Why INJ, RNDR, FET can see crucial growth this November

- AI tokens including INJ, FET, and RNDR showed bullish tendencies.

- The sentiment around the cryptocurrencies remained optimistic as well.

Over the last 30 days, tokens related to the Artificial Intelligence (AI)/Big Data economy have put an impressive performance, such that the Bitcoin [BTC] pump within the same period looks like a child’s play in comparison.

Realistic or not, here’s RNDR’s market cap in INJ’s terms

The AI chronicle is back

Cryptocurrencies including Injective [INJ], Fetch.ai [FET], and Render [RNDR] gained 82.60%, 62.19%, and 68.38% respectively within this same period. Needless to say, Bitcoin’s dominance and the rise of some altcoins have been influential in the price increase of these tokens.

However, BTC’s hike is not the major influence driving the hike. Instead, there has been a surge in the attention given to AI tokens. This is mainly because of the plethora of AI conferences billed to happen in November.

Thus, investors and traders alike seem to be employing the “buy the rumor, sell the news” strategy that seemed to have worked in the past.

A look at dev.events, a platform built to aggregate occasions planned in the AI space, showed that there are conferences billed to happen almost every day in the month of November.

For instance, there is a Data+AI World Tour in Munich on 7 November. Another world tour has been fixed for 9 November in Paris, and a Machine Learning (ML) week fixed for Berlin a week later.

ChatGPT’s parent company, OpenAI, also has a developer conference slated for 6 November. Previously, specifically, earlier in the year, some of these AI tokens went on an incredible upward run during the height of ChatGPT’s popularity.

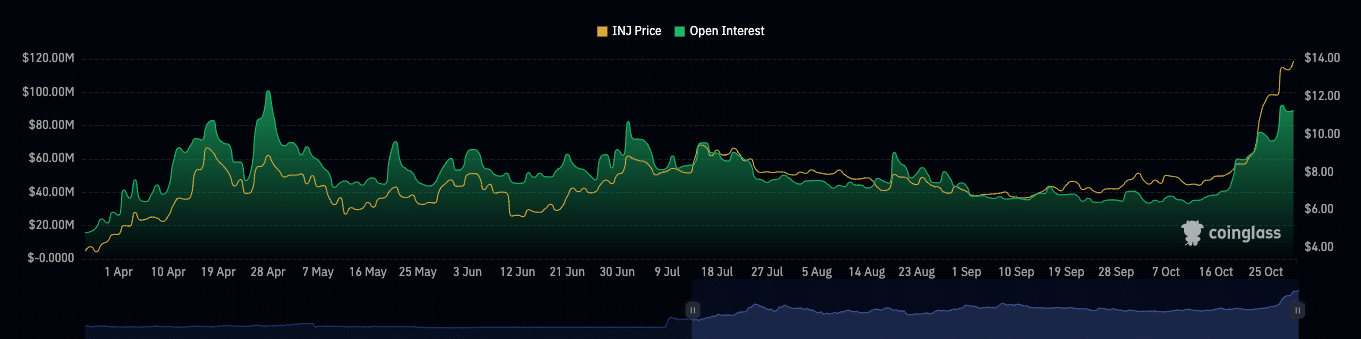

So, it is not out of place to expect another uptick despite the recent double-digit hike. But can these tokens continue to build on the AI narrative? One indicator that can give an insight into the possibility is Open Interest. For now, let’s shift our focus to Injective.

Interest in tokens surge

Per Coinglass’ data, INJ’s Open Interest has been rising since 14 October. An increase in Open Interest alongside a surge in price is a confirmation of an upward trend. The opposite happens when the Open Interest decreases.

At the time of writing, INJ changed hands at $13.75. If the Open Interest continues to increase, then the price action could gain more strength. In this case, the $13 region could serve as a good entry point, as another uptrend could be likely.

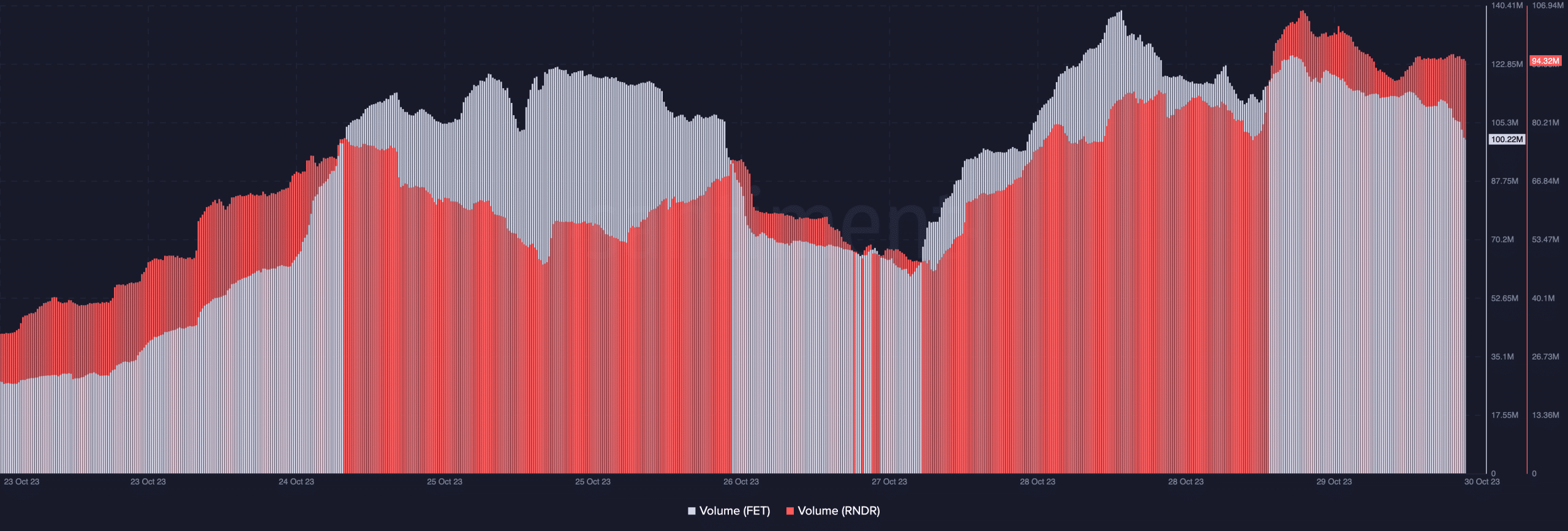

For FET and RNDR, the scenarios may not be any different. However, the volume metric will be used to build the case for these tokens to start with. Market players may be familiar with FET because it has been around for a while.

But Render may seem a little strange, especially for those who are not religious followers of happenings in the market. In quick summary, the Render network is a provider of decentralized Graphics Processing Unit (GPU)-based rendering solutions.

RNDR then serves as its utility token and can be used to pay for AI-generated animations and other visual identities.

Jumping volume, optimistic sentiment

According to Santiment, RNDR’s volume has jumped to 94.32 million. FET, on the other hand, hit a height of 125.09 million on 29 October. But at press time, the volume had decreased to 100.22 million.

Rising volume on rising prices is a sign of a continuous upward trend. But a drop in the volume, alongside a fall in price, signals a downward trend.

In the last 24 hours, FET’s value has decreased by 5.27%. This is considered a pullback. But considering the current circumstances, it is likely for the token value to recover provided interest in the token stays high and transactions increase.

RNDR may also have the tendency to retrace. However, like FET, it seems destined for another uptick similar to what it has shown in the last month.

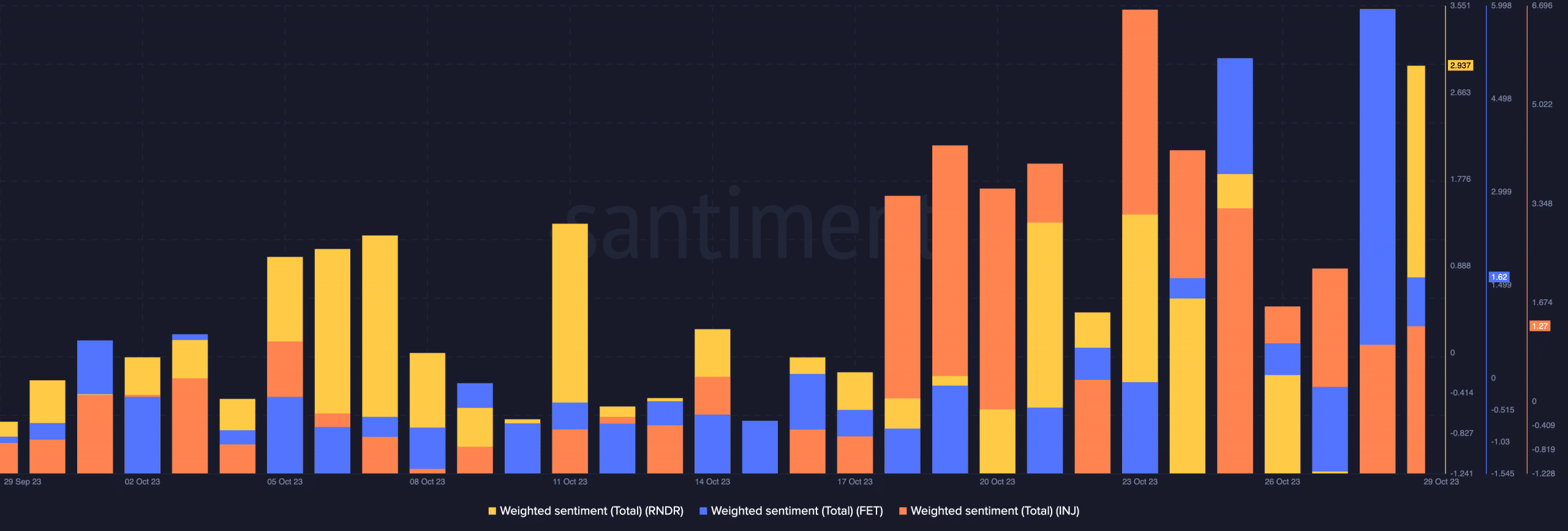

With respect to Weighted Sentiment, on-chain data showed that INJ, FET, and RNDR all have optimistic outlooks. The Weighted Sentiment measures the commentary about projects within a specific period.

In the last 30 days, all three tokens have had the metric dominate the positive axis of the metric. As of this writing, the Weighted Sentiment decreased for all three. However, the metric was still in the positive zone.

So, it is possible that traders were making positive comments about the project. At the same time, employing caution because of the incredible performances these cryptocurrencies have had lately.

The next part to consider in assessing the possibility of the tokens’ reaction to AI conferences-packed November is the price action.

Bulls stay solid despite…

For FET, its bullish structure has maintained the same position despite attempts by sellers to stop the trajectory. A look at the FET/USD 4-hour chart showed that some profit-taking seems to be happening.

However, bulls are trying to regain control of the market by creating a support at $0.36.

Should the support hold, a move in the direction of $0.40-$0.45 may be likely. That will only happen if a strong buying momentum reappears. But the Relative Strength Index (RSI) was down 64.85

The RSI reading was a result of the previous overbought level of 80.45 hit on 28 October. So, it was only expected that the indicator would drop and drive the token price down.

Meanwhile, at press time, buyers still had a solid presence, as per the RSI. So, increased buying pressure could drive a renewed uptick.

INJ’s movement on the daily chart was similar to FET. The reason for the rally could be connected to the strong support at $7.28. However, INJ faced rejection at $13.57, which was later invalidated as buying pressure pushed the price up to 13.68.At the time of writing, the Moving Average Convergence Divergence (MACD) was 0.47. This value suggested that traders may want to refrain from taking short positions. Hence, there was a solid likelihood of another rally in the short term.

RNDR might be the biggest gainer again

RNDR, on its own part, showed more promise than INJ and FET. This assertion was because of indicators including the Money Flow Index (MFI) and Awesome Oscillator (AO).

With the increasing green bars of the AO, the press time daily chart indicated that the buying momentum for RNDR seemed too strong for bears to quench.

Is your portfolio green? Check out the FET Profit Calculator

Also, the MFI jumped to 88.69. This reading is a sign of increased buying pressure and strength for the RNDR price action. However, a reading of the MFI above 80 suggested that the token was overbought.

Hence, a pullback is likely. But the retracement might only last a short while. So, traders shouldn’t overlook a possible ride in the $3.00 to $3.50 direction.

![Fetch.ai [FET] price action](https://ambcrypto.com/wp-content/uploads/2023/10/FETUSD_2023-10-30_08-20-28.png)

![Injective [INJ] price action](https://ambcrypto.com/wp-content/uploads/2023/10/INJUSD_2023-10-30_08-28-11.png)

![Render [RNDR] price action](https://ambcrypto.com/wp-content/uploads/2023/10/RNDRUSD_2023-10-30_08-37-21.png)