Why crypto is down today – Analyzing key factors behind the downtrend

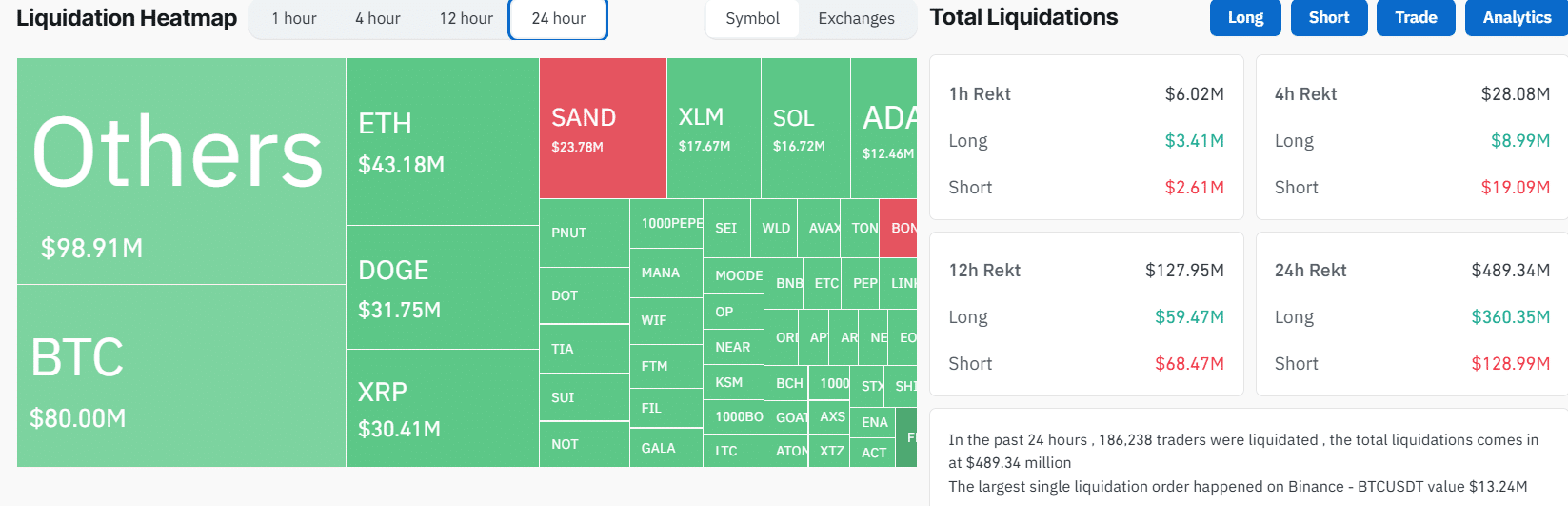

- The cryptocurrency market saw more than $489 million in total liquidations after Bitcoin and most altcoins plunged lower.

- Forced selling from long liquidations and profit-taking fuelled the downtrend.

The cryptocurrency market experienced a spike in volatility over the weekend after all the top ten largest cryptos by market capitalization traded lower.

At press time, the market showed signs of recovery but the total market cap was still down by 0.47% in 24 hours to $3.35 trillion.

Bitcoin [BTC] saw violent price swings after oscillating between $95,700 and $98,600 in the last 24 hours. Meanwhile, Ethereum [ETH], the largest altcoin was down by 1.39% to trade at $3,383 at press time.

Besides a surge in volatility, which is often seen during the weekends due to low trading volumes, several other factors also caused the price decline.

$360M in long liquidations fueled the downtrend

Data from Coinglass shows that in just 24 hours, the total liquidations across the crypto market reached $489 million. These liquidations affected more than 186,000 traders.

Traders with leveraged long positions suffered the biggest blow, with more than $360 million being wiped out. Bitcoin recorded $56 million in liquidations, marking the largest single-day long liquidations on BTC in over a week.

At the same time, Ethereum and Dogecoin [DOGE] saw the highest liquidations among altcoins, with $32 million and $21 million being wiped out, respectively.

Whenever long traders are liquidated, they are forced to close their positions through selling. Therefore, this scenario fuelled the recent downturn.

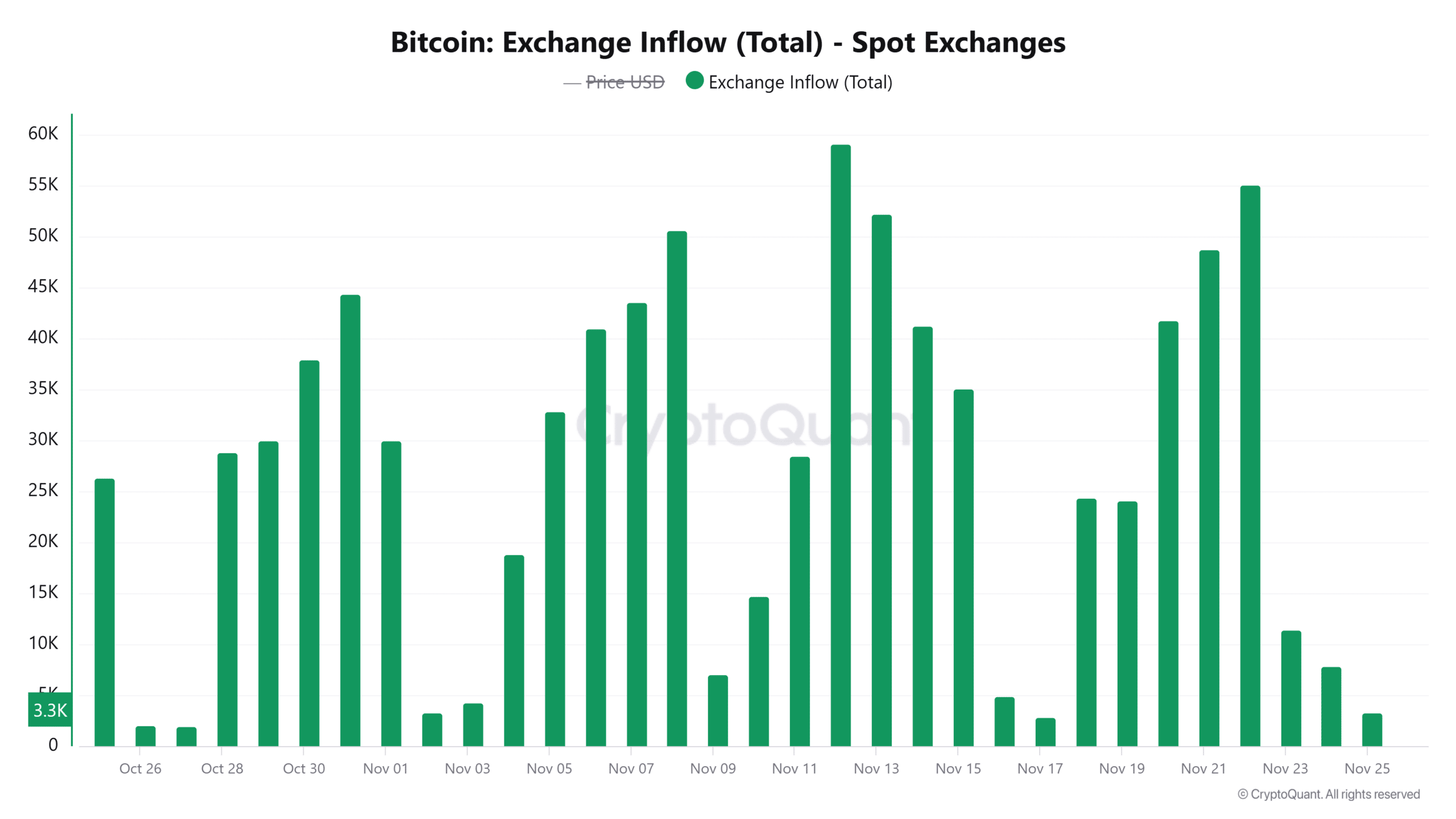

Profit-taking activity

As aforementioned, weekends are usually associated with low trading volumes. Due to this, a slight uptick in buying or selling activity can have a significant impact on price.

Data from CryptoQuant shows that in the last three days, more than 74,000 BTC have been moved to spot exchanges. These inflows suggest that some traders are keen on taking profits after the recent gains.

Moreover, out of this amount, around 19,238 BTC was deposited to exchanges over the weekend. Possible selling activity after these deposits might have fuelled a downtrend in Bitcoin prices and subsequently, altcoins.

Market sentiment still shows greed

Despite the recent correction, the market sentiment remains bullish. This is seen in the Fear and Greed Index with a value of 82, showing “extreme greed.”

While this metric shows that traders are highly optimistic and confident, it can also hint at an upcoming correction or trend reversal. Therefore, traders should watch out for signs of intense profit-taking, as that could fuel further dips.