Why Coinbase’s listing announcement has more than what meets the eye

On 11 April, Coinbase announced its decision to list over 50 assets made up of 45 ERC-20 tokens and 5 Solana Program Library tokens. Since then, however, the exchange giant has been under fire as many believe that a few of the tokens could be irrelevant or subject to massive rug-pulls.

Allegations of insider trading

As expected in some quarters, some of these tokens saw a significant increment in value. Big Data Protocol (BDP) and Dope Wars Paper [PAPER] rallied by over 100% and 80%, respectively, which led many to question the choice of selected tokens.

In fact, pseudonymous crypto-analyst Cobie has accused the cryptocurrency giant of “remaining on the bleeding edge of decentralization” while “pioneering continued trustless technology adoption by listing rugged, dead shitcoins over a year after they died.”

In saying so, Cobie also did a little digging into some of the proposed digital assets. He noted that following Coinbase’s announcement, assets like Big Data Protocol, which had previously vanished over the past year after locking people out of their assets, pumped by 132%.The announcement pushed it to a market cap of $3.3M.

He further claimed that over the last year, assets like Polkamon and StudentCoin have seen rug pulls. These episodes have bled investors of hundreds of thousands of dollars in investments.

Coinbase back at it with the great listing suggestions of “Polkamon”, “Big Data Protocol” and “StudentCoin”.

Let’s take a look at these highly desirable assets.

— Cobie (@cobie) April 12, 2022

Furthermore, Cobie also claimed that he found an ETH wallet that made heavy purchases worth hundreds of thousands of dollars. These purchases apparently involved tokens featured in the announcement roughly 24 hours before it was even made.

Found an ETH address that bought hundreds of thousands of dollars of tokens exclusively featured in the Coinbase Asset Listing post about 24 hours before it was published, rofl pic.twitter.com/5QlVTjl0Jp

— Cobie (@cobie) April 12, 2022

Soon, other Twitter users also weighed in and highlighted a similar manner of purchases in some of the tokens to be listed.

Someone made a fresh wallet and front ran 7 figures into $UPI and $AVT before the @Coinbase announcement of listings.

Makes sense now.

Clear insider trading going on behind the Coinbase doors.$UPI Txns: https://t.co/qP9cyB9UATActual Wallet: https://t.co/bi2AulZg7d

— Crypto Max (@ScruFFuR) February 8, 2022

Wading through troubled waters?

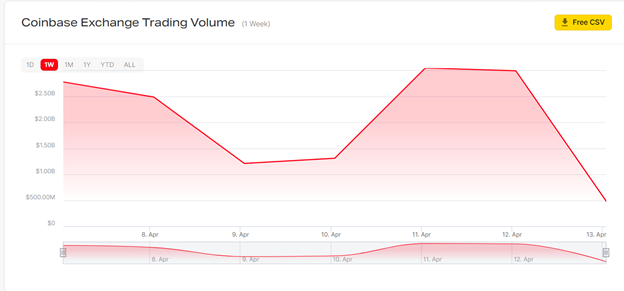

The distasteful allegations levied against Coinbase appeared to have affected traffic on the platform. At the time of press, trading volume on the exchange appeared to have dropped significantly after shedding close to 12% of its total trading volume in the last 24 hours.

While Coinbase is yet to list any of the digital assets announced, investors who trade on the platform might have begun to question the giant’s listing standards. In doing so, they might be pulling out their capital to other competing exchanges.

However, a review of the top 3 exchanges within the latest 24-hour window revealed no significant increase in trading volumes on any of the other leading platforms. In the last 24 hours, Binance, for example, recorded a 22% decrease in trading volume. Similarly, OKX’s volumes fell by 33.66%.

Incoming oversight?

With more regulatory attention on investor protection these days, it is likely that more regulatory oversight might find its way to the crypto-market soon.