Why is Bitcoin up today? THIS is a major reason behind BTC’s rise

- The surge in BTC buying by whales, coupled with the influx of newly minted USDC, appeared to be key driving factors.

- Declining exchange reserves and negative Netflow signals indicated that the rally was likely to persist.

In the last 24 hours, Bitcoin [BTC] has appreciated by 4.13% and was trading at $57,054.21 at press time. Indications are that this upward trend may continue into the following days.

Nonetheless, it remains puzzling why BTC experienced a sudden rise despite $34.79 million being bet on its decline per data from Coinglass.

Whales propel BTC rally with strategic accumulation

Recent tracking data highlighted significant Bitcoin accumulation by whales, signaling their increased confidence in the asset and making a noticeable impact on market dynamics.

Since the beginning of September, Lookonchain has observed whales acquiring 2,814 BTC. In a notable move, a whale recently set up a new wallet to transfer 300 BTC, worth approximately $17.19 million.

Additionally, in two transactions 600 BTC was withdrawn from Binance and moved to a new wallet.

These transfers from centralized exchanges to private wallets suggest that these major players are positioning their Bitcoin for long-term holding, reducing potential sell pressure on the market.

Concurrently, the USDC Treasury minted 50 million USDC, adding substantial liquidity to the market. Such infusions are known to increase buying pressure on assets, including BTC, leading prices upward.

BTC upswing likely to continue

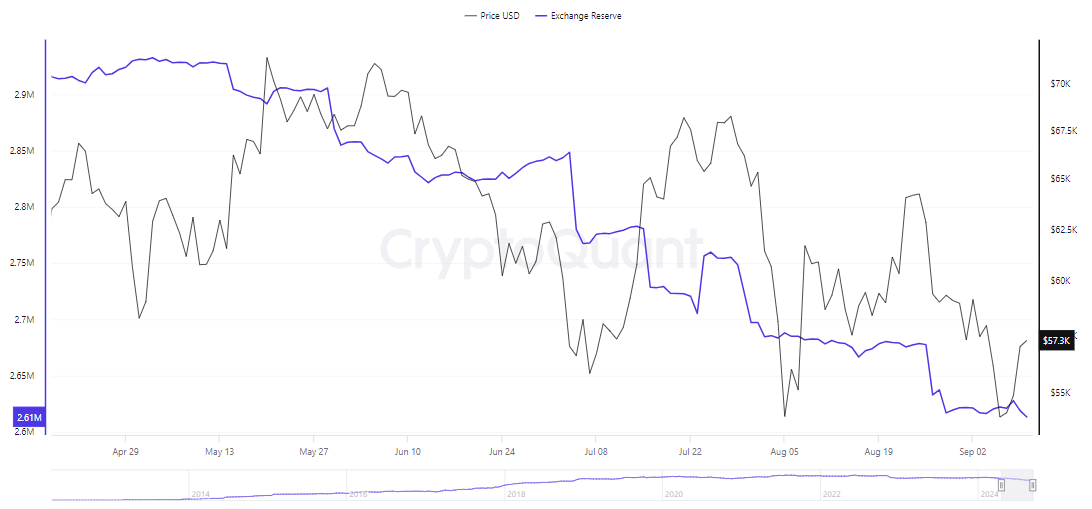

CryptoQuant’s insight of Exchange Reserve and Netflow metrics indicated that Bitcoin’s current upward trajectory was expected to persist, as it recovered from the recent market downturn.

The Exchange Reserve for BTC, which measures the amount of the cryptocurrency held in exchange wallets, has sharply decreased to 2,613,649.772.

Typically, a rising exchange reserve suggests a bearish outlook due to the ease of selling in liquid markets.

Conversely, a declining reserve points to a supply squeeze and growing long-term confidence among investors, giving a sign of bullish sentiment.

Further supporting this bullish outlook, AMBCrypto found that the Exchange Netflow across all centralized exchanges has predominantly been negative.

This negative Netflow indicates that assets are being moved from exchanges to private wallets, reducing the potential selling pressure on BTC. Such trends are often influenced by large-scale investors or whales.

As these whale activities continue, retail investor sentiment has also shifted, and it’s now predominantly bullish.

Retail traders capitalize on BTC’s upward trend

Retail traders are increasingly bullish on Bitcoin, as evidenced by their growing bets on the cryptocurrency’s price rise.

This shift is mirrored by a significant increase in Trading Volume, which has surged by 47.98%, amounting to $64 billion. Similarly, the Options Volume has seen a dramatic 91.90% increase.

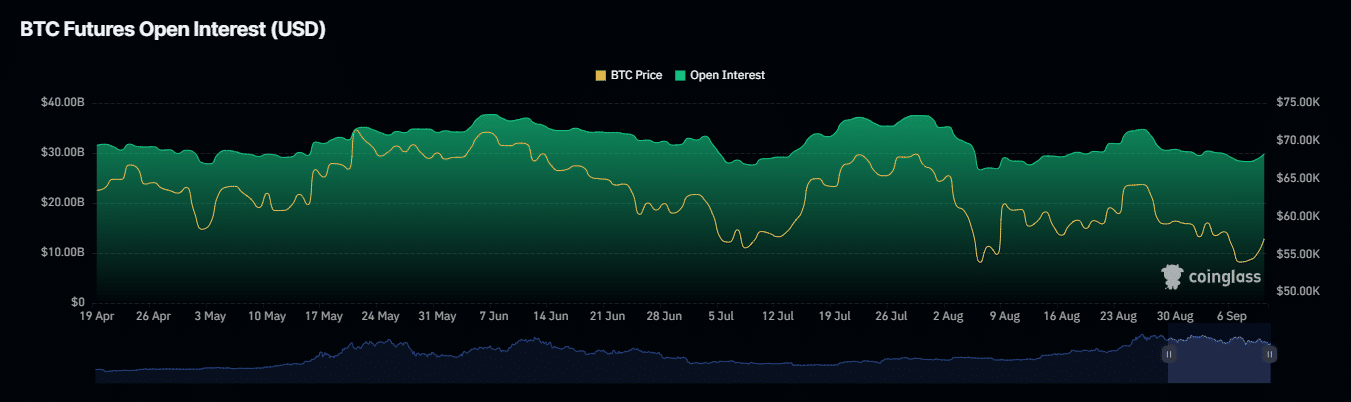

Moreover, the Open Interest (OI), according to Coinglass, has also risen by 3.66% to $29.98 billion at press time.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

This uptick in both volume and OI indicated a substantial influx of money into the BTC Futures market, underscoring the strength of the current price trend.

If this momentum continues, Bitcoin is likely to see even higher prices in the days ahead, signaling sustained interest from retail investors.