Why Dogecoin, DOT, AVAX might not be a good option for your portfolio

Cryptocurrency markets so far this year have seen a significant uptrend, which many have considered a reward for surviving the aftermath of the collapse of Terra-Luna in May 2022 and the significant losses caused by the unexpected fallout of cryptocurrency exchange FTX in November 2022.

The prices of leading coins Bitcoin [BTC] and Ethereum [ETH], on a year-to-date (YTD), have increased by 30% and 28%, respectively, both trading momentarily at price levels last seen prior to FTX’s collapse.

Since 1 January, the prices of alternative coins such as Fantom [FTM] have witnessed a remarkable increase of over 100%, while the comparatively recent Aptos [APT] has experienced an exponential growth of 300%.

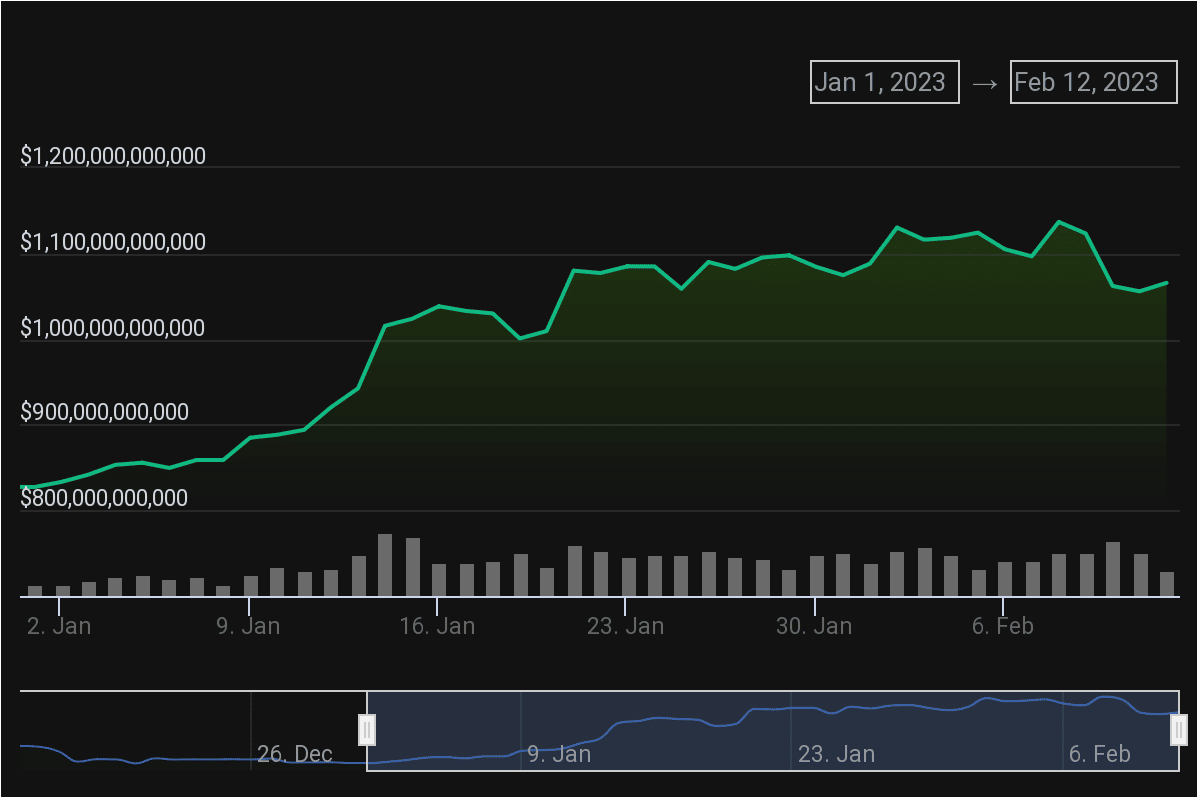

Per data from CoinGecko, in the past 42 days, global cryptocurrency market capitalization has rallied by 24%.

While the holders of king coin BTC and leading altcoin ETH have recorded profits for the first time in several months, the question still remains as to what other assets to invest in for maximum profit in the long term.

These altcoins might be your safe haven, analyst says

Crypto market analyst Jessica Doosan in a blog post published in December 2022, opined that there were 25 “lossless” crypto coins that investors “will make extremely significant profits in the years 2024–2025.”

They include Polkadot [DOT], Ocean Protocol [OCEAN], Mate [MATE], Near [NEAR], Loopring [LRC], Decentraland [MANA], The SandBox [SAND], ZCash [ZEC], Dogecoin [DOGE], Biconomy [BICO], PancakeSwap [CAKE], Rarible [RARI], Mobox [MBOX], dYdX [DYDX], Avalon [AVA], Avalanche [AVAX], Lossless [LSS], Gala [GALA], Theta [THETA], Bloktopia [BLOK], Victoria VR [VR], Ravencoin [RVN], MultiversX [EGLD], Algorand [ALGO], and MoonRiver [MOVR].

Let’s evaluate the performance outlook of the top three altcoins with the highest market capitalization among the 25 recommended by Doosan, namely DOT, DOGE, and AVAX in the short term, and what can be expected by those who hold them.

Expect a price decline in the short term

An examination of the daily chart price trends of DOT, DOGE, and AVAX revealed a shared pattern – all three have started a new bearish cycle.

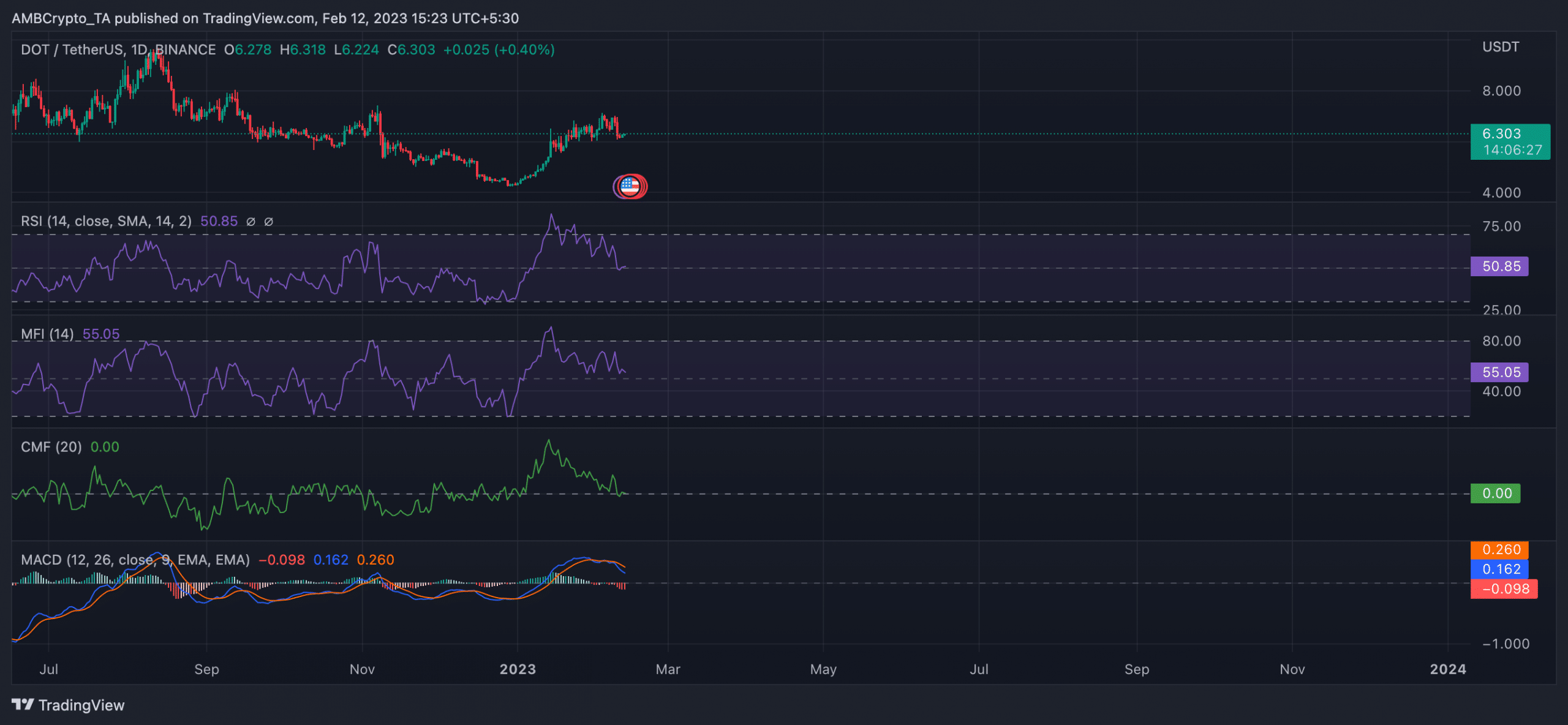

As for DOT, its YTD price has grown by 45%, data from CoinGecko showed. Following several weeks of the rally, its price eventually peaked at $7.10 on 3 February and has since been on a downtrend.

This coincided with when the MACD line intersected with the trend line in a downtrend ushering in the new bear cycle. At press time, DOT traded at $6.29, having declined by 11%.

With a continued decline in buying momentum, key indicators such as the Relative Strength Index (RSI) and Money Flow Index (MFI) were spotted lying close to their respective neutral zones.

In a continued decline, the positions of these momentum indicators revealed that buying pressure for DOT had weakened in the past few weeks, and a shortfall of liquidity to drive up price will occasion a prolonged price decline.

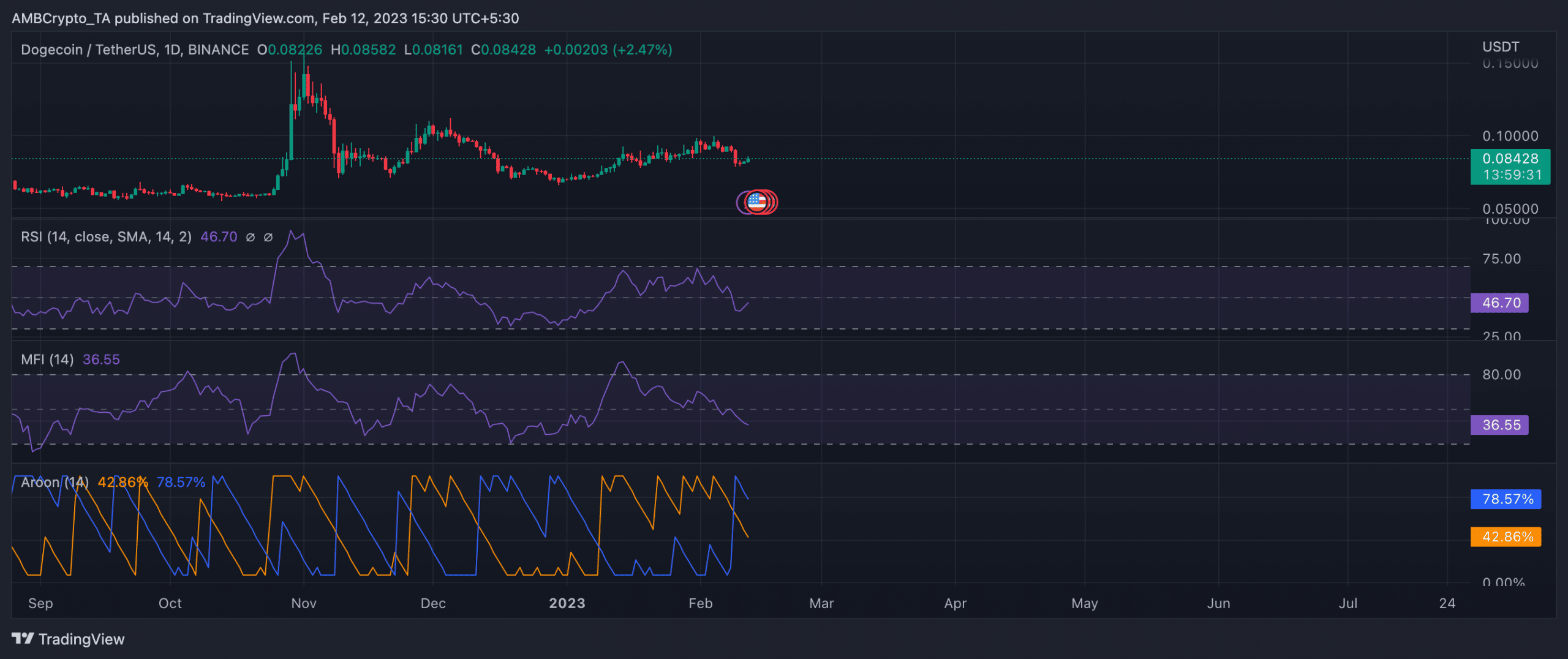

Things were the same for the leading meme coin DOGE. At press time, DOGE exchanged hands at $0.08456. Its price has grown by 20% since the beginning of the year. Also lingering under significant bearishness, its RSI and MFI have breached their respective neutral spots and were headed toward oversold regions.

This showed that DOGE’s accumulation trend had slowed significantly as many holders were invested in selling their holdings to realize profits.

The Aroon Up line (orange) at 42.86% confirmed the weakened buying trend in the DOGE market. On the other hand, the Aroon Down line (blue) rested at 78.57%.

When the Aroon Up line is close to zero, the uptrend is weak, and the most recent high was reached a long time ago. This can be an indication of a potential trend reversal.

Likewise, when the Aroon Down line is close to 100, it indicates that the downtrend is strong and that the most recent low was reached relatively recently.

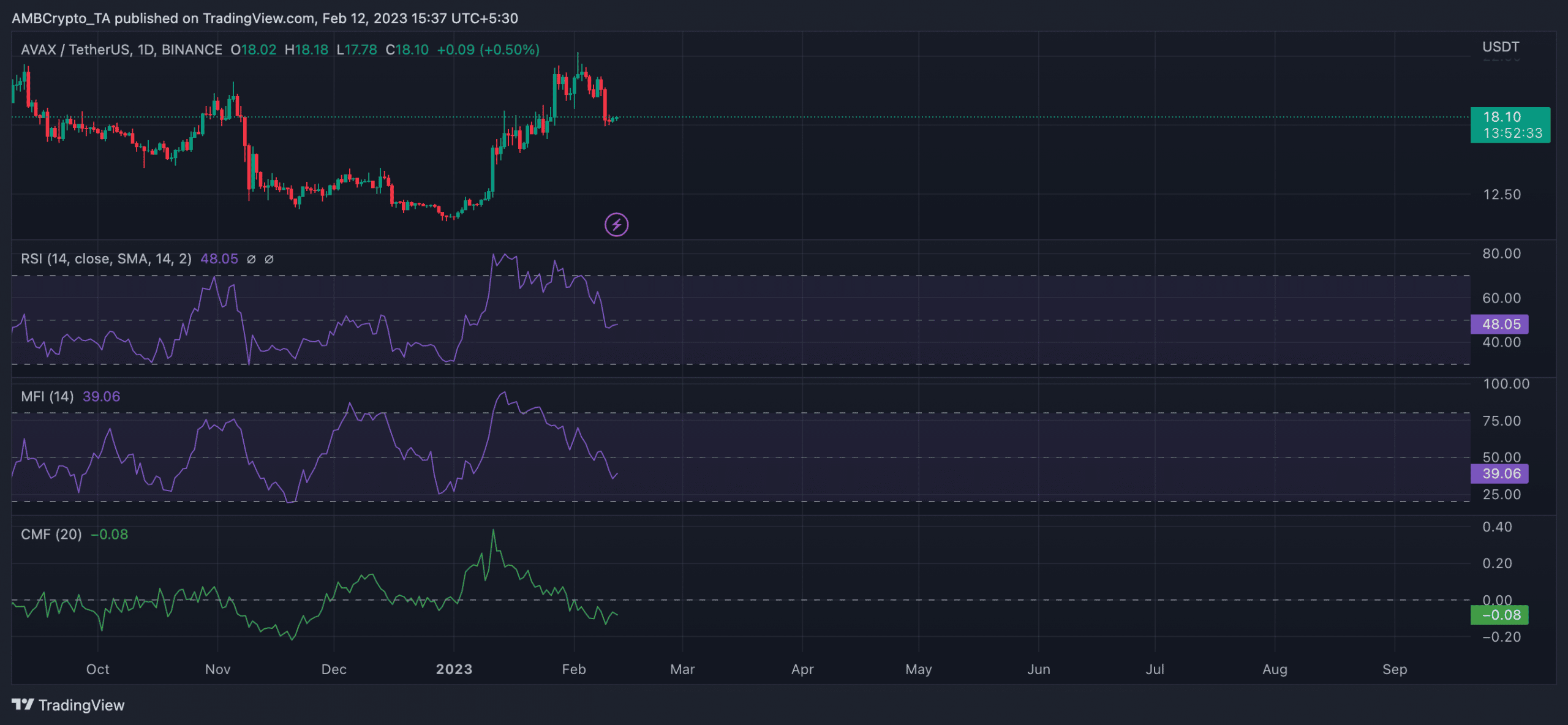

As for AVAX, its key momentum indicators were also situated close to oversold lows at press time. In addition, its Chaikin Money Flow (CMF) had breached the center line in a downtrend and was negative -0.08 at press time.

This showed that buying momentum had declined significantly, and distribution was underway. With the CMF in a downtrend, AVAX’s price is expected to fall further.

Negative sentiment continues to trail these assets

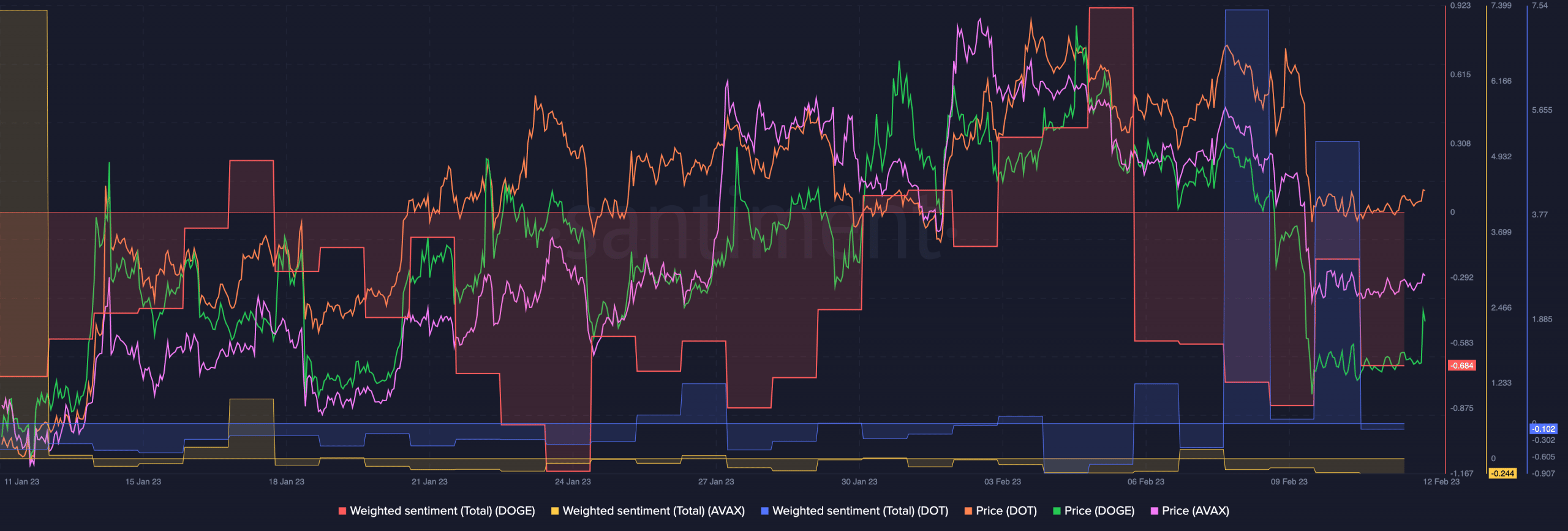

In the last month, DOT, DOGE, and AVAX have been trailed by negative investors sentiments, data from Santiment showed.

With weighted sentiment still negative for all three assets at the time of writing, a price correction upwards is only plausible if investor conviction also changes.