Why is Bitcoin down today? How the U.S. govt spurred BTC’s price drop

- The U.S. government transferred BTC worth billions of dollars during a time when sell pressure was already high.

- However, a bullish divergence appeared on BTC’s chart, hinting at a trend reversal.

Bitcoin [BTC] had showcased a promising performance over the past few days, as it inched closer towards $70k. However, bears stepped up in the last 24 hours and pushed the king coin’s price down.

Let’s take a closer look at the market to find out why Bitcoin is down today.

Why is Bitcoin down today?

As sellers took control, BTC’s price dropped by over 4% in the last 24 hours, per CoinMarketCap. AMBCrypto had earlier reported that there were chances of BTC dropping to $66k.

At the time of writing, BTC was trading at $66,672.03 with a market capitalization of over $1.32 trillion.

On the 29th of July, IntoTheBlock had pointed out a possible reason behind BTC’s latest dip. As per the tweet, almost all BTC holders were in profit.

Though this looked optimistic on the surface, it might have instead motivated investors to sell their holdings to earn profits, causing this price correction.

The role of the U.S. government

Lookonchain revealed yet another possible reason for Bitcoin’s price decline. On the 29th of July, the U.S. government transferred BTC worth more than $2 billion to a new wallet.

At press time, the U.S. government held 179,155 BTC, worth $12.14 billion.

Generally, when governments make such huge transfers, it affects market sentiment and causes volatility. For example, a few weeks ago, the German government sold all of its BTC holdings, which impacted Bitcoin’s price.

Since the U.S. is a major market for crypto, it’s not a surprise to see BTC’s falling because of a major transfer made by its government.

There is hope for bulls

However, AMBCrypto’s analysis of CryptoQuant’s data revealed that BTC’s exchange reserve was increasing. This suggested that selling pressure on BTC was high.

Also, its aSORP turned red, which meant that more investors were selling at a profit at press time. In the middle of a bull market, it can indicate a market top.

While BTC bears continued to push the king of cryptos’ price, a key indicator hinted at a possible trend reversal.

Ali, a popular crypto analyst, recently posted a tweet highlighting that BTC showed bullish divergence against the RSI in the lower time frames.

The TD sequential, yet another prominent indicator, flagged a buy signal, signaling a price increase. At the time of writing, BTC’s Fear and Greed Index had a reading of 37%, meaning that the market was in a “fear” phase.

Whenever the metric hits this level, it suggests that the chances of a price increase are high.

Read Bitcoin’s [BTC] Price Prediction 2024-25

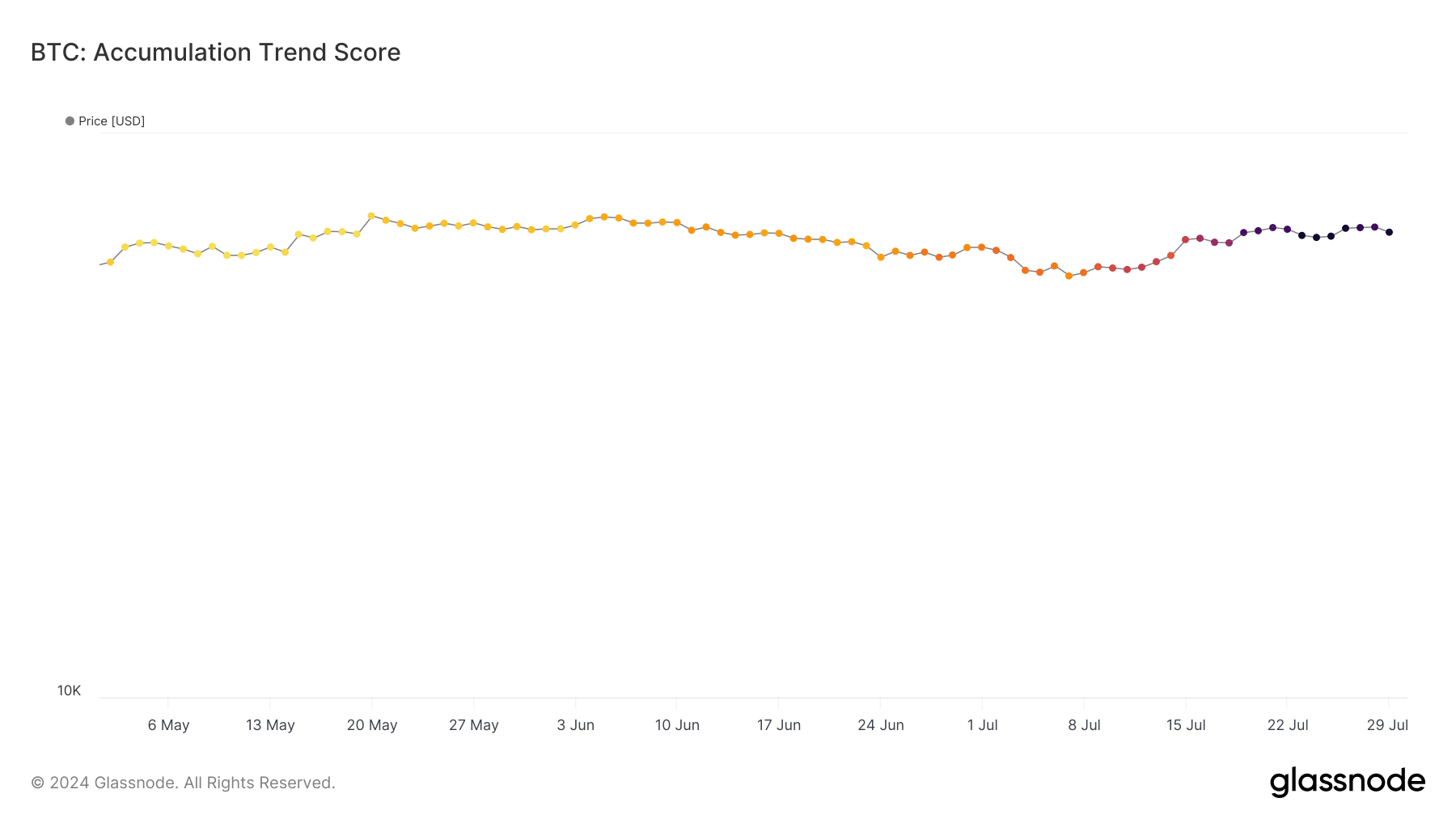

AMBCrypto then checked Glassnode’s data. We found that despite the recent selloffs, BTC’s accumulation trend score had a value of 0.99.

A number close to 1 indicates that investors are considering accumulating more, which is generally considered bullish.