Altcoins are rallying, but here’s why BNB is being left behind

- BNB’s price only moved up by 1.5% in the last 24 hours.

- Bearish sentiment around the coin was dominant in the market.

The crypto market has become bullish, allowing several cryptos’ values to surge, but Binance Coin [BNB] investors might be at risk.

A recent analysis mentioned that BNB was among the cryptos that had the least potential to grow, as it has already risen enough over the years. To see how viable that is, AMBCrypto checked BNB’s metrics.

Will BNB’s bull rally end?

The value of Bitcoin [BTC], the king of cryptos, surged above the $70k mark, which contributed the most to turning the entire market bullish.

Thanks to that, BNB’s value also gained upward momentum as its price increased by over 17% in the last seven days. But the growth momentum has declined in the recent past.

As per CoinMarketCap, BNB’s value only moved up by over 1.5% in the last 24 hours. At press time, the coin was trading at $594.95 with a market capitalization of over $88.9 billion.

A possible reason behind this halt could be found in Wolf of Altcoins’ tweet. The popular crypto analyst recently posted a tweet mentioning cryptos that might be too late to buy, and BNB was one of them.

Therefore, AMBCrypto took a look at Santiment’s data to see whether BNB’s bull rally was actually short-lived.

This can be expected from BNB

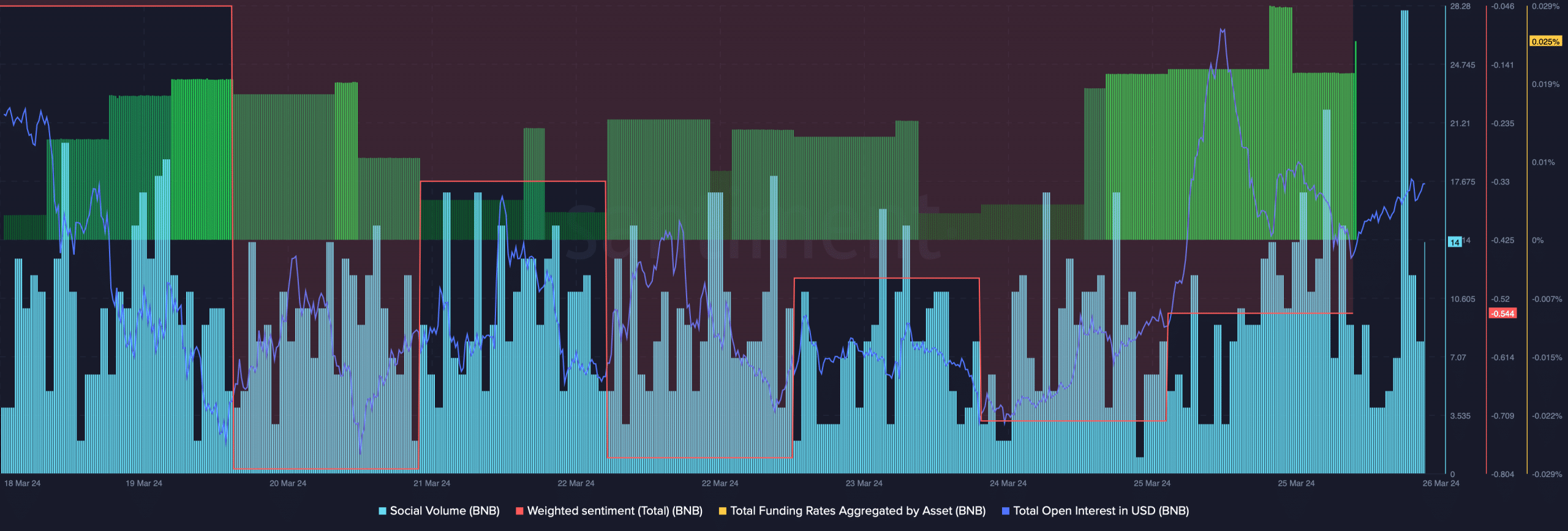

Our analysis revealed that BNB’s Social Volume remained high throughout the last week. However, sentiment around the coin turned bearish, which was evident from the drop in its Weighted Sentiment.

However, the coin’s derivatives metrics looked somewhat bullish. For instance, BNB’s Funding Rate increased, indicating its high demand in the derivatives market.

Additionally, after a slight drop, the coin’s Open Interest also moved up, indicating that the chances of a continued price uptrend were high.

To better understand whether the coin’s uptrend would end, AMBCrypto analyzed its daily chart.

Read Binance Coin’s [BNB] Price Prediction 2024-25

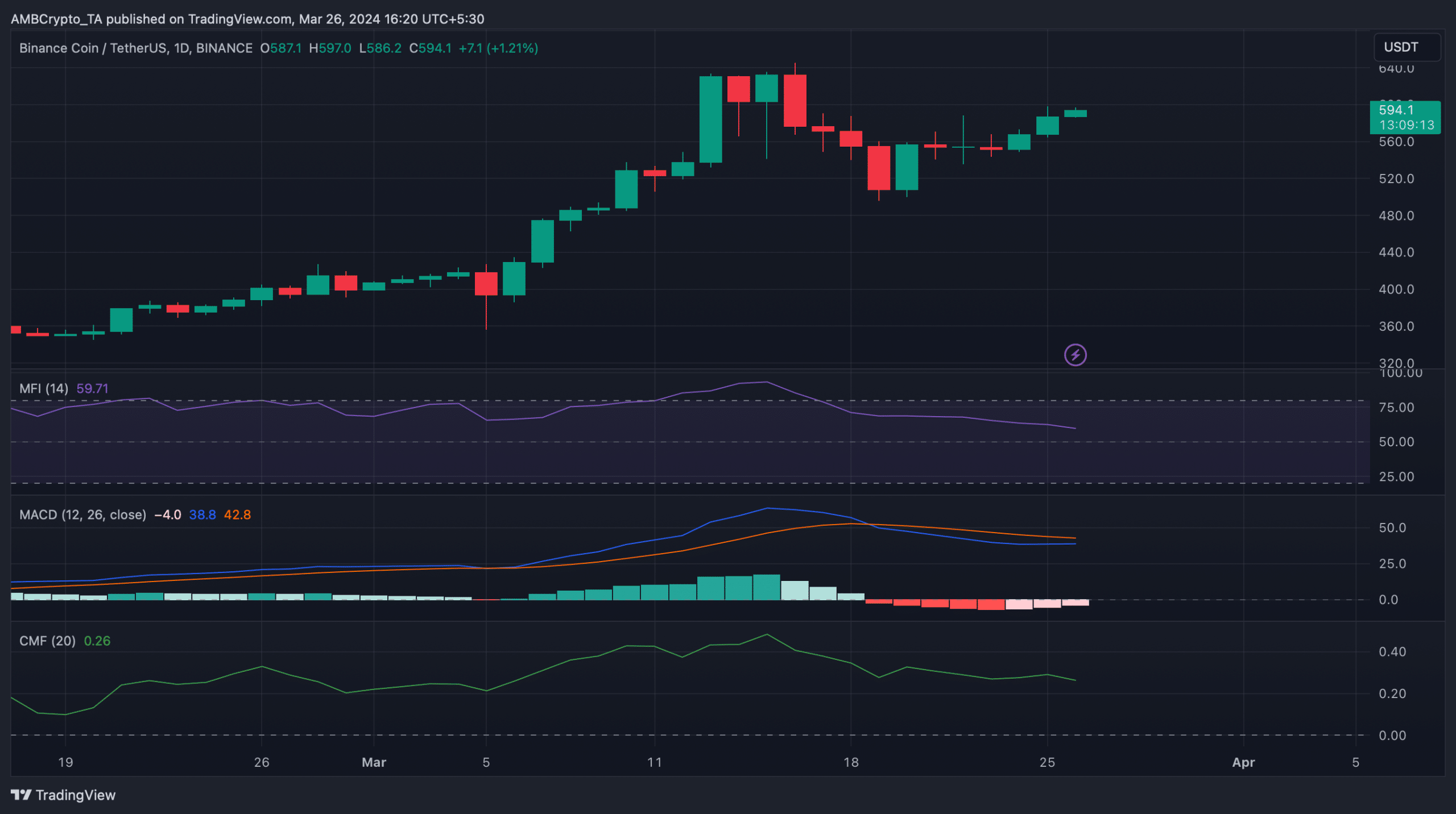

As per our analysis, BNB’s Money Flow Index (MFI) and Chaikin Money Flow (CMF) both registered sideways movement over the last few days. So, investors might witness a few slow-moving days.

Nonetheless, the MACD looked in buyers’ favor as it displayed the possibility of a bullish crossover.