Ethereum

Why Ethereum saw long liquidations worth $62M in 24 hours

Despite the drop in ETH’s price, options volume, and Open Interest, its Funding Rate has remained positive.

- ETH’s long traders have witnessed significant liquidations in the past 24 hours.

- The coin’s options volume and Open Interest have also declined.

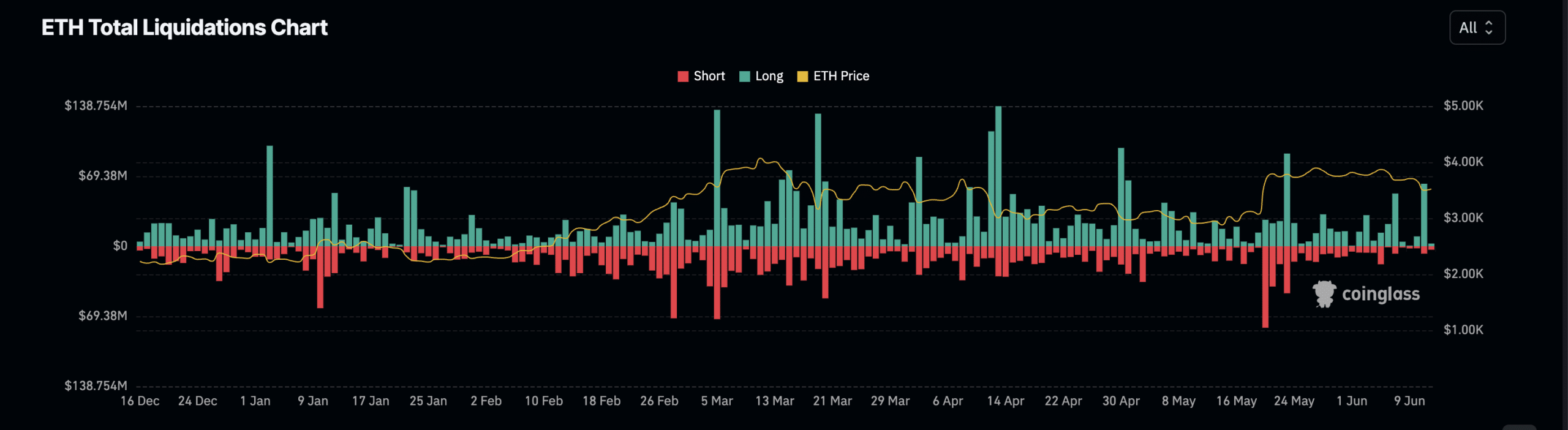

Ethereum [ETH] witnessed a spike in long liquidations on the 11th of June, according to Coinglass

.Information from the derivatives market data provider showed that the altcoin’s long liquidations on that day represented its highest since the 23rd of May.

In an asset’s derivatives market, liquidations happen when a trader’s position is forcefully closed due to insufficient funds to maintain it.

Long liquidations happen when an asset’s value drops unexpectedly, forcing traders with open positions in favor of a price rally to exit.

On the 11th of June, ETH long liquidations totaled $62 million, while short liquidations amounted to $7.3 million.

Decline in ETH’s derivatives market

The past 24 hours have been marked by a decline in ETH’s derivatives market activity. For example, the total volume of trades executed in the altcoin’s options market has dropped by 52%.

During that period, options trading volume totaled $321 million.

A decline in an options trading volume suggests fewer participants are buying or selling options.

Whenever fewer trades are completed in an asset’s options market, it becomes less liquid. This often results in wider bid-ask spreads, making it potentially more difficult for participants to execute trades at desired prices.

In addition, the coin’s Open Interest has also dropped. At $15.73 billion at press time, it has fallen by 2% during the period under review.

An asset’s Open Interest measures the total number of outstanding contracts or positions that have not been closed or settled. When it declines, more traders exit their positions without opening new ones.

However, despite ETH’s price decline in the past 24 hours, the ensuing long liquidations, and a drop in options volume and Open Interest, its Funding Rate across cryptocurrency exchanges has remained positive.

At press time, the coin’s Funding Rate was 0.0069%. For context, the last time ETH’s Funding Rate was negative was on the 3rd of May.

Funding Rates are used in perpetual futures contracts to ensure the contract price stays close to the spot price.

Read Ethereum’s [ETH] Price Prediction 2024-25

When an asset’s Funding Rate is positive, it suggests a strong demand for long positions.

This means more traders are buying the coin expecting to sell it at a higher price than those purchasing it in anticipation of a price decline.