Why crypto market is going up – Is FOMO the real catalyst behind the rise?

- The cryptocurrency market capitalization has ballooned to $2.7 trillion after a $500 billion hike in under one week.

- Retail FOMO, US politics, and short-sellers could be driving the rally.

The cryptocurrency market is experiencing one of its best months this year. Bitcoin [BTC] has made successive new highs in the last seven days, and it recently ripped past $81,000. Ethereum [ETH] also flipped $3,100 for the first time in three months.

The gains have been widespread as the total market capitalization has pushed past the $2.7 trillion mark. In just one week, total crypto market capitalization has surged by more than $500 billion.

Several factors were driving this bull run and if the positive sentiment continues, it could lead to more gains.

Fear of missing out (FOMO)

Cryptocurrency traders, especially short-term holders, are known to be reactive. Unlike long-term holders who often focus on fundamentals, short-term holders react to price volatility and hype.

This behavior was seen in the Fear and Greed Index, which had a value of 76 at press time, an indication that the market was in “extreme greed”. On the 10th of November, this index surged to 78, its highest level in a year.

Data from Google Trends also shows that the word “Bitcoin” was gaining interest with a search score of 50/100. This was a notable hike from 18/100 barely a month ago.

When retail interest is high, it drives buying activity, which in turn leads to price gains. However, FOMO is usually short-lived, and once buyers are exhausted, crypto prices could correct or consolidate.

Speculation of a pro-crypto Senate leader

After the Republican Party won the 5th of November US elections, the focus has now turned to the Senate leadership. Speculation was rife that Florida Senator, Rick Scott, will take the position of Senate majority leader after he was endorsed by Tesla CEO, Elon Musk.

Scott is a pro-crypto senator given that earlier this year, he was among those who voted for the SAB 121 resolution allowing banks to custody digital assets.

In February 2024, Scott also supported the CBDC Anti-Surveillance State Act proposed by pro-crypto Senator Ted Cruz. Scott opposed CBDCs saying that they enabled government surveillance. If Scott wins the vote, it could pave the way for pro-crypto bills. This could drive more gains across the market.

Short liquidations

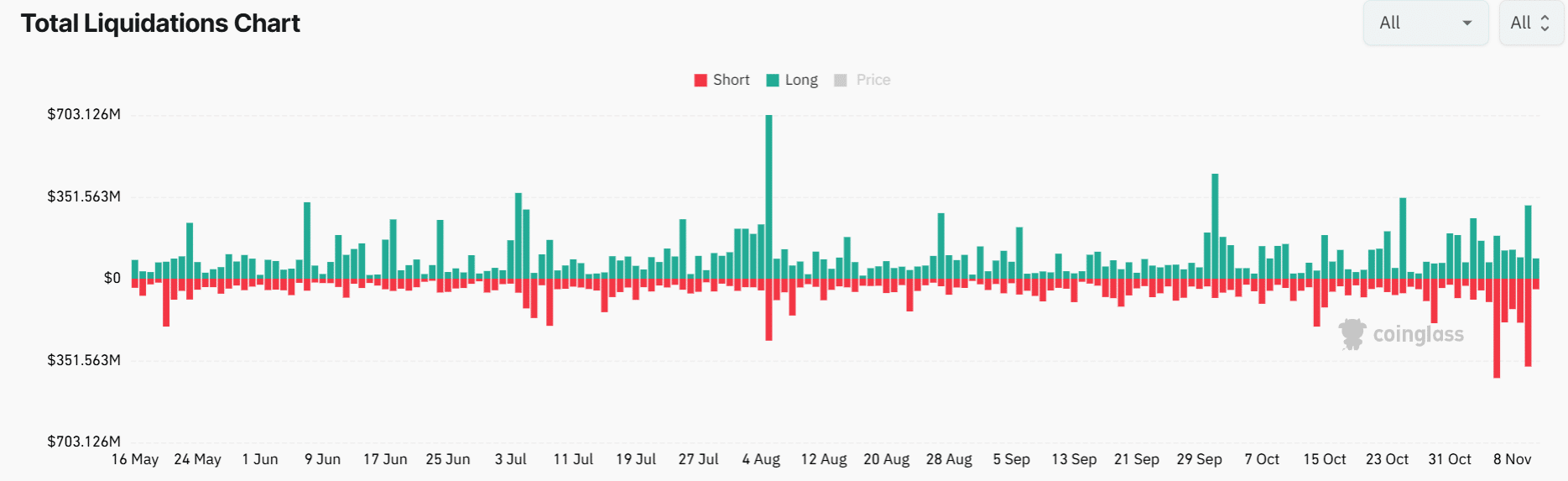

The recent volatility across the crypto market has led to a surge in liquidations. Data from Coinglass showed that in the past week, short liquidations have spiked and continued to rise as in the last 24 hours, $283 million worth of shorts were liquidated.

When short sellers are liquidated, they are forced to buy to close their positions. This forced buying tends to accelerate the uptrend. Despite more than $650 million in both long and short positions being liquidated in the past 24 hours, open interest continued to climb, which showed an overall bullish sentiment.

In fact, Bitcoin’s open interest has continued to make new highs and stood at $49 billion at press time. When open interest is rising, it indicates that the bullish sentiment is growing.

Read Bitcoin’s [BTC] Price Prediction 2024-25

However, CryptoQuant CEO, Ki Young Ju, stated that the futures market suggested that Bitcoin was “overheated.” Therefore, he anticipated that prices could correct and consolidate before the bull run extends.

However, if the current bullish momentum continues until the end of the year, it could lead to a bear market in 2025.