Why is BRETT dropping today? Key factors behind the 20% fall

- Affected by Bitcoin’s collapse, BRETT holders sold in large numbers, thereby triggering a notable correction.

- Demand for the token is at one of its lowest, as sentiment was also gloomy.

Brett [BRETT], the memecoin and top crypto on Base, saw its price nosedive by a staggering 20.13% in the last 24 hours. As a result, the price of the token dropped to $0.11 despite trading at $0.16 three days earlier.

But why is BRETT dropping? Undeniably, the plunge in price could be linked to the broader crypto market collapse. In the last 24 hours, the total crypto market fell by 8.52% while losing hold on the $2 trillion mark.

Selling pressure takes over the memecoin

Bitcoin [BTC], in its usual element, was the drive, as the price fell below $55,000 while trading below the 200 EMA. The last time this happened, the market experienced a long-period correction.

This time, it could be a similar situation and BRETT might not evade this phase.

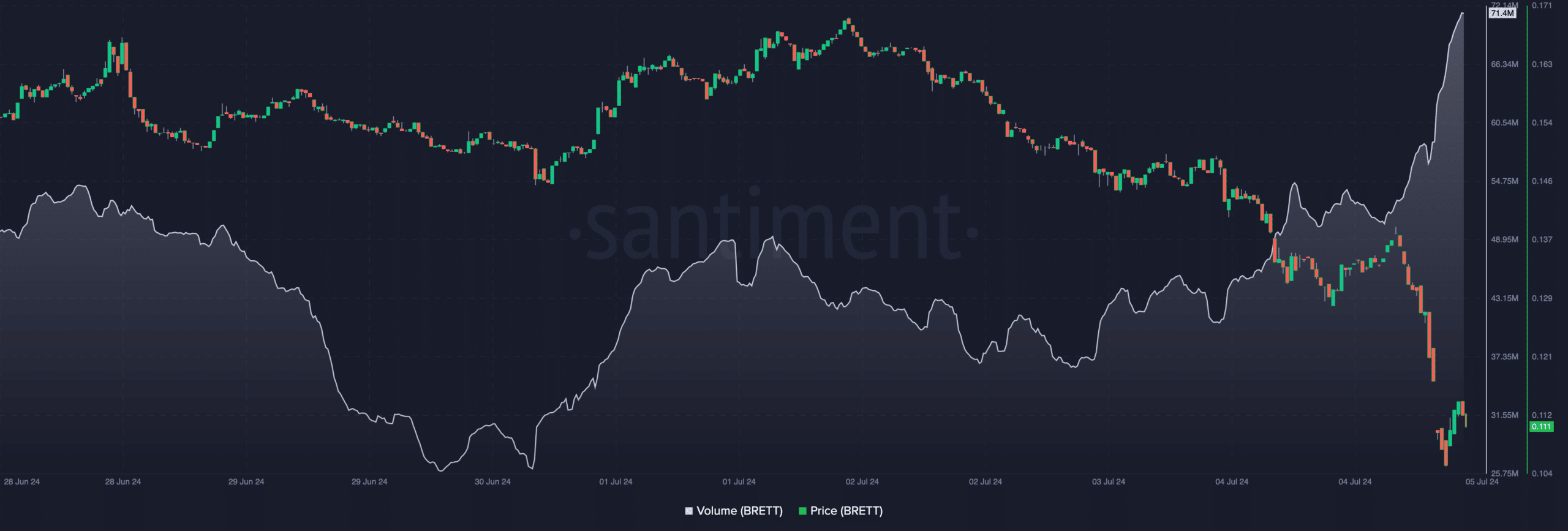

On BRETT’s part, they were the individual reason for the price drop. First, AMBCrypto observed that the volume of the token jumped to $71.40 million at press time.

Volume indicates interest. When it increases, it means there is a lot of buying and selling going on. However, when it decreases, it indicates that interest in the token is waning.

But to get an idea of the weight of buying and selling, one can look at the price. For instance, if volume rises and price increase, it means buying pressure is present.

However, for the token, the decrease in value and increase in volume indicates that selling pressure was intense.

Therefore, if the volume continues, to rise, it could offer strength to the downtrend. If this is the case, BRETT’s price could drop below $0.10 in the coming days.

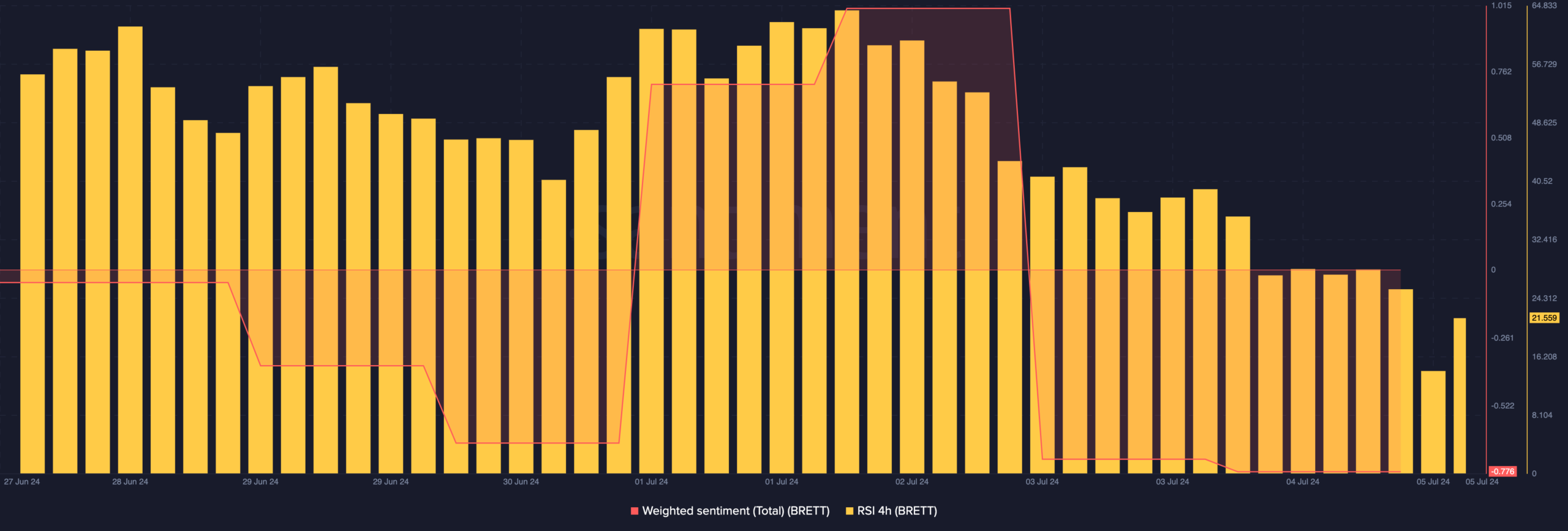

Beyond this, another factor that affected BRETT’s price was its Weighted Sentiment, which measures the positive or negative comments about a project on social media platforms.

BRETT is oversold, but no way out yet

If there are more positive comments, then the reading of the metric will be positive. However, in a case where there are more negative than positive discussion, the reading hits red.

At press time, BRETT’s Weighted Sentiment was down to -0.776. This implied that most discussions about the token tilted toward the bearish side.

When things like this happen, it becomes difficult for the token to get a good level of demand.

As a result of this, the price of BRETT dropped. Meanwhile, the Relative Strength Index (RSI) on the memecoin’s 4-hour chart was down to 21.55.

The RSI measures momentum. When it is over 70, it means an asset is overbought. However, when it is below 30, it means that an asset is oversold.

For BRETT, the token was oversold, and the usual expectation is a rebound.

Is your portfolio green? Check out the BRETT Profit Calculator

However, that could be challenging, especially as the broader market has not shown any sign of recovery.

Should this remain the case, the value of the token might drop below $0.10 as initially mentioned. However., this could be invalidated if Bitcoin’s price recover and other cryptocurrencies follow.