Why is Bitcoin up today? THIS could be a key reason

- Bitcoin hit a new monthly high ahead of Fed’s decision.

- BTC whales doubled down on BTC despite short-term term market uncertainty.

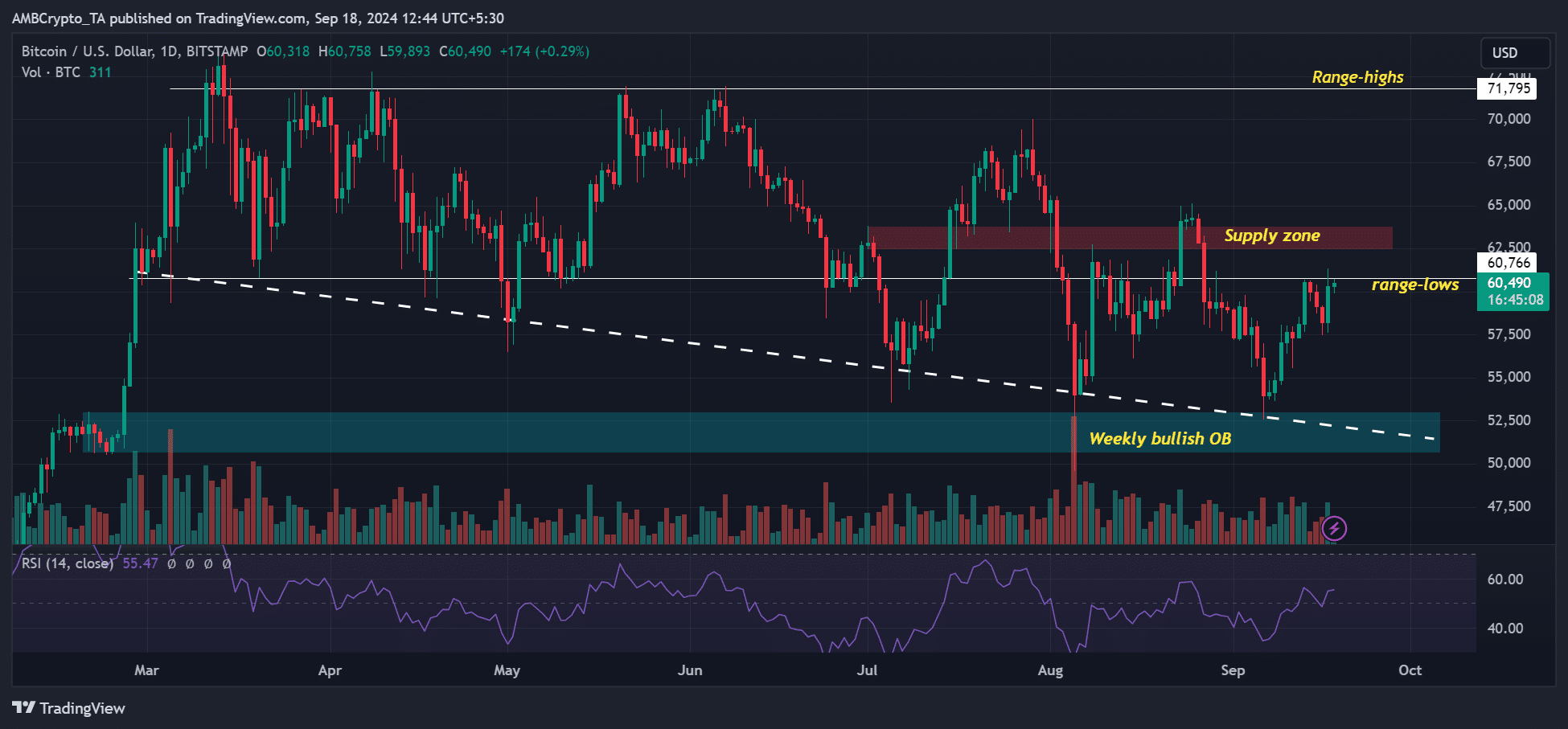

Bitcoin [BTC] hit a new monthly high of $61.3K on the 17th of September, just a few hours before the Fed’s decision on the 18th of September.

BTC has recovered about 14% from its early August lows and was back at its previous range lows.

Expectations of a potential Fed interest rate cut partly boosted the recent BTC uptick. Last week, U.S. economic data confirmed a disinflationary trend, while the US labor market stagnated.

This has tipped some policymakers and U.S. politicians to call for a 0.75% Fed rate cut to cushion the labor markets.

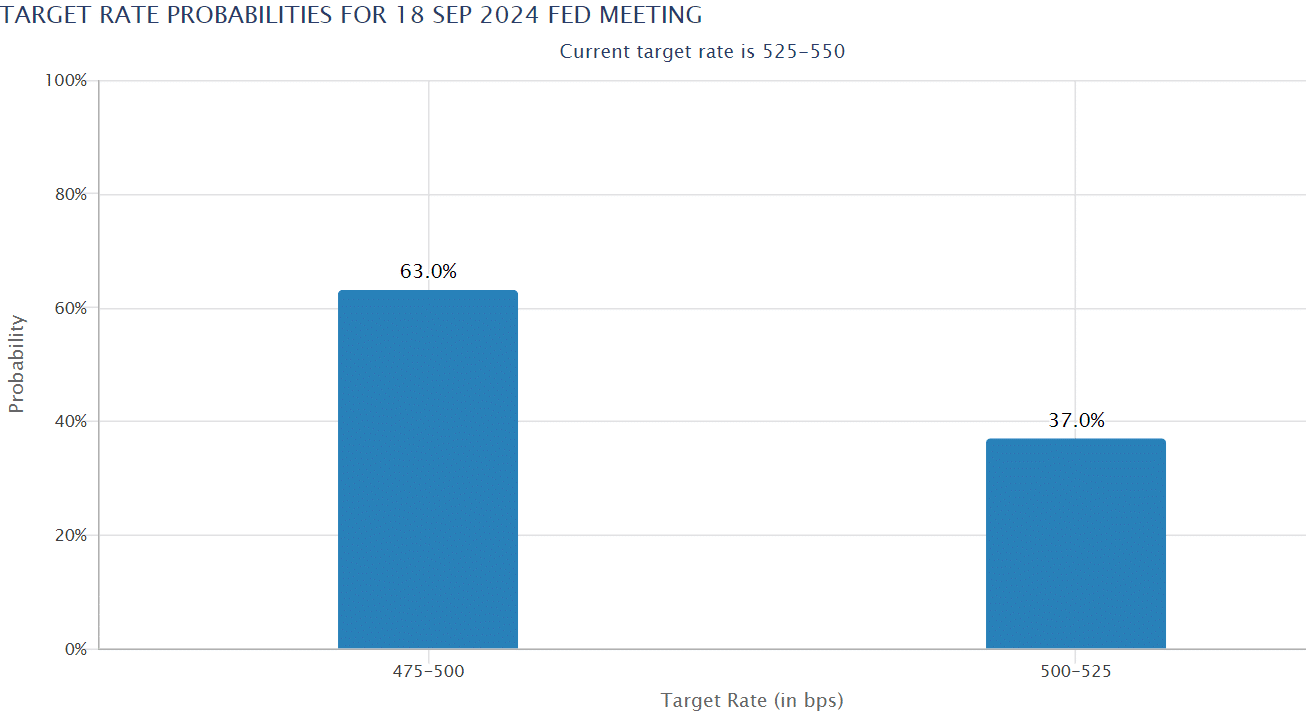

At the time of writing, interest rate traders were pricing a 63% chance of 0.50% (50 bps) Fed rate interest cut. This was a massive U-turn from a 14% chance of a 50 bps rate cut seen a week ago.

Impact of interest rate cuts

Market observers agree that Fed interest rate cuts are structurally bullish for risk markets, given relatively cheaper credit.

However, some have opined that a 50 bps cut was an aggressive move that would signal the Fed’s concern about the economy. This might not be good for risk assets like crypto in the short term.

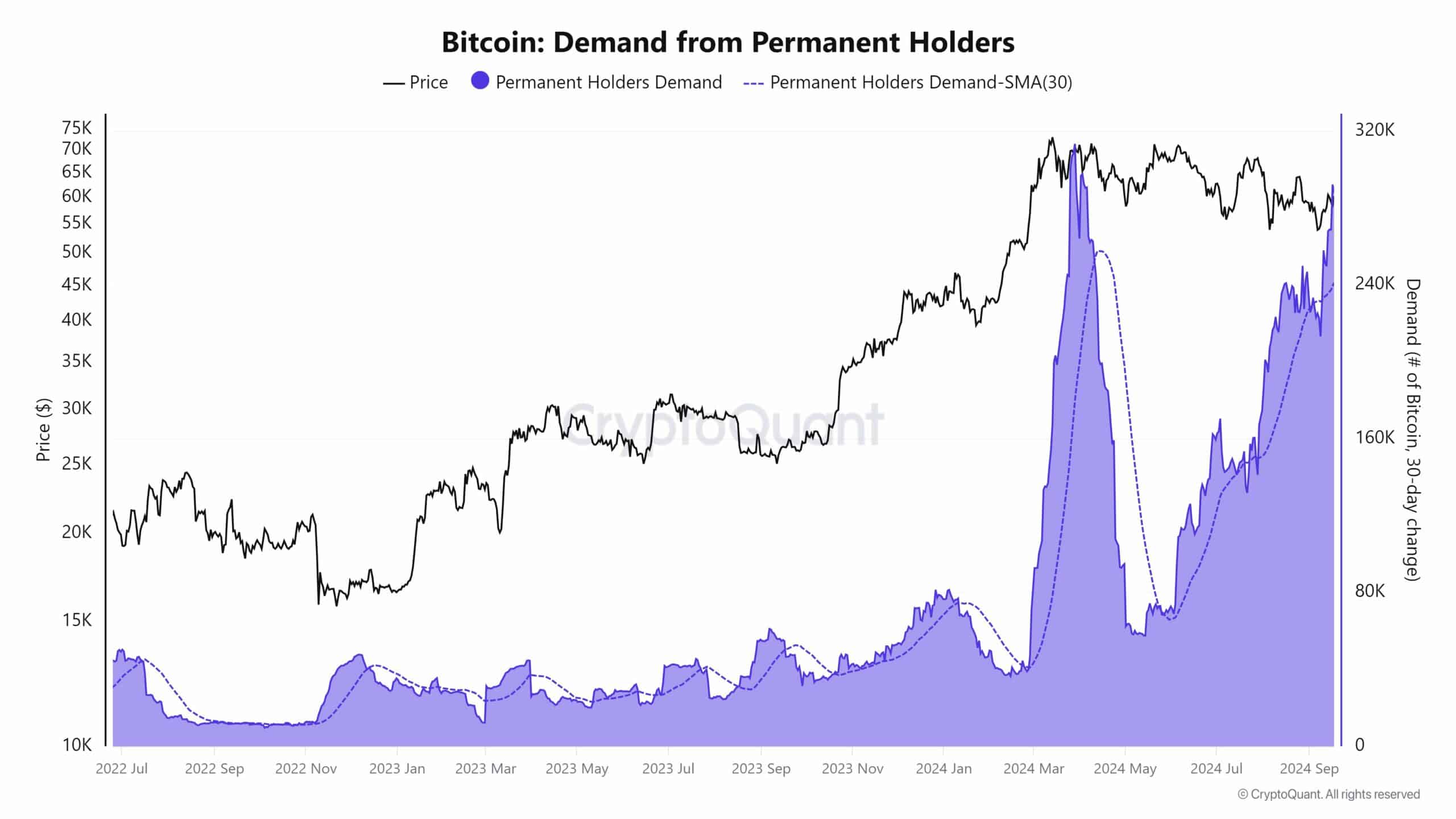

In the meantime, whales seemed well positioned for the Fed rate decision. CryptoQuant founder Ki Young Ju noted BTC whales have aggressively accumulated BTC in the past six days amid an intensifying supply shock.

Additionally, U.S. spot BTC ETFs showed increased demand, with a $186.76 million net daily inflow on Tuesday. This reinforced investors’ risk-on mode ahead of the Fed decision.

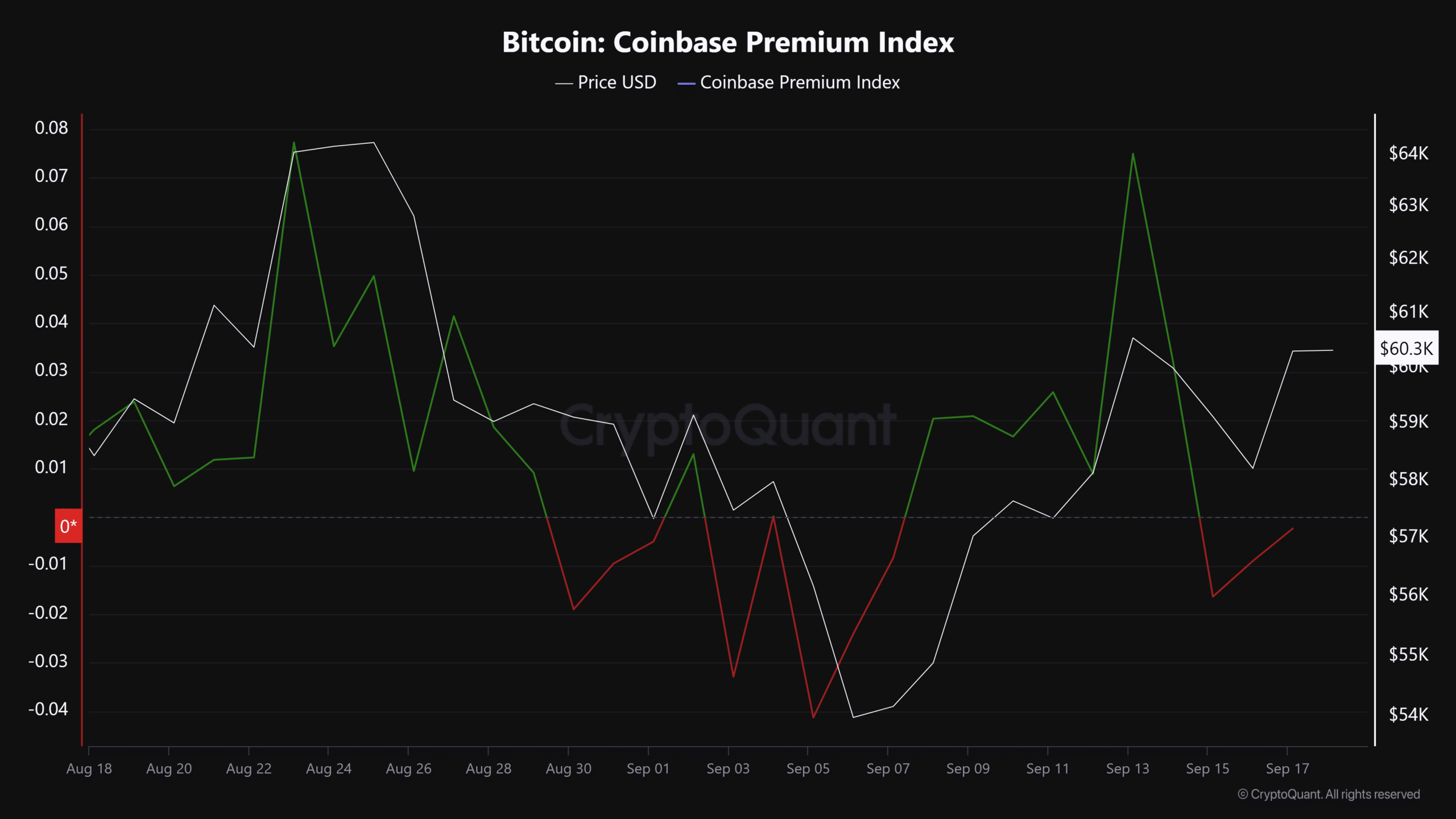

However, at the time of writing, the demand from U.S. investors wasn’t too strong, as illustrated by a negative reading from the Coinbase Premium Index.

This demonstrated short-term market uncertainty amid a potential first Fed rate cut since 2020. Whether the risk-on approach seen from U.S. spot BTC ETF investors will persist after the Fed decision remains to be seen.

![Cronos [CRO]](https://ambcrypto.com/wp-content/uploads/2025/07/Gladys-33-400x240.webp)