Why investing in Bitcoin RIGHT NOW might be a very profitable decision

In the Bitcoin market, the biggest question on any investor’s mind is this – “When should I invest?” And, that’s a fair question, especially since profitability is the only driving factor for an investor.

Well, it looks like the opportunity has once again arrived since Bitcoin is at its highest profitability in a while. Here’s how you can bet on that –

Bitcoin is profitable

Based on the strong market rally of the past 6 weeks and the hard-hitting crash that followed, there is some apprehension if the market is overheating or not.

An overheated market refers to a rapidly growing market that turns unsustainable. However, that does not seem to be the case when one looks at the BTC market right now. In fact, this is the best time to jump in as buying opportunity is pretty profitable at the moment.

Traditionally, the 200-day moving average (DMA) is considered to be a standard indicator of buying and selling. If BTC’s price is above it, it’s usually the beginning of strong upward movement. On the contrary, movement in the opposite direction is usually an indication of a fall.

Right now, Bitcoin’s price movement is in line with the 200 DMA – A clear sign that the market is not overheated.

Bitcoin’s price action in line with the 200 DMA | Source: TradingView – AMBCrypto

In fact, another buy signal comes from the Mayer multiple. The indicator’s low values, at press time, seemed to suggest that Bitcoin is cheap relative to long-term trends. By implication, this translates to the present being a good time to buy.

At the time of writing, the aforementioned metric’s presence under 1 was a good enough signal.

Bitcoin Mayer multiple | Source: CheckOnChain – AMBCrypto

However, in order to understand the state of the market for investment the overall value of the market must be checked if it’s in a state of profit or loss.

How is the market doing?

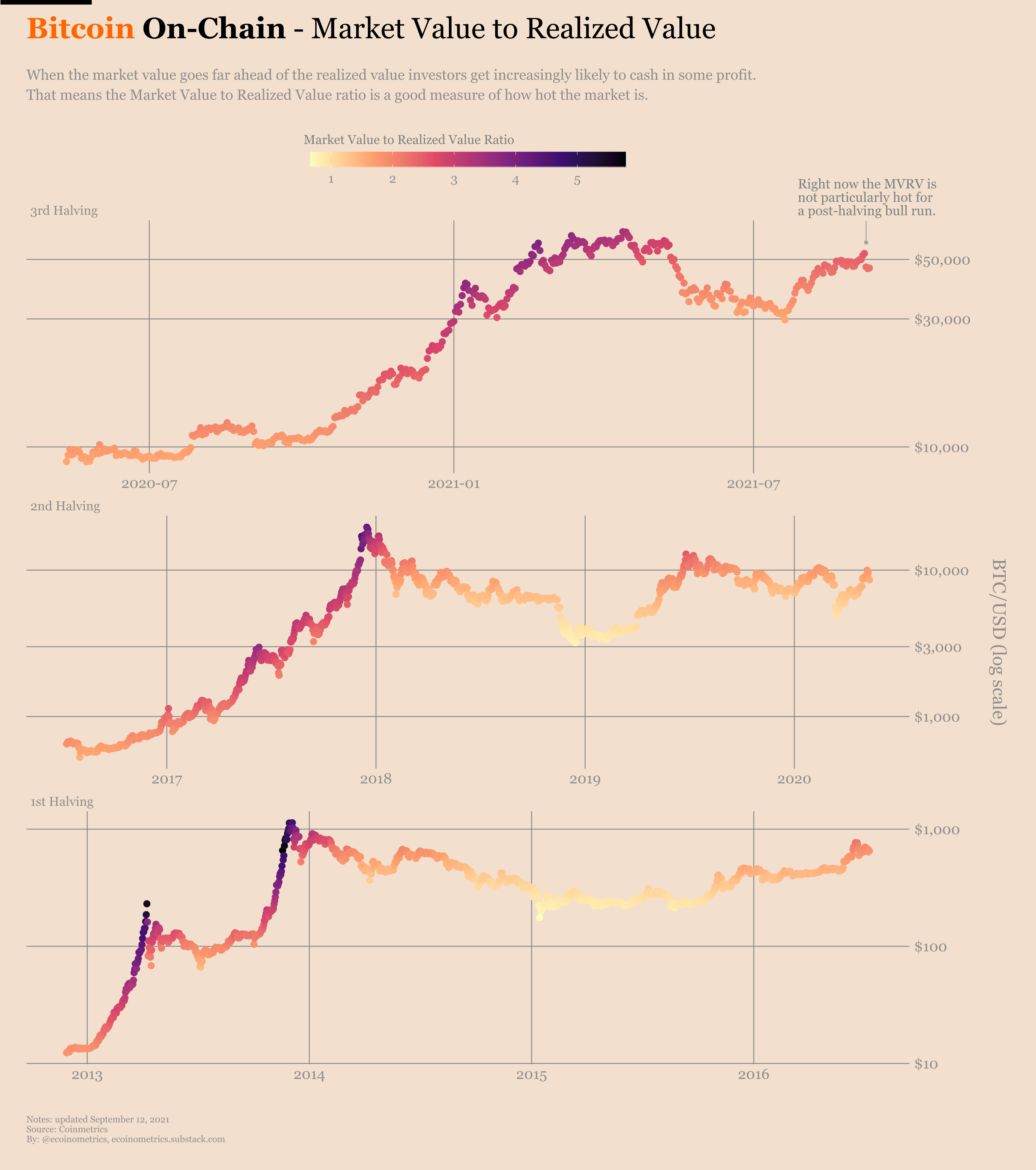

To check the state of profitability, we can use the MVRV ratio whose historical high values post halvings underline signs of a bull market. Consequentially, the market signs did not seem particularly indicative of a bull run.

And yet, given the press time MVRV value of 2.2, it could be the beginning of one. The values of 2.0 – 5.0 mark profitable returns which can be expected within a month. This is the sweet spot for investing and you can expect gains within a month from now.

However, anything above 5.0 is not good since they point to corrections arriving within a month. The market is far from that though. In fact, the MVRV hasn’t been close to 5 for over 7 years now.

Bitcoin MVRV historical values | Source: Ecoinometrics

Finally, understanding market sentiment is equally important too. This way, one can gauge where the market is really heading.

At press time, the Fear and Greed index was at its lowest in 50 days at 30.0 (fear). Price consolidation or recovery could push it back into the neutral zone. This will again be a good sign for investors looking to find profits.

Bitcoin’s Fear and Greed Index | Source: Alternative – AMBCrypto

All in all, the market is in a healthy state, with the aforementioned indicators flashing buy signals since profitability is coming up soon.