Why Ethereum MUST stay above $4k for the next 48 hours, at least

It’s time for yet another options expiry, and the Ethereum market this time too stands divided. Given the chaotic state of the broader market, traders from both the sides of the spectrum have their own set of reasons to be biased at this point.

ETH’s price has been going downhill for more than a week now, but its macro-bullish framework is still pretty much in-tact. Even though the largest altcoin has shed more close to 11% over the past week, it continues to hover above $4k. In fact, at the time of this analysis, ETH was just shy of $4.1k.

Chase for an uptrend continues?

Even though short term corrections do not instigate fundamental changes, it is important to stay abreast of the prevailing market sentiment to know what to anticipate going forward.

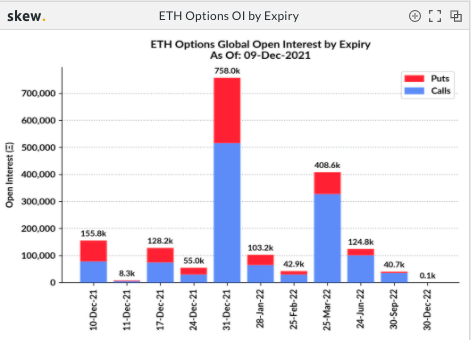

Now, as per data from Skew, over 164.1k Ethereum contracts are set to expire in two batches – 155.8k on 10 December [today] and the remaining 8.3k on 11 December [tomorrow].

Now, when the chart attached below is carefully observed, the number of call and put contracts are fairly even for both the days. This means that the tug of war between bullish and bearish traders would be neck to neck.

Source: Skew

Skew’s OI by strike price chart clearly outlines that the number of call contracts have an upper hand in the strike price bands above $4k, while the puts dominate the lower price bands.

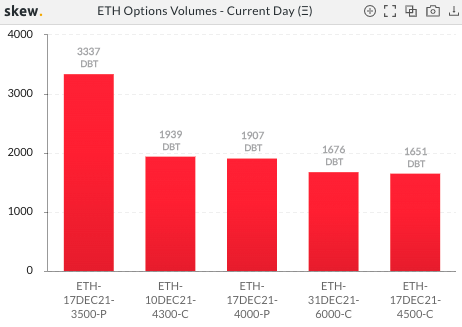

However, despite the bigger picture, it should be noted that the bearish sentient has gained more steam today. At the time of writing, close to 3337 DBT put contracts were purchased in an anticipation of Ethereum hitting $3.5k. Another additional 1907 contracts have also been bought around the $4k strike price.

Having said that, it should be noted that the market isn’t completely devoid of bullish traders. 1939 and 1651 DBT call contracts have also contributed to today’s options volumes. The strike prices for these contracts stand at $4300 and $4500 respectively.

Source: Skew

Looking at the aforementioned datasets, it sort of becomes clear that the majority of novel traders who’ve entered into the market are pessimistic about Ethereum’s price.

The do or die situation

The asset’s price is indeed at an indecisive juncture at this point. As can be seen from the snapshot attached below, ETH has properly dunked below $4k only on two instances so far in December. One on the 4 December, when the entire market crashed and then two days later on the 6th. Other than these two instances, it has by and large been able to remain above the aforementioned threshold.

At the time of this analysis, ETH was seen recovering from its daily low of $4021. In fact, the previous candle and the candle in the making were in green at the time of this analysis, highlighting the alt’s desperate effort to stay above $4k.

So, if it continues to do so, the odds of a downtrend in the foreseeable future would gradually fade away. Nonetheless, if it doesn’t cling onto $4k, then things might get helter-skelter. More so, because traders would be triggered to exercise their option of selling ETH, which would in-turn set instigate a selling bias.