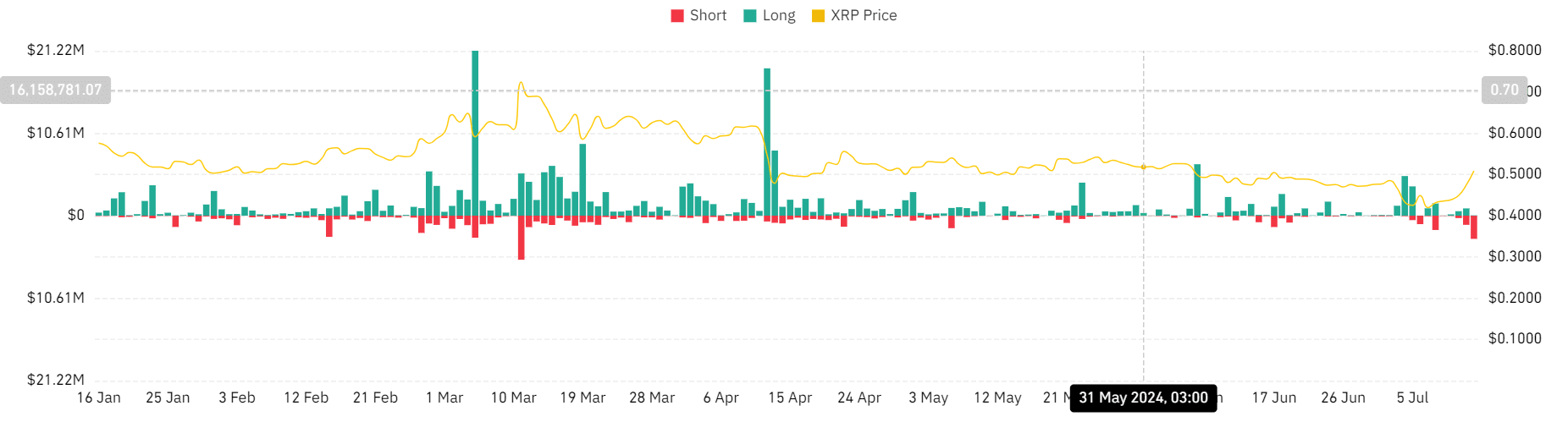

Finally, according to Coinglass, XRP has recorded a sharp decline in long positions over the last 7 days from a high of $1.5M to a low of $52k.

Over the same period, short position liquidations surged to a high of $2.98M. This is a sign that long-term position holders are confident about the altcoin’s future potential. At the same time, those betting against the market have been forced to close their position, thus resulting in higher buying pressure.