Why FLOKI should be on your watchlist this bull season

- FLOKI was up by more than 20% in the last 24 hours.

- Market indicators looked bearish, suggesting a price correction.

FLOKI has burned a substantial amount of tokens in the last few days. Token burns reduce circulating supply of an asset, which is bullish as it might have a positive impact on the asset’s price. Therefore, let’s see how FLOKI responded to its latest burning episode.

FLOKI burn is helping the memecoin

FLOKI recently posted a tweet highlighting how many tokens it has burned. A week ago the meme burned tokens worth more than $1 million. Soon after that, tokens worth more than $3.2 million were burned again.

The tweet also mentioned the Floki Staking program which has a 5 – 20% early unstake penalty fee, which comes in the form of FLOKI tokens which is burnt perpetually whenever a Floki staker unstakes earlier.

It also added that The FlokiFi Locker DeFi crypto locker protocol which buys and burns the coin also drove this burning spree. Since burning decreased supply and increased demand, it did have a positive impact on the memecoin’s price.

According to CoinMarketCap, in the last 24 hours alone the memecoin’s value surged by over 20%. At the time of writing, FLOKI was trading at $0.0002821 with a market capitalization of over $2.69 billion.

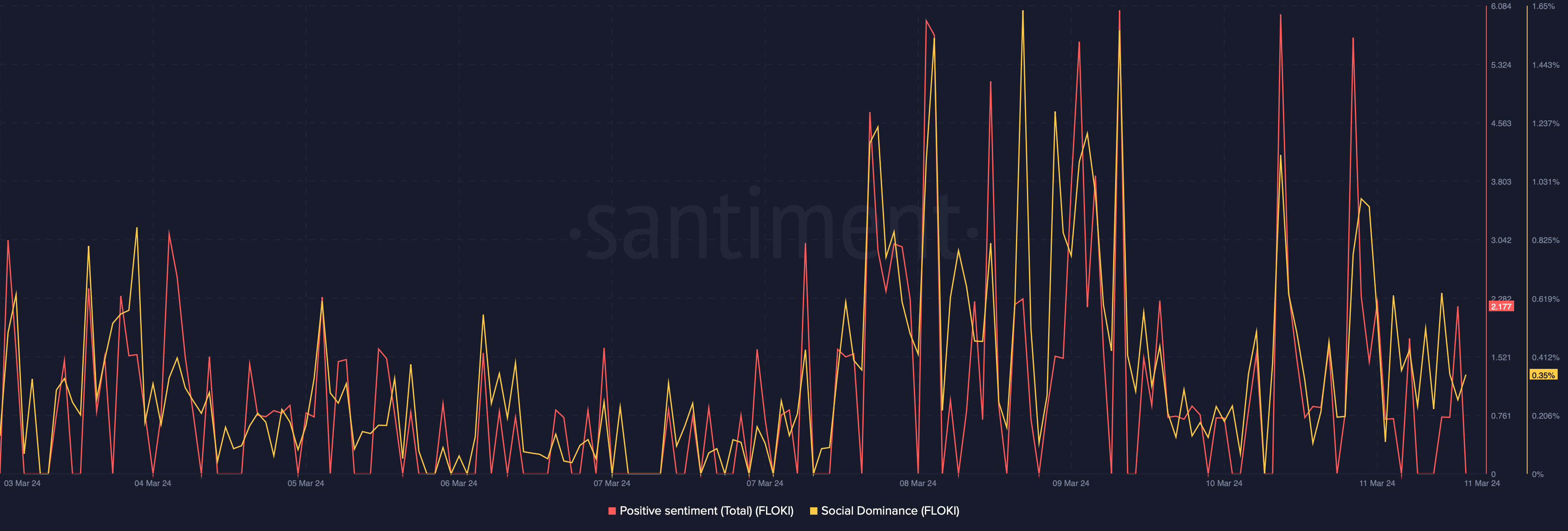

This also had a positive effect on the memecoin’s social metrics. AMBCrypto’s analysis of Santiment’s data revealed that FLOKI’s social dominance spiked. Its positive sentiment also went up, meaning that investors’ confidence in the memecoin was high.

Is a further uptrend possible?

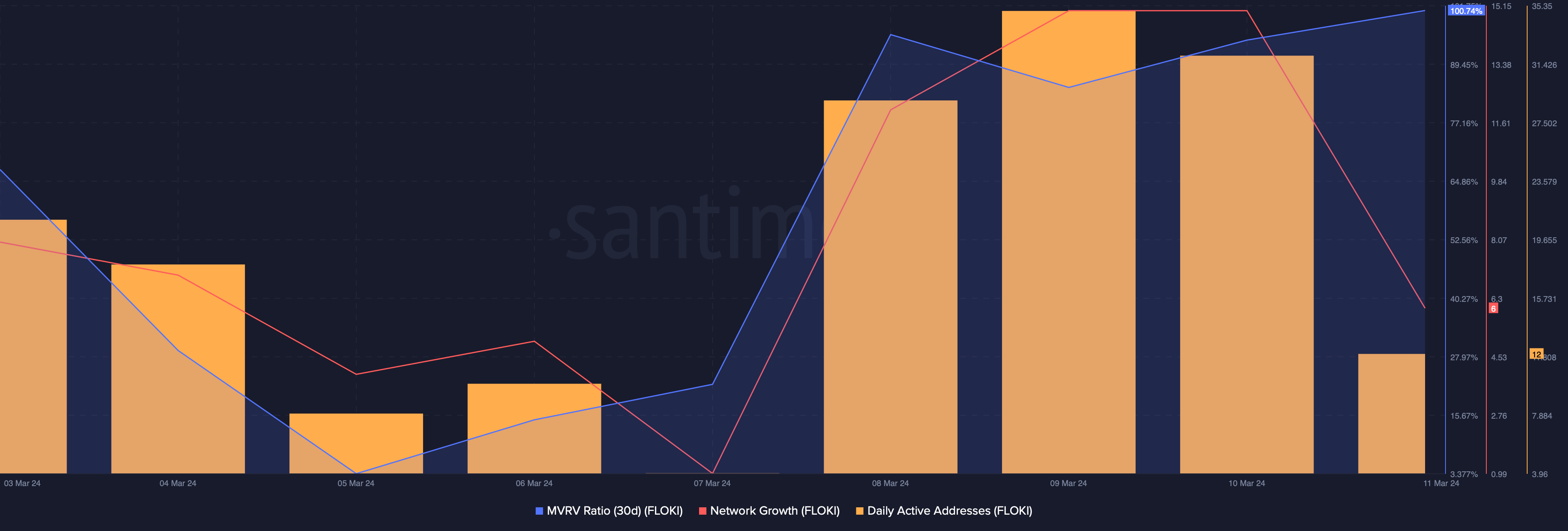

Apart from this, network activity around the memecoin also remained high during its price rise. Our analysis of Santiment’s data revealed that FLOKI’s daily active addresses went up.

Additionally, its network growth also spiked. This meant that more addresses were created to transfer the token.

The memecoin’s MVRV ratio increased substantially as it reached 100%. At first glance, this might look bullish, but such a MVRV ratio indicates that selling pressure might increase, which can put an end to the memecoin’s bull rally.

A similar possibility of selling pressure increasing in the coming days was revealed by a few market indicators.

Realistic or not, here’s FLOKI’s market cap in BTC’s terms

For example, FLOKI’s Relative Strength Index (RSI) was resting in the overbought zone. The Money Flow Index (MFI) also followed the same trend and entered the overbought zone.

Nonetheless, the memecoin might continue its rally as its MACD displayed bullish upperhand in the market.