Why Ethereum needs to cross $2.5K to turn bullish again

- The January lows which launched the rally to $4k were retested in the early hours on the 5th of July.

- It’s too early to call for an Ethereum bottom, but investors can wait for more clarity over the next week.

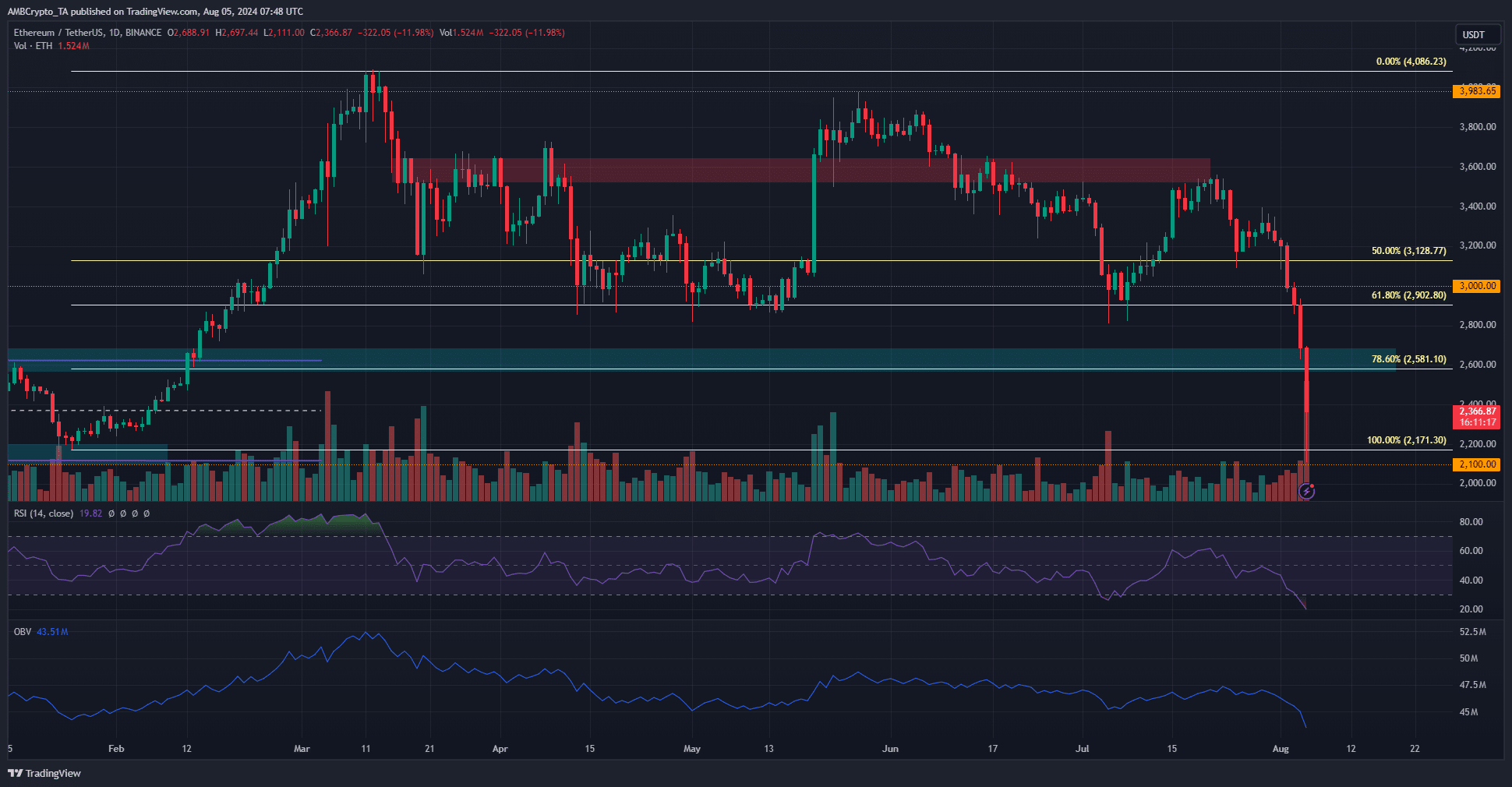

Ethereum [ETH] plummeted to the January lows over the past few hours. Its descent below $2.9k was followed by a 27.5% drop over the next 12 hours.

At press time, ETH has bounced to $2366 from the $2.1k lows, a 12.17% bounce.

The smart money that bought close to $20 million when prices were at $2.9k and $3.1k has not been correct this time, smudging a previously perfect track record.

The February rally’s launchpad was retested

The price crash of the past couple of days was brutal. In just the last 24 hours, Ethereum markets saw $346.5 million worth of liquidations. The daily RSI fell to 19, the lowest since 18th August 2023.

The daily session has not yet closed, but as things stand, the rally earlier this year has been wholly retraced. The $2.5k-$2.6k zone is likely to serve as resistance on the way upward.

The OBV formed a new low to encapsulate the idea of extreme selling volume. The day’s trading volume is 1.55 million ETH and counting, the highest in 2024.

While it might be a good reason to buy, more conservative traders and investors would want to see prices reclaim key support zones and stay above them for a few days before they’re confident enough to bid.

The Futures market wiped out swathes of ETH traders

Source: Coinalyze

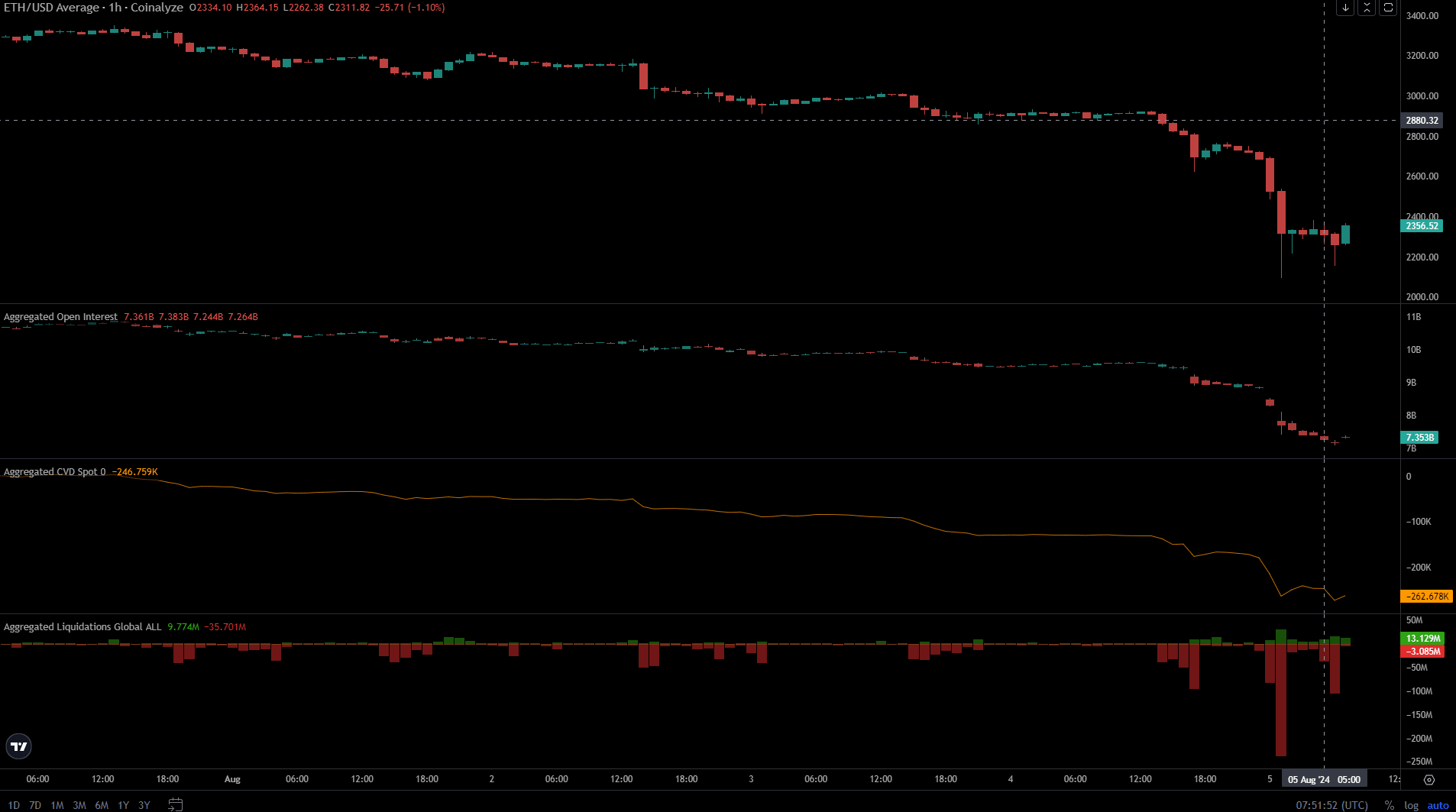

Market crashes like these are not a good time to be in a leveraged trade, as 270k+ crypto traders found out over the weekend. The Open Interest has fallen from $9.9 billion on the 3rd of August to $7.35 billion at press time.

Is your portfolio green? Check out the ETH Profit Calculator

The spot CVD fell deeper, supporting the idea of intense selling. The liquidations of the past couple of days were mostly long, as expected.

A bounce toward $2.5k was possible, but the New York trading session can see added selling pressure.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion.